The cryptocurrency market has been a whirlwind of activity over the past week, with Bitcoin (BTC) seeing the most notable uptick, climbing over the $30,000 mark for the first time in two months, a crucial psychological milestone that could return much-needed confidence to the market.

At press time, Bitcoin is trading at $30,343.

Over the weekend, Bitcoin managed to maintain the $30,000 level, even briefly surpassing $31,000. This price jump was fueled by a wave of news regarding institutional adoption, which has been a key driver of Bitcoin’s price since the beginning of the year as it indicates growing mainstream acceptance and potential increased demand for the digital asset.

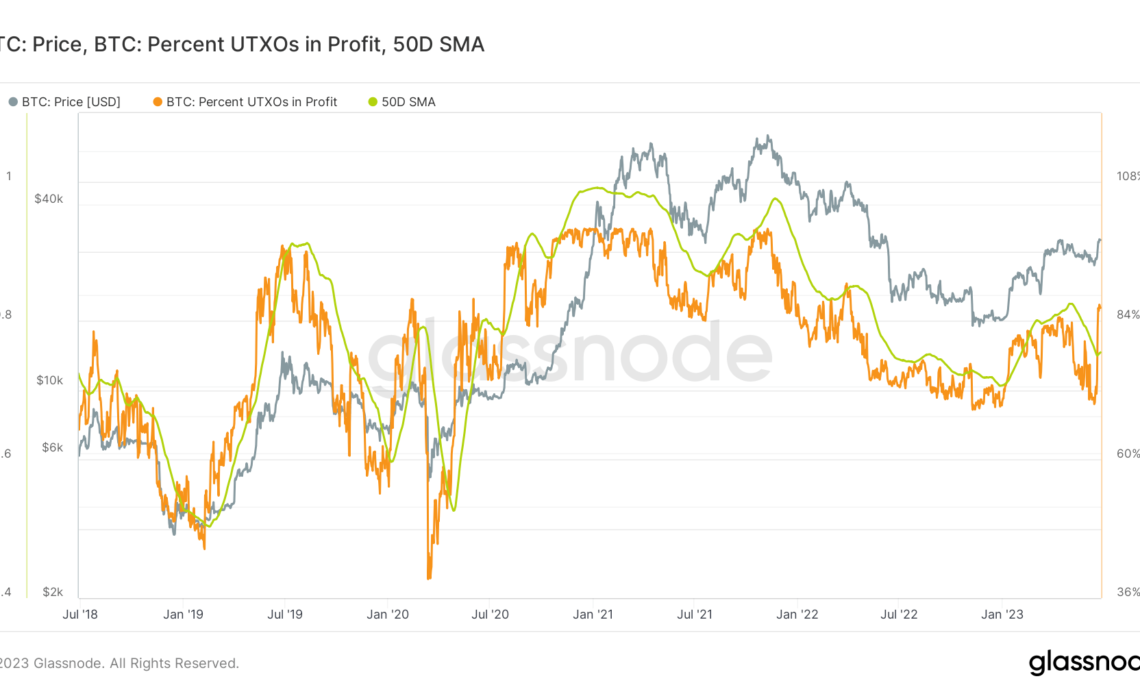

This surge in Bitcoin’s price has increased the profitability of most holders. This is evident when analyzing on-chain data, especially UTXOs in profit. Unspent Transaction Outputs (UTXOs) are the outputs of Bitcoin transactions that have not been spent and can be thought of as individual ‘coins’ or pieces of coins that reside in a Bitcoin wallet. They are crucial when analyzing the market because they provide a snapshot of the economic activity on the Bitcoin network.

Estimating the profit and loss of Bitcoin’s supply is important as it provides insight into the market sentiment and potential future price movements. One way to assess this is by analyzing the number of current UTXOs that are in profit or loss.

Glassnode calculates the number of UTXOs in profit/loss by counting all existing UTXOs whose price at creation time was lower or higher than their current price. To account for the increasing number of UTXOs over time, the data is normalized by the size of the UTXOs to obtain the relative number of UTXOs in profit/loss, i.e., the percentage.

The percentage of UTXOs in profit approaches 100% every time a previous all-time high is broken. According to Glassnode, applying the 50-day simple moving average (SMA) to the data fits the historic data optimally and creates a much better signal that indicates both global and local Bitcoin cycle tops.

