Bloomberg Intelligence crypto market analyst Jamie Coutts predicts PayPal’s new PayPalUSD (PYUSD) stablecoin will have a huge impact on Ethereum (ETH).

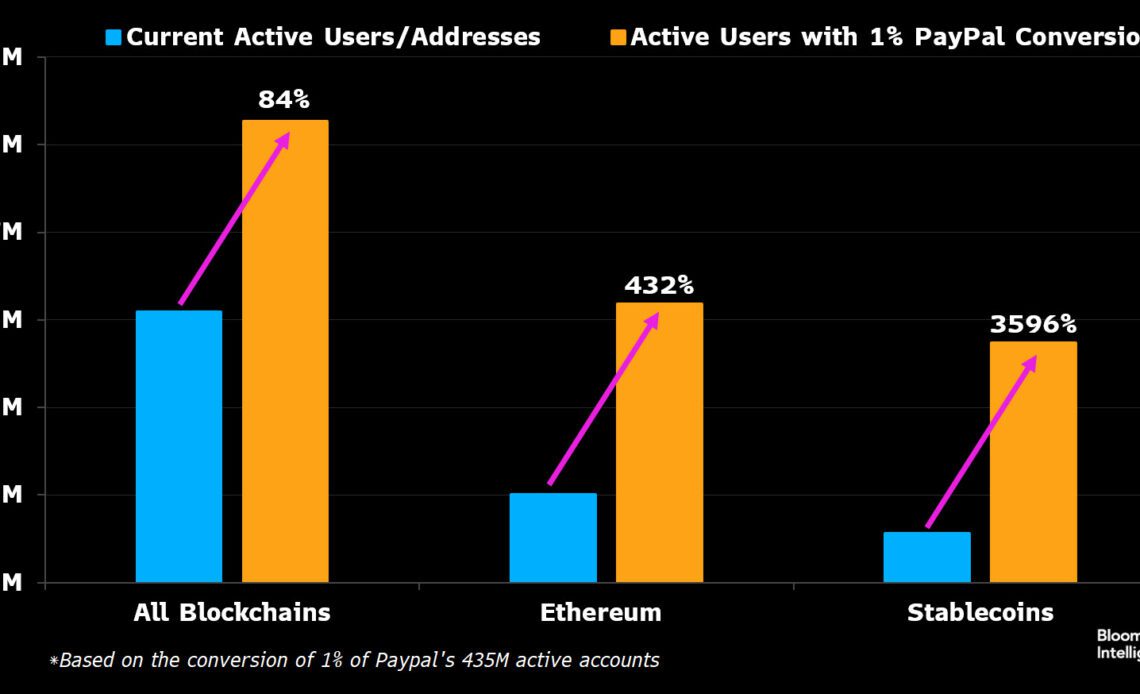

Coutts says that there is massive growth potential for Ethereum even if just a small percentage of PayPal’s existing customer base adopts the stablecoin, which aims to keep a 1:1 peg to the US dollar and is built on Ethereum.

“The PayPal announcement is not priced in.

PayPal has 435 million active accounts vs. Ethereum Layer-1/Layer-2 active addresses 1 million.

If 1% convert a dollar balance to PYUSD (4.35 million) and begin to use it then the ramifications for the Ethereum ecosystem and ETH, the asset, are massive.”

Coutts also says that he is bullish on the layer-1 (L1) smart contract platform after an expansion of layer-2 (L2) projects had less of an adverse impact on ETH’s financials than he expected.

“The dual surprise of faster L2 adoption and less than expected cannibalization of the L1 financials has our confidence in Ethereum’s potential to accrue more value than alternative L1s over the cycle.”

