2023 has been a whipsaw year for investor sentiment and even though equities markets have defied expectations, a recent report from ARK Invest highlights reasons why the remainder of 2023 could present several economic challenges.

ARK manages $13.9 billion in assets, and its CEO, Cathie Wood, is a strong advocate for cryptocurrencies. In partnership with the European asset manager 21Shares, ARK Investment first applied for a Bitcoin exchange-traded fund (ETF) in June 2021. Their most recent request for a spot BTC ETF, which is currently pending review by the U.S. Securities and Exchange Commission (SEC), was initially filed in May 2023.

Long-term bullish, short term bearish?

Despite ARK’s bullish view on Bitcoin which is supported by their research on how the fusion of Bitcoin and Artificial Intelligence could transform corporate operations by positively impacting productivity and costs, the investment firm doesn’t foresee a straightforward path for a Bitcoin bull run given the current macroeconomic conditions.

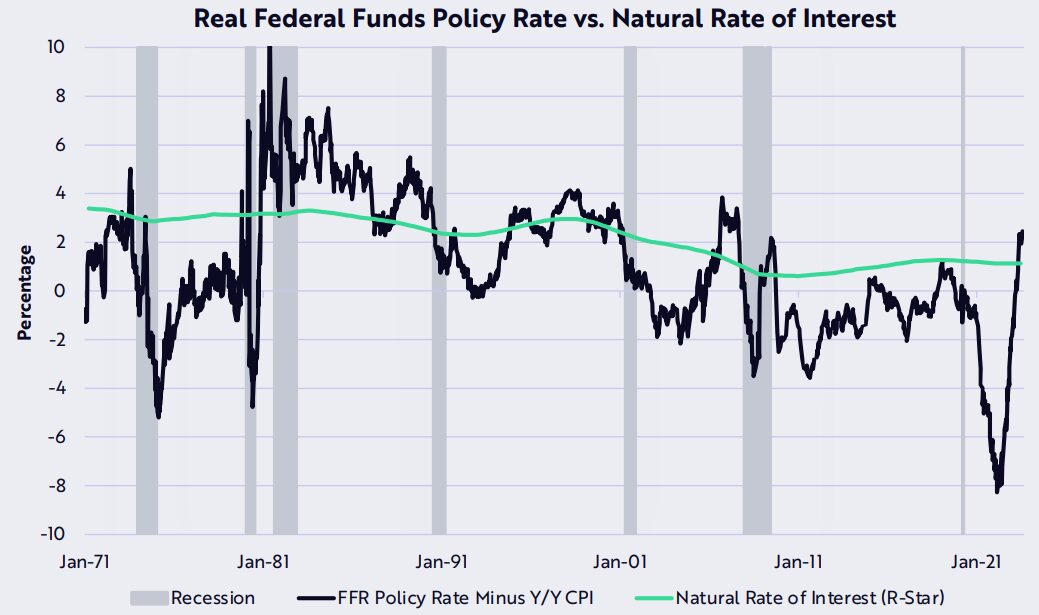

In the newsletter, ARK cites several reasons for their less than optimistic scenario for cryptocurrencies, including interest rates, gross domestic product (GDP) estimates, unemployment and inflation. One point is that the U.S. Federal Reserve (Fed) is implementing a restrictive monetary policy for the first time since 2009, as indicated by the “Natural Rate of Interest.”

The “Natural Rate of Interest” is a theoretical rate at which the economy neither expands or contracts. ARK explains that whenever this indicator exceeds the “Real Federal Funds Policy Rate,” it puts pressure on lending and borrowing rates.

ARK anticipates that inflation will continue to slow down, which would drive up the “Real Federal Funds Policy Rate” and increase the gap above the “Natural Rate of Interest.” Essentially, the report holds a bearish macroeconomic view due to this indicator.

The analysts also focused on the divergence between real GDP (production) and GDI (income). According to the report, GDP and GDI should closely align, as income earned should equal the value of goods and services produced.

However, the most recent data shows that Real GDP is approximately 3% higher than Real GDI, indicating that downward revisions in production data should be expected.

Another focus point was U.S. employment data and the analysts note that the government has consistently revised these figures downward for six…

Click Here to Read the Full Original Article at Cointelegraph.com News…