The cryptocurrency market has been shaken by turbulence over the past year, but Bitcoin is now staging a remarkable comeback, breaking past the $67,000 mark for the first time since late 2023.

This unexpected surge has electrified the Bitcoin community, sparking widespread optimism and a sense of renewed hope among investors.

Related Reading

Confidence In Bitcoin High

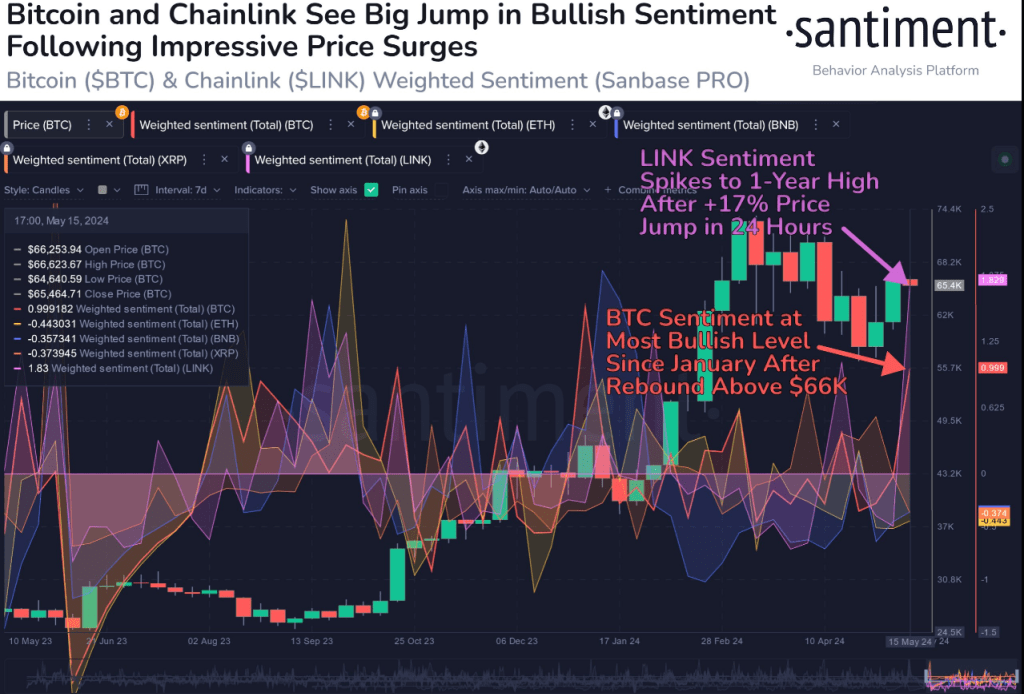

The collective mood of the Bitcoin community, as measured by Santiment’s “Weighted Sentiment” metric, has reached its most bullish level since the SEC’s landmark approval of Bitcoin spot ETFs in late 2023.

That pivotal regulatory move had significantly bolstered confidence in the cryptocurrency’s legitimacy and legitimized it as an investable asset class.

🥳 The crowd’s sentiment has shifted toward #Bitcoin after the surprise bounce above $66K Wednesday (and now above $67.2K). Additionally, #Chainlink is seeing its most #bullish sentiment in over a year. #FOMO staying low will help these rises continue. https://t.co/TcEPBdS9Oh pic.twitter.com/czvE1mOgId

— Santiment (@santimentfeed) May 17, 2024

Social media platforms are now abuzz with enthusiastic discussions as Bitcoin enthusiasts express excitement about the cryptocurrency’s potential. Many are drawing parallels to the last major bull run in 2021, when Bitcoin reached its all-time high of over $68,000.

Cautionary Notes Amidst The Enthusiasm

While the Bitcoin community celebrates this latest achievement, seasoned analysts are urging investors to tread carefully and avoid the pitfalls of impulsive decision-making. Cryptocurrency markets are notoriously volatile, and Bitcoin’s price history is filled with dramatic ups and downs.

Bitcoin’s recent resurgence also coincides with a broader upswing in traditional markets, raising questions about the extent to which the cryptocurrency’s performance is intertwined with the wider financial ecosystem. A potential downturn in the stock market, for example, could negatively impact Bitcoin’s momentum as investors shift their funds accordingly.

Managing FOMO, Maintaining A Long-Term Perspective

As Bitcoin’s price climbs, so too does the risk of FOMO – the fear of missing out. This psychological phenomenon can drive investors to make impulsive decisions, fearing they’ll miss out on significant gains.

The resurgence of Bitcoin has reinvigorated the cryptocurrency community, but seasoned…

Click Here to Read the Full Original Article at NewsBTC…