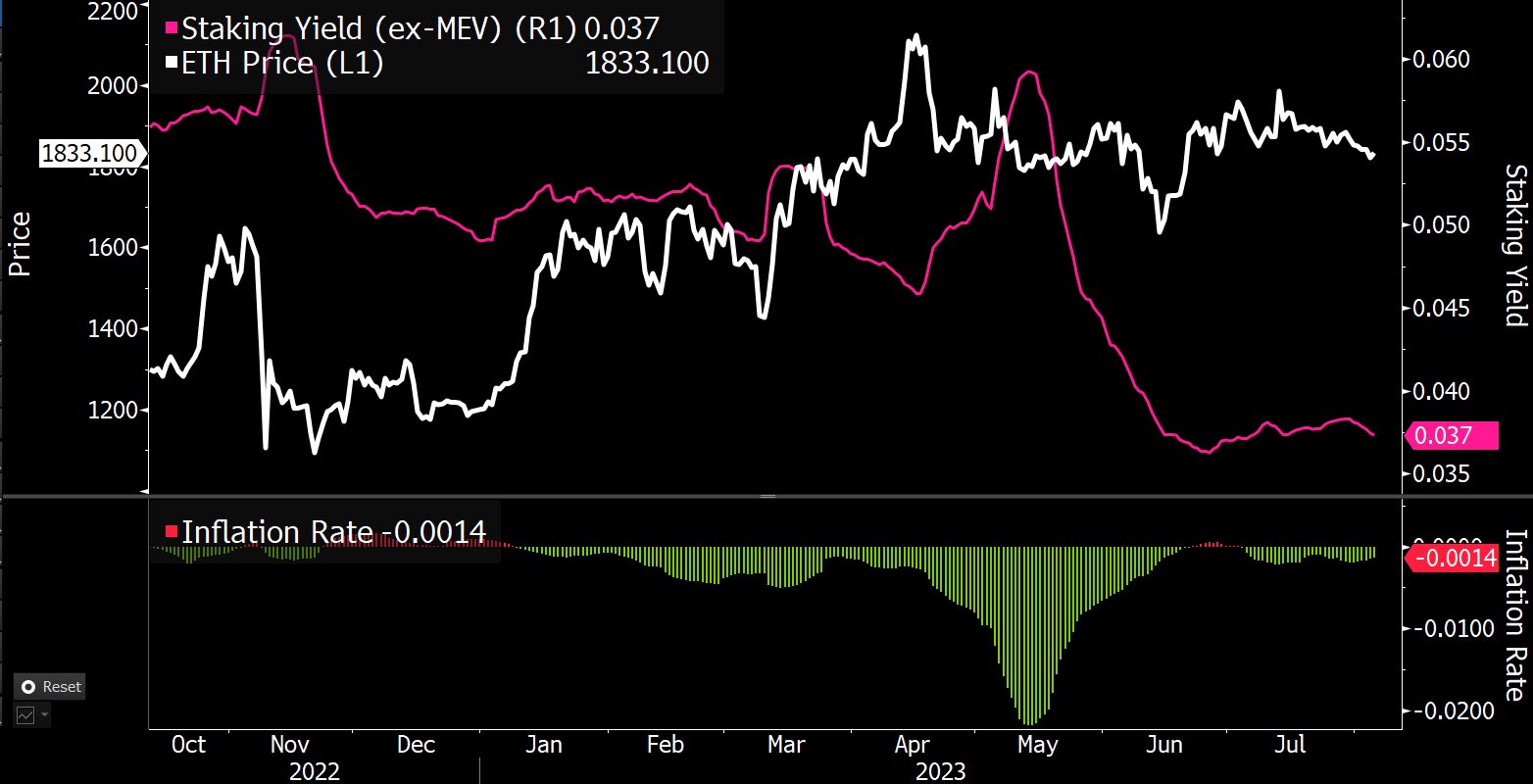

The analyst says ETH’s sideways price action doesn’t tell the full story of all that is going on in the ecosystem, including network development and increased Ethereum staking.

