The size and popularity of the Bitcoin options market have made it one of the best tools for gauging market sentiment and predicting volatility. Previous CryptoSlate analysis found that options wielded an outsized influence over Bitcoin’s price volatility and were responsible for most of the volatility we’ve seen this quarter.

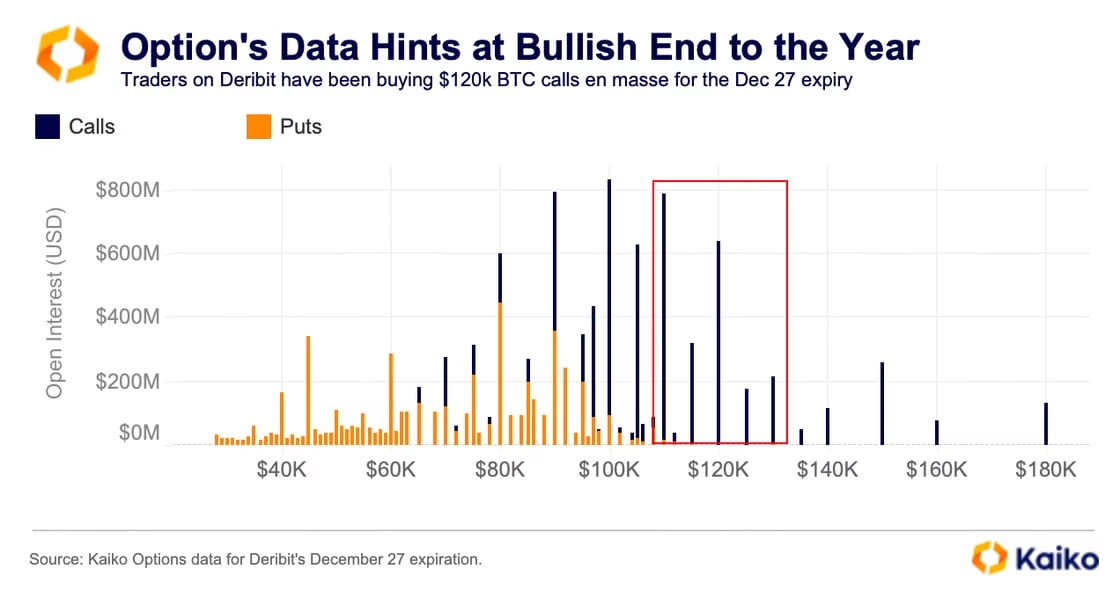

Options data has shown a significant concentration of open interest (OI) at the $120,000 strike price for contracts expiring at the end of the year. This particular strike price has garnered significant attention from traders, with over $640 million in OI on Deribit alone. This OI far surpasses the activity we’ve seen at neighboring strikes across most platforms. Such a heavy focus on a single strike price shows speculators are optimistic about a price increase but creates a possibility of high volatility in the coming weeks.

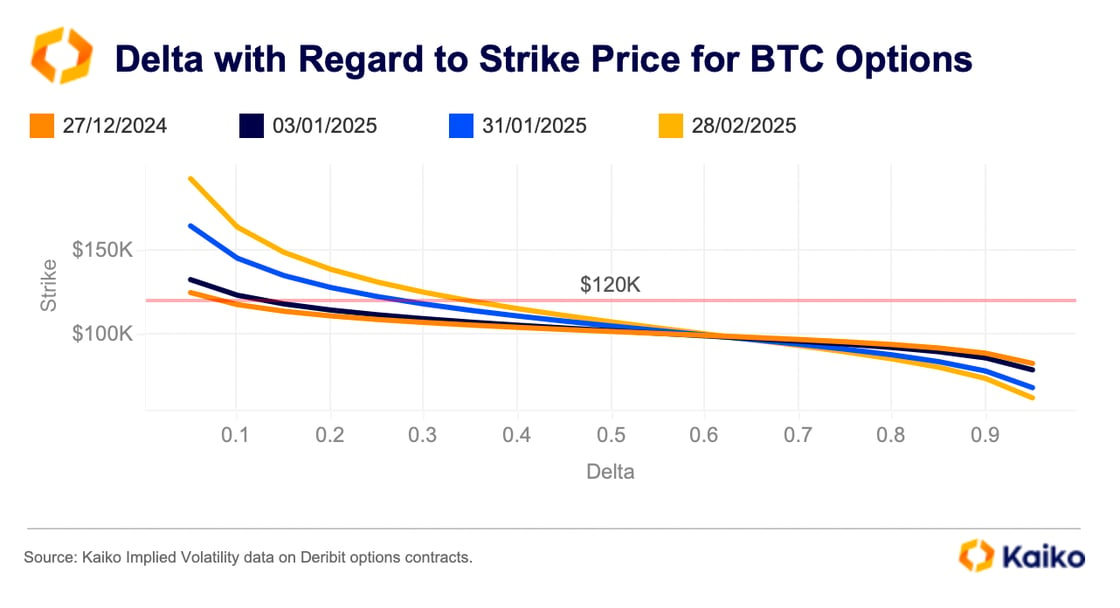

Open interest in strike prices far above the current spot price of Bitcoin can indicate that traders are willing to bet on extraordinary price movements. While Bitcoin’s price at press time remains significantly below the $120,000 level, fixed at around $107,000, the options delta can provide a clearer perspective on the probability of such bets materializing.

Delta, a key options metric, represents the sensitivity of an option’s price to changes in the underlying asset and can also serve as an approximation of the option’s probability of expiring in the money. For the $120,000 strike expiring on December 27, the delta sits at approximately 0.10, suggesting a 10% chance that Bitcoin will reach or exceed this price by year’s end, data from Kaiko showed.

As options are forward-looking, they provide insight into where traders believe the market could move and how volatile they expect it to be. A high concentration of open interest at a particular strike and substantial volume show which levels traders see as significant. In this case, the $120,000 strike emerges as a preferred point.

This is particularly significant because options activity often precedes spot market trends, as traders use options to hedge, speculate, or capitalize on expected volatility. High open interest on such a high strike price shows the market is preparing for a sharp price increase.

The size of…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…