The news this week that PayPal will issue a U.S. dollar stablecoin on the Ethereum network has understandably lit up the crypto world, even setting off a minor rally in other tokens. Optimists see it as a watershed moment of validation for blockchain and smart contracts, from a very serious fintech player.

This is an excerpt from The Node newsletter, a daily roundup of the most pivotal crypto news on CoinDesk and beyond. You can subscribe to get the full newsletter here.

But there’s reason to suspect that technology per se wasn’t the most persuasive factor for the $64 billion payments giant. Instead, the more immediate motive may be quite simple:

PayPal wants to collect the interest on your dollars.

See, PYUSD, like other reputable dollar stablecoins, will be “backed” by a collection of dollar bank deposits and highly liquid dollar equivalents, held in a trust managed by Paxos. Short-dated U.S. Treasuries, which are likely to make up the bulk of PYUSD’s backing, are now offering a whopping 5% yield. PayPal gets to keep that yield.

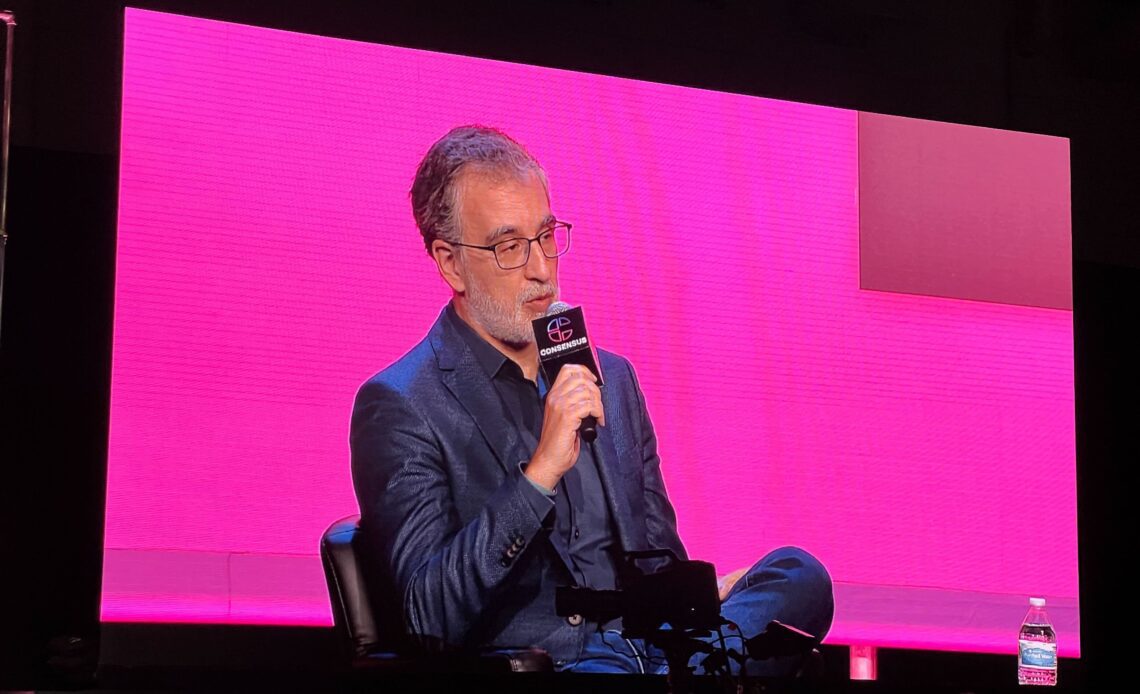

That puts a different spin on comments this week from Jose Fernandez da Ponte, head of PayPal’s crypto efforts. Da Ponte told CNBC Crypto that “We think of PYUSD as an extension of the PayPal balance … making it available outside of the PayPal ecosystem.”

See also: PayPal’s New Stablecoin and the ‘2 Wolves’ Inside Crypto | Opinion

A PayPal balance is the money a customer leaves on the platform – or, going forward, money they leave with PayPal in exchange for PYUSD. Users, for the record, should absolutely not do this at scale, partly because your money is at risk of seizure (and will be just as seizable in stablecoin form). More importantly, you shouldn’t leave a PayPal balance because PayPal does not pay any interest. That’s why your money became PayPal’s revenue opportunity as soon as underlying interest rates started going up.

How much money do people leave deposited on PayPal?

PayPal doesn’t make the numbers entirely clear. In its quarterly reports, the company reports interest revenue on customer deposits to Wall Street as part of a larger category it calls “Revenues from other Value Added Services.” That includes “interest earned on certain assets underlying customer balances,” but also a plethora of other revenue sources…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…