“Flat Price Masks Improving Value Accretion:

1. Network is back on a growth trajectory driven by growing L2s, less severe monetary tightening

2. Mostly deflationary despite bear market (pre-merge inflation was 4%+)

3. Despite cooling activity, ETH staked accelerated up 38% in three months.”

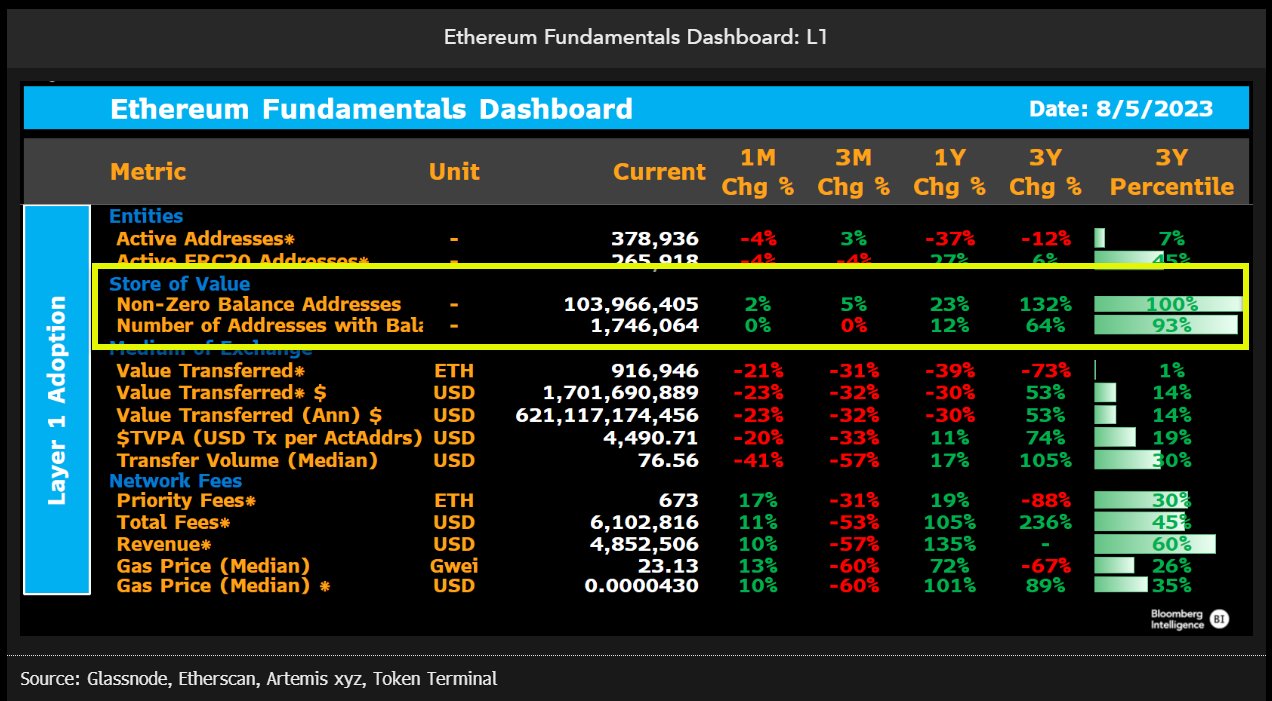

According to Coutts, ETH accumulation is increasing during the stalled crypto market.

“While activity is down, investors are nonetheless demonstrating aggressive accumulation behavior. The total number of non-zero balance addresses exceeds 100 million, with over 1.7 million wallets containing at least one ETH.”

Coutts notices that ETH’s network is generating 3x the amount of revenue compared to the fourth quarter of 2022.

“Depending on your framing, dollar value of the network’s GDP/revenue, while down significantly from 2021, has increased 3x from the fourth quarter 2022 low and is now outpacing the price. L1 generates approximately $6 million in fee revenue per day – 80% is burnt (buyback) and the rest paid to validators (div).”

He also notes that the increase in fees is similar to a 2020…

Click Here to Read the Full Original Article at The Daily Hodl…