While Bitcoin (BTC) investors may not consider the U.S. midterm elections as a significant event, an eerie fractal from 2018 may provide a clue to what could happen before the year ends.

Bitcoin to hit $12K-$14K after midterms?

Comparing Bitcoin’s price actions that led to the midterm elections of 2018 with the ones in 2022 shows a strikingly similar bear market trend.

For instance, BTC price trended lower in 2018 while holding a horizontal level near $6,000 as support, only to break below it after the midterm elections.

In 2022, the cryptocurrency has halfway mirrored this trend. Its price now awaits a close below the current horizontal support level of around $19,000. With the midterm elections scheduled for Nov. 8, the said breakdown scenario could occur sooner or later, as illustrated below.

Independent market analyst Aditya Siddhartha Roy thinks Bitcoin’s price will fall into the $12,000-$14,000 range if a similar breakdown occurs. He further notes that the cryptocurrency could bottom out in November or December 2022, just like in 2018.

$BTC Bottom Analysis

Comparing to 2018 & 2022 Bear market

•Support Getting Weak – TrendLine Manipulation – Midterm Elections – Post Midterm Elections Dump – #BTC Bottom

•Nov-Dec could be bottom for #Bitcoin•Retweet Appreciated #cryptocurrency #Crypto #ETH $ETH #Binance pic.twitter.com/GHDiHu4H3H

— Aditya Siddhartha Roy❁ (@Adityaroypspk) October 16, 2022

Stock market warnings for Bitcoin

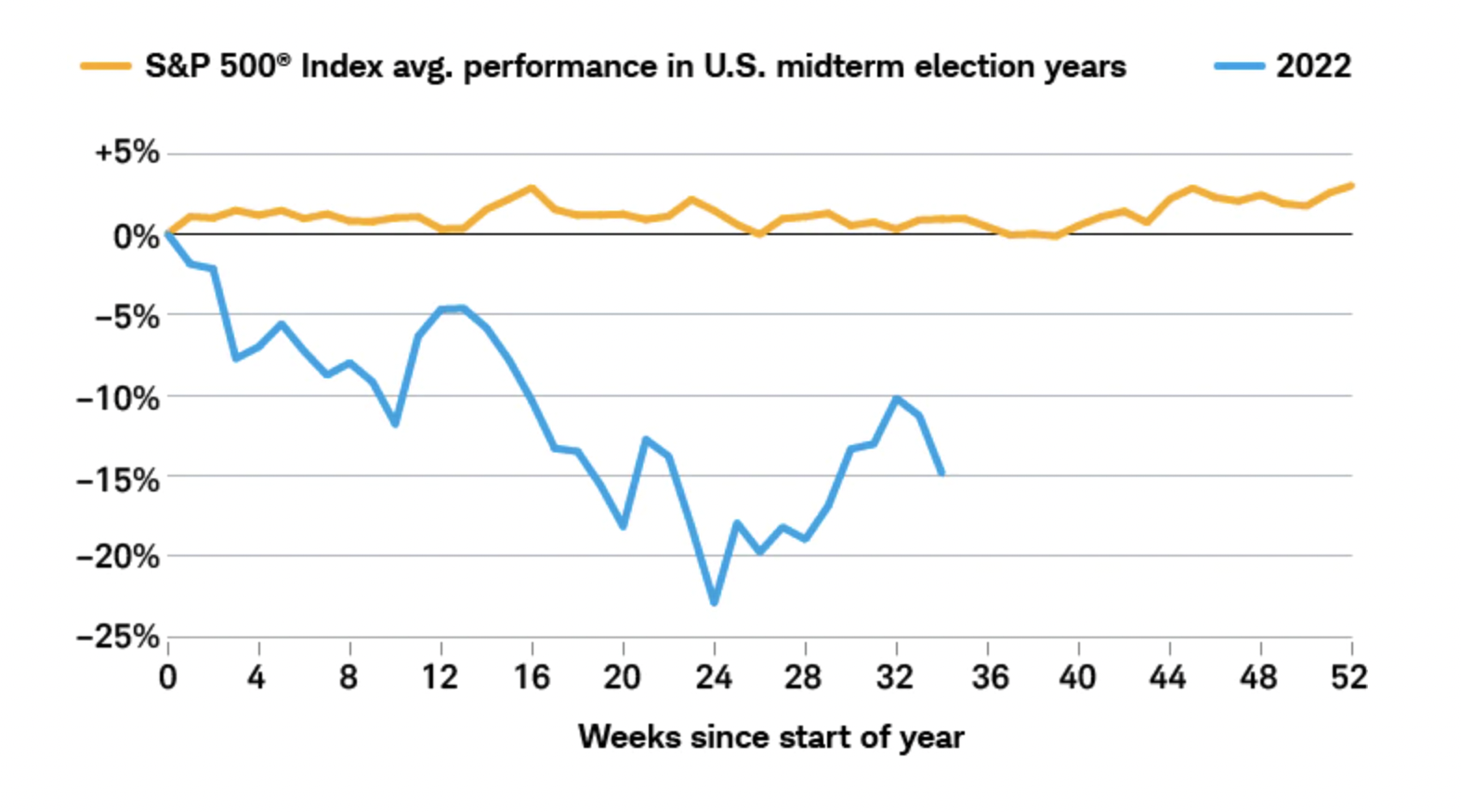

The bearish prediction surfaces as Bitcoin’s correlation grows stronger with the U.S. equities in the wake of the Federal Reserve’s monetary policies. Both markets have witnessed sharp drawdowns in the period of the U.S. central bank’s rate hikes in 2022.

Historically, in 17 of the 19 midterms since 1946, the stock market has performed better in the six months after an election than in the six months following it.

That is primarily due to the market’s expectations of higher government spending from a new Congress, notes Liz Ann Sonders, Charles Schwab’s chief investment strategist, who further argues that 2022 could yield a different outcome.

“An additional infusion of funds seems unlikely this year, given the government’s historic levels of spending and stimulus in response to…

Click Here to Read the Full Original Article at Cointelegraph.com News…