The United States Federal Reserve began its most aggressive quantitative tightening efforts in March 2022, raising benchmark interest rates in the year since from near-zero to 4.75% to 5% annually. While the central bank has successfully brought down inflation to some degree, the increasing interest rates are starting to cause cracks in the global banking industry.

The market expects the Fed to end quantitative tightening and provide favorable liquidity conditions to avoid a global financial crisis as the banks begin to fail. The shift in the Fed’s policy should have significant implications for financial assets.

Jurrien Timmer, the director of global macro at Fidelity, discussed the likely impact of the Fed’s dovish pivot on stocks, gold and Bitcoin.

Market expects the Fed to put an end to interest rate hikes

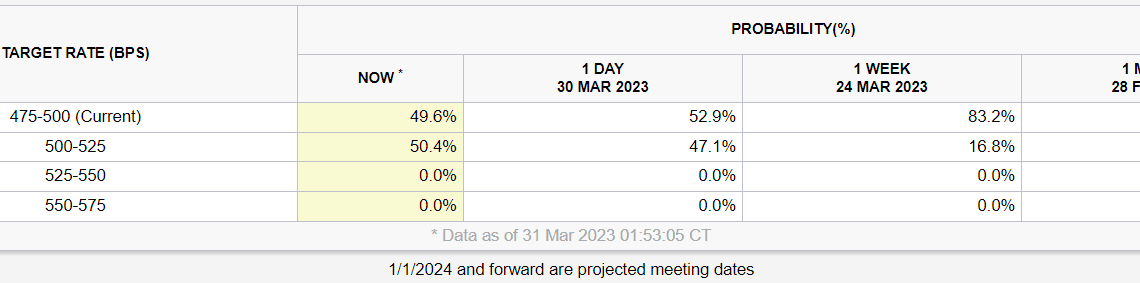

The Fed is largely expected to either maintain the interest rates at current levels or start cutting rates. CME’s FedWatch Tool shows that the market is currently placing a 50% chance that the March 25 basis point hike was the last one for a while.

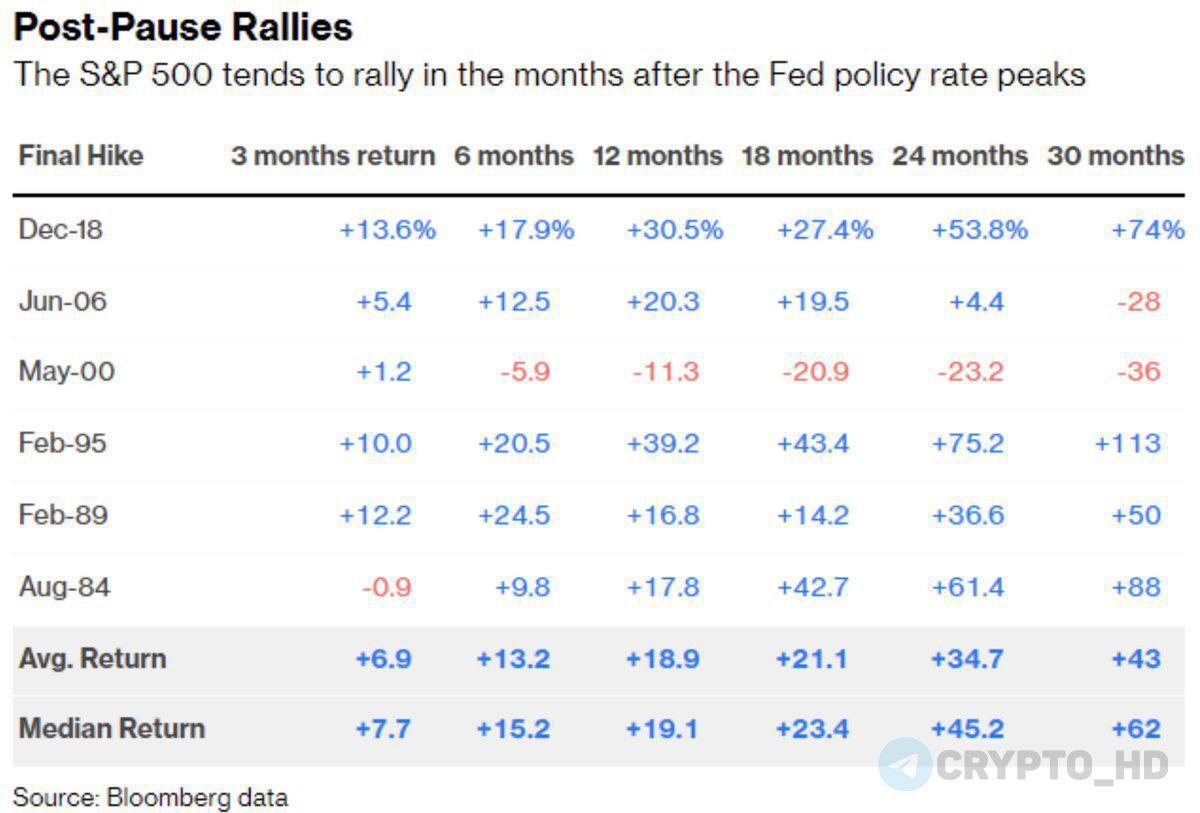

If the Fed stops its rate hikes, risk assets like equities can experience a positive rally based on historical data. The average one-year return in the S&P 500 index after the last rate hike since 1984 has been 18.9%.

Timmer also recently noted in a tweet that “The last hike is often (but not always) quickly followed by a cut.”

A rate cut would make credit cheaper across companies and individuals, improving the market’s liquidity. Low-interest regimes are often associated with bull runs in risk assets like stocks and crypto.

The last hike is often (but not always) quickly followed by a cut. pic.twitter.com/08czI2C6lq

— Jurrien Timmer (@TimmerFidelity) March 27, 2023

However, Timmer mentioned it is a “bullish development for stocks (lower cost of capital). But historically, the final Fed tightening produces anything but a clear-cut direction for stocks.” There have been instances where the stocks have maintained bearish trends for a couple of years before trend reversals.

If the Fed is done raising rates and takes a dovish pivot soon, as many expect, it could be a bullish development for stocks (lower cost of capital). But historically, the final Fed tightening produces anything but a clear-cut direction for stocks. Careful what you wish for. pic.twitter.com/xQw6WfcTjR

— Jurrien Timmer…

Click Here to Read the Full Original Article at Cointelegraph.com News…