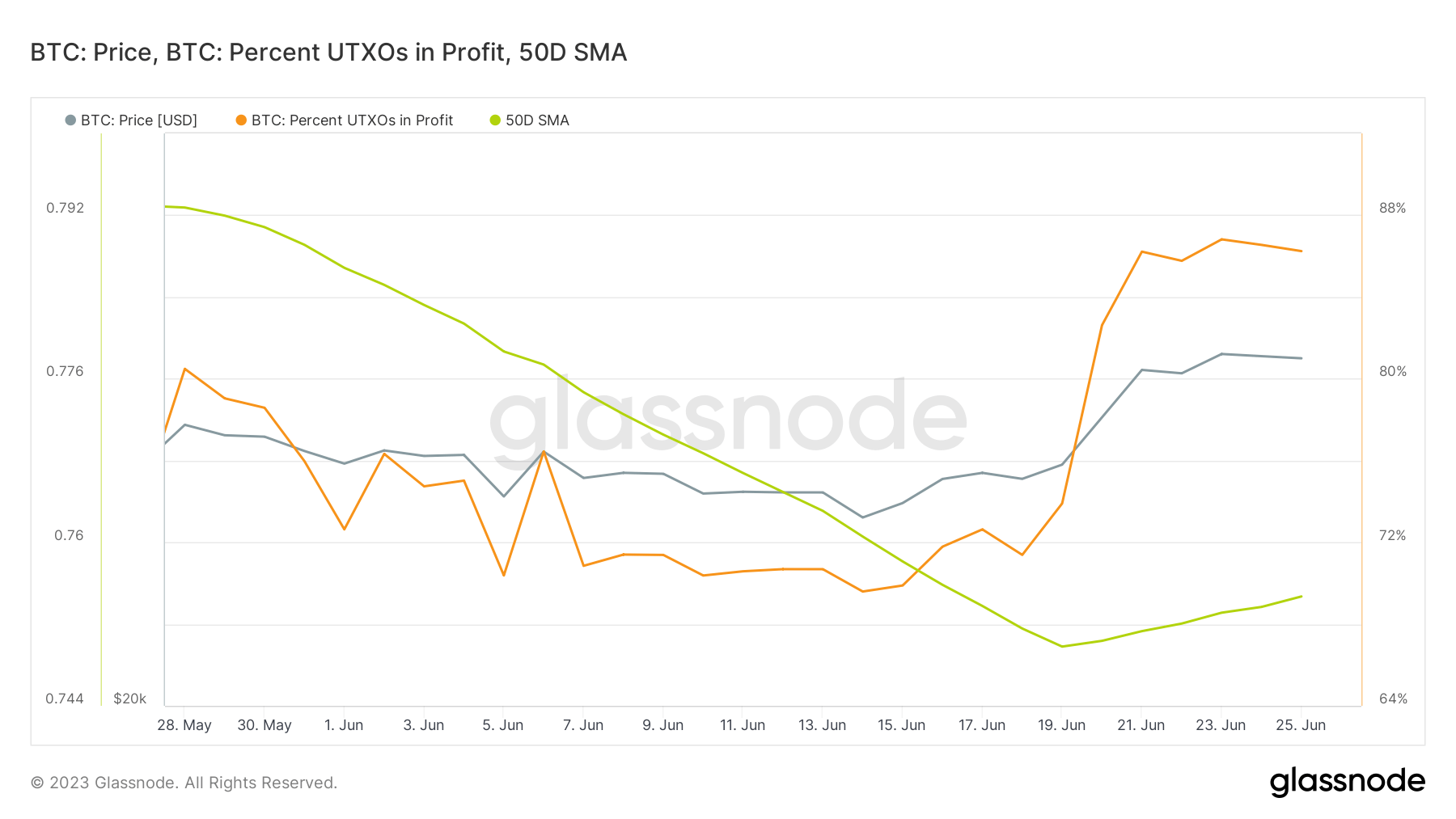

CryptoSlate analysis found that 86.24% of Bitcoin UTXOs are currently in profit. This is a sharp spike from 69.59% recorded on June 14 and a slight drop from the 14-month high of 86.8% recorded on June 23. This indicates that most Bitcoin holders are currently profitable, which could significantly affect the market’s future trajectory.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…