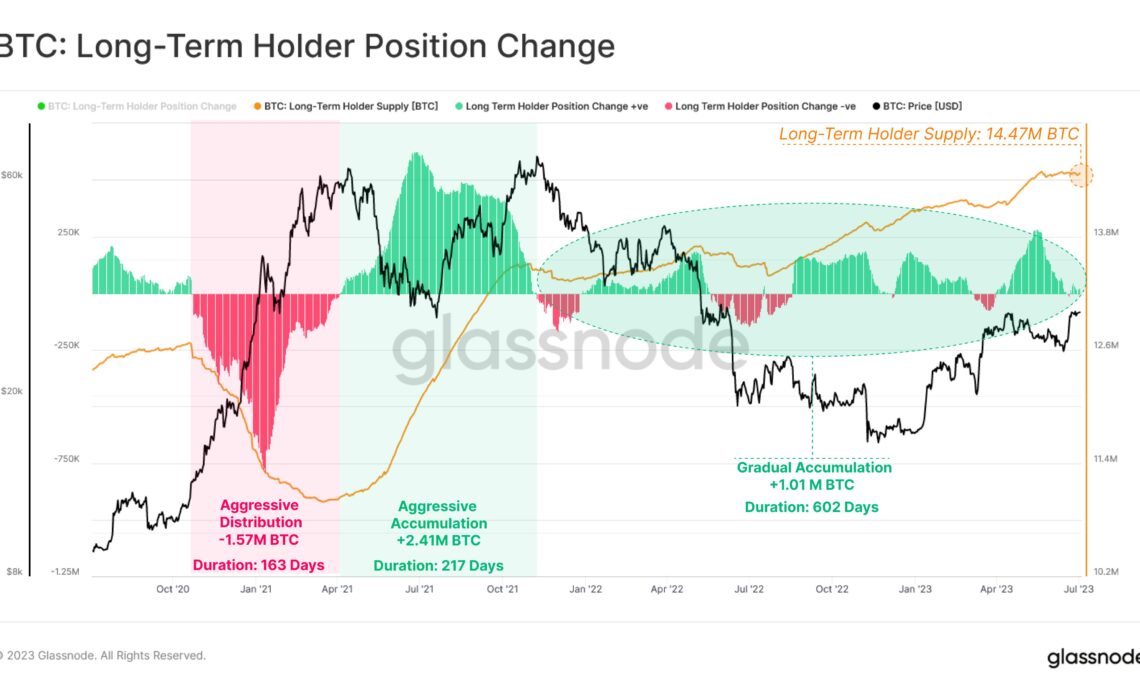

Long-term holders have been gradually accumulating Bitcoin (BTC) for nearly two years, according to the crypto analytics firm Glassnode.

Glassnode notes in a new tweet that long-term holders have amassed 1.01 million BTC over the past 602 days, bringing that cohort’s total supply to 14.47 million Bitcoin, just 20,000 BTC short of the all-time high.

The analytics firm also notes that “shrimp” holders, meaning addresses with less than 1 BTC, have been “aggressively” accumulating Bitcoin at a rate of 33,400 BTC a month.

Glassnode says there have been only 130 out of 5263 total trading days, roughly 2.5%, that have recorded a larger monthly position change. The shrimp cohort now holds 1.33 million BTC.

Bitcoin is trading at $31,017 at time of writing. The top-ranked crypto asset by market cap is up 1.3% in the past 24 hours, around 0.7% in the past week, nearly 14% in the past month, and roughly 87% since the start of 2023.

Despite the massive gains this year, Bitcoin remains around 55% down from its all-time high of more than $69,000, which it hit in November 2021.

The crypto analytics firm IntoTheBlock notes about 75% of BTC holders are making money at Bitcoin’s current price. The firm also says 69% of BTC holders have held onto their Bitcoin for more than one year.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Illus_man/Andy Chipus

Click Here to Read the Full Original Article at The Daily Hodl…