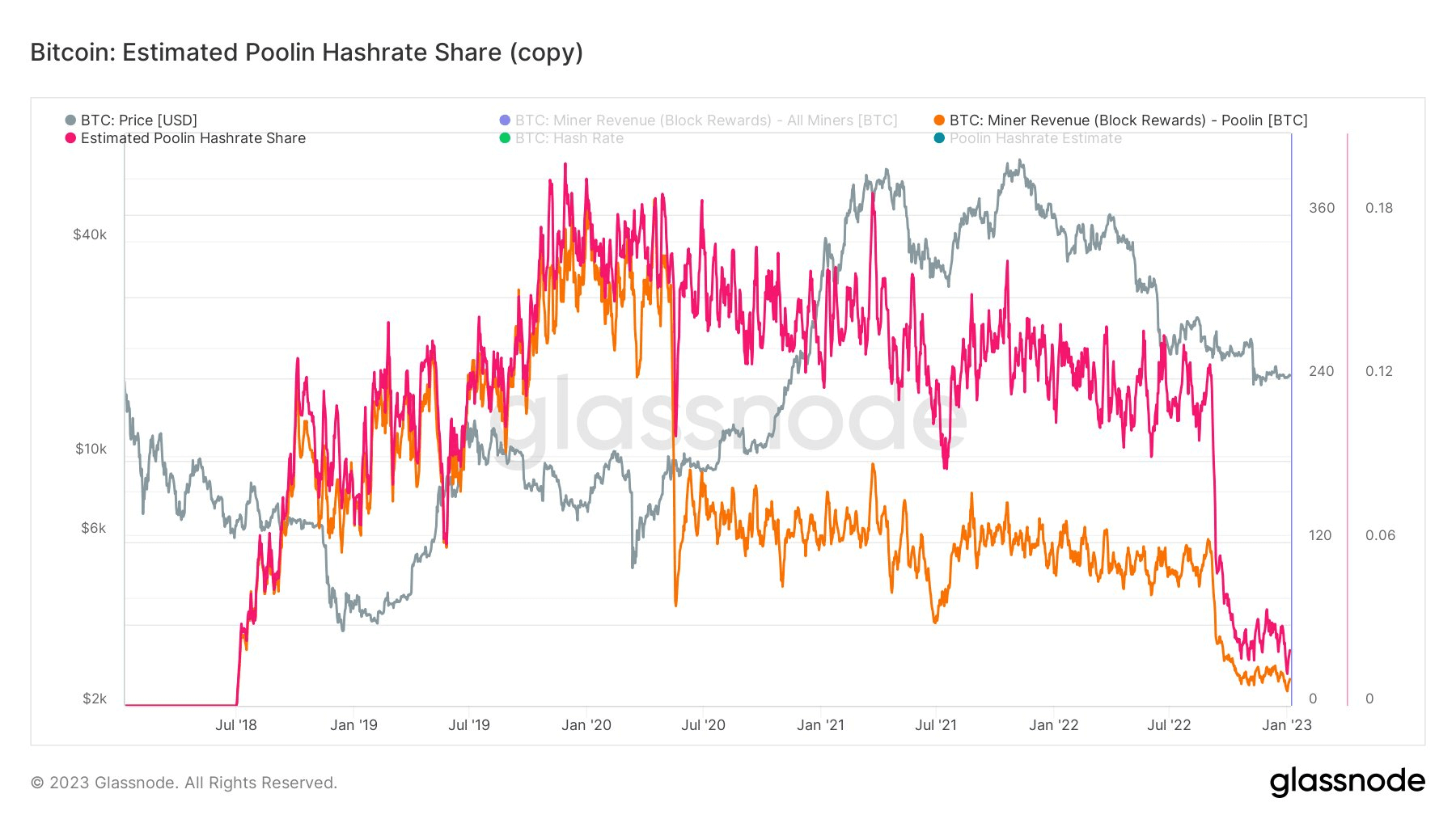

China-based Bitcoin mining pool, Poolin, registers a record decline in hash rate share to 1% from its all-time high of 18% – a 94% decline, according to data from Glassnode.

Poolin contributed 4354 blocks in the Bitcoin mining pool with a hash rate share of 8.182% if we extend the timeline to a year. But, in 2022, Bitcoin mining suffered a significant blow due to increasing mining difficulty, declining Bitcoin prices, and miners closing their businesses due to declining profitability.

The recent downturn can be traced back to last September when the mining pool firm announced liquidity problems. The pool accounted for approximately 12% of Bitcoin’s hash rate prior to its announcement.

Poolin further suspended all withdrawals, flash trades, and internal transfers from its network to preserve assets and stabilize liquidity. Consequently, many miners left the pool, resulting in a drop in hashing power and block rewards.

Amidst this, Poolin had the largest miner outflow in two years, amounting to 10,000 Bitcoins. Further, CryptoSlate’s previous analysis shows that Bitcoin held in Poolin wallets dropped sharply from 22,000 BTC in early November to 6000 BTC in December. It accounted for a substantial portion of the market’s overall decline in balances held by miners.

Worth noting Bitcoin mining became difficult in China after the Chinese government banned crypto mining in 2021. In 2020, Poolin announced its partnership with Three Arrows Capital, a crypto hedge fund that declared bankruptcy after the Terra-Luna collapse last year.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…