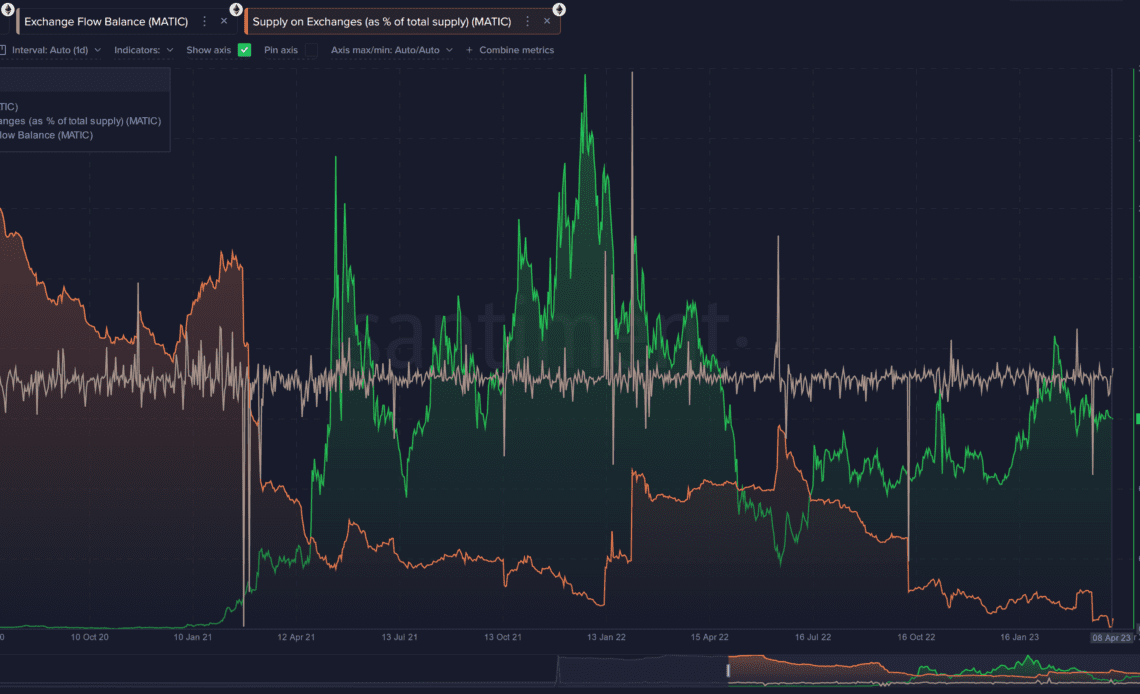

Blockchain scaling solution Polygon (MATIC) is currently witnessing its lowest levels of supply on exchanges in four years, according to the crypto analytics firm Santiment.

Santiment notes in a new analysis that only 7.1% of MATIC’s supply is currently sitting on exchanges, the lowest level since the crypto asset’s introduction in 2019.

The firm says the low exchange supply “does imply limited continued selloff opportunities that should put investors somewhat at ease.”

MATIC is trading at $1.12 at time of writing. The 10th-ranked crypto asset by market cap is up 0.51% in the past 24 hours but down more than 1.75% in the past seven days. Polygon remains up more than 47% since the start of 2023, however.

Santiment also examines Polygon’s mean dollar invested age, which represents the average age of each dollar invested in MATIC.

“Dormant money is also showing some signs of moving with multiple large dips happening on the mean dollar invested age curve. Typically, when this curve flattens out, it’s a sign that some old addresses are circulating coins again, which is typically a positive for an asset. If we start to see another massive drop in this mean dollar invested age curve like we did back in January, 2021, ready your ? ? ? emojis!”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Click Here to Read the Full Original Article at The Daily Hodl…