Polkadot (DOT) looks ready to extend its ongoing price recovery due to a classic bullish pattern forming on its daily chart.

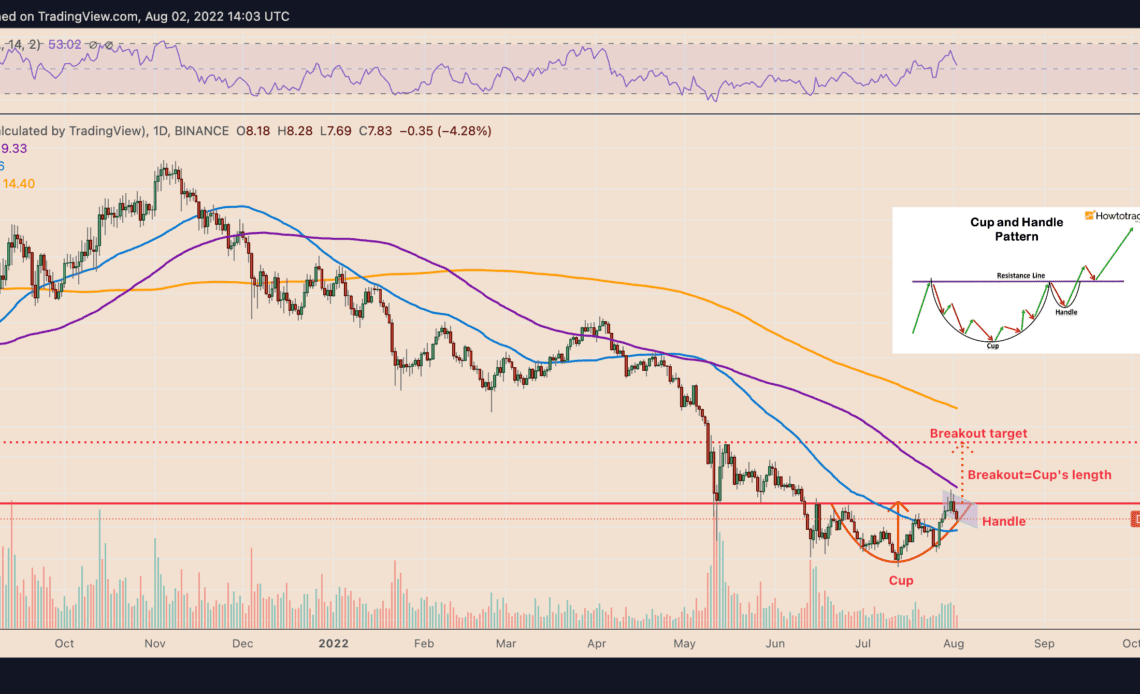

DOT paints “cup and handle” pattern

Notably, DOT has been forming a “cup and handle” pattern since mid-June, confirmed by its price crashing and recovering in a rounding, U-shaped trajectory (cup), followed by the development of a trading range on the right-hand side (handle).

Cup and handle patterns are typically bullish continuation setups that form during an uptrend. But in rare cases, they appear at the end of a downtrend, leading to a bullish price reversal. As a result, DOT’s possibility of continuing its price recovery seems high.

Thus, from the technical perspective, DOT initially eyes a breakout above its cup and handle’s resistance line near $8.50.

A decisive close above the resistance line, i.e., a breakout move accompanied by a rise in volume, could have DOT eye approximately $12 as its upside target by September, up more than 50% from today’s price.

Polkadot price breakdown setup

However, DOT’s road to $12 risks exhaustion due to presence of key technical resistance levels midway.

For instance, the Polkadot token could run into its 100-day simple moving average (100-day SMA; the purple wave) near $9.50 only to pull back toward $8.50. This outlook takes cues from DOT’s price retreat on July 31 from the same wave resistance (highlighted by a circle sign below).

Meanwhile, a breakdown below the cup’s curvy support could invalidate the bullish cup and handle setup altogether.

As a result, DOT could risk an extended price correction toward $6.25, which has been serving as support since June 13 against multiple downturns. In other words, DOT could drop by nearly 20% from today’s price at most by September.

Polkadot network metrics show stability

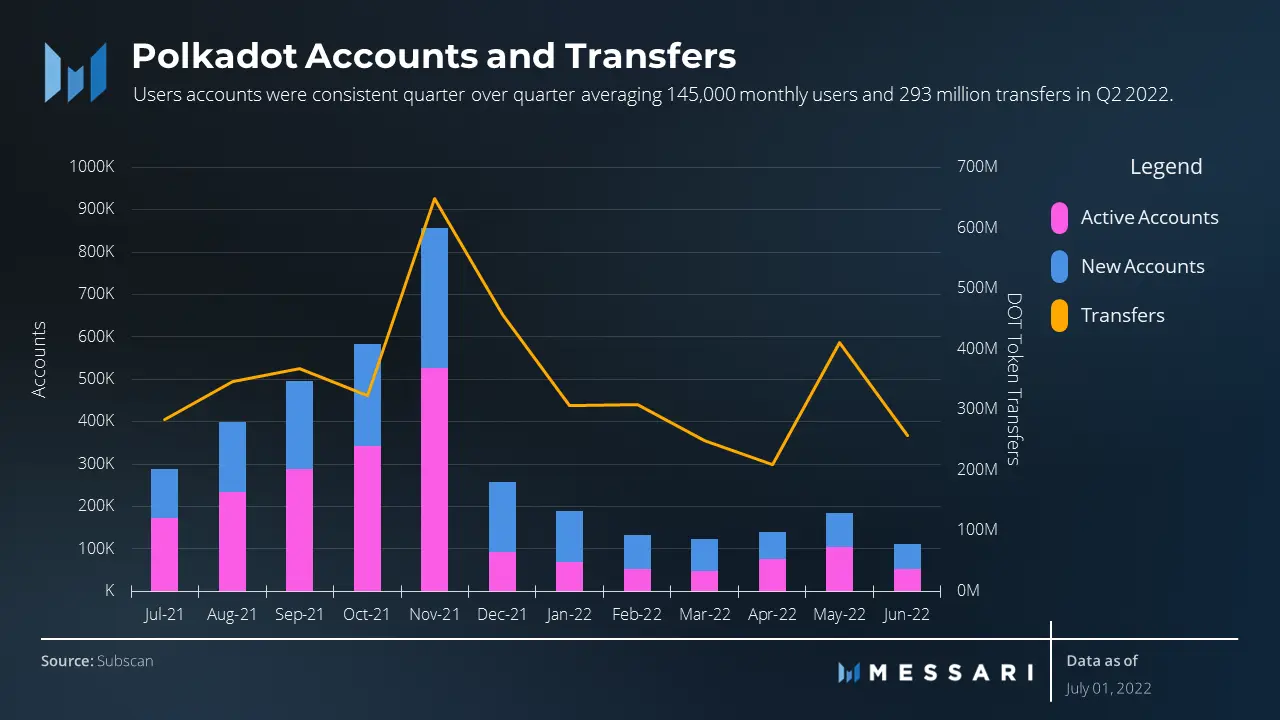

Along with the broader market, Polkadot experienced a sharp decline in its market capitalization mainly due to macroeconomic turbulences. As of Aug. 2, the project’s net valuation was $7.92 billion versus its record high of $55.51 billion in November 2021.

In comparison, Polkadot’s network metrics are healthier. For example, it saw 145,000 monthly users in Q2/2022 versus 149,000 monthly users in Q1/2022, according to Messari’s quarterly DOT report in July.

Similarly, DOT transfers remained almost the same…

Click Here to Read the Full Original Article at Cointelegraph.com News…