The emergence of the Ordinals protocol has transformed Bitcoin from a somewhat stale single-asset chain into something much more exciting.

However, this newfound excitement has sparked pushback from laser-eyed purists, who argue that BTC was not intended for non-monetary transactions – some going as far as calling the protocol a spam attack on the network.

Brushing aside the protests, Ordinals Capitalists say a permissionless system also includes the liberty to utilize Bitcoin in any manner one chooses. They accuse purists of attempting to spoil their fun.

The divergent viewpoints have set the stage for a potential chain split – which ultimately serves no one’s best interest.

Taproot opened Pandora’s box

The Taproot soft fork was rolled out in November 2021. At the time, it was primarily regarded as an upgrade to improve network security, efficiency, and scalability. However, it also enabled executable commands and the implementation of certain scripts – thus laying the foundation for Ethereum-like functionality such as smart contracts and dApps.

In January, the impact of this additional Ethereum-like functionality began to take shape as developer Casey Rodarmor released Ordinals. This protocol allows for each of the 100,000,000 satoshis in a Bitcoin to be inscribed with additional metadata, including text, images, video, and code.

By February, the Ordinals protocol was used to write a wizard jpeg into the blockchain, opening the door to a Bitcoin NFT market. But as a “square peg, round hole” use of the technology, acquiring and trading Bitcoin NFTs was a cumbersome and technically challenging feat, requiring knowledge of node synching and trusting a third party to release the NFT upon payment.

Recently, supporting wallets, including Ordinals Wallet, Xverse, and Hiro Wallet, have rolled out to address these pain points, making the process more like the standard experience NFT buyers are used to.

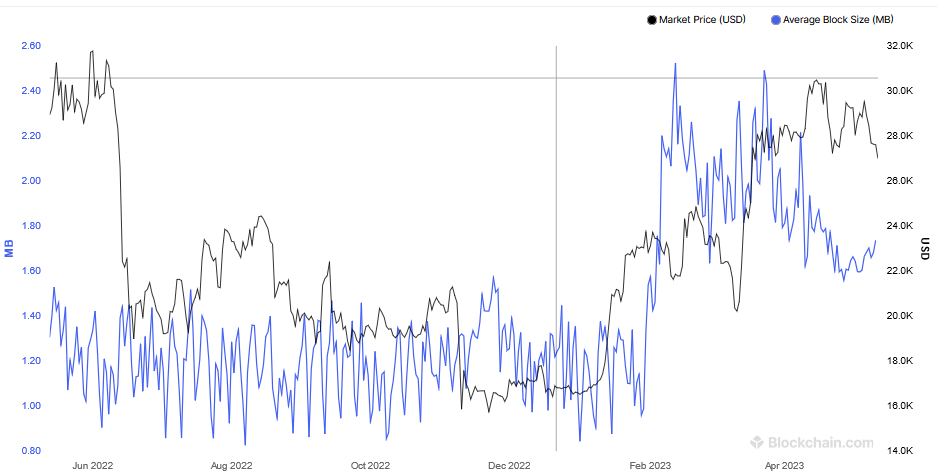

Before Ordinals NFTs went live, the average block size was hovering around 1.2 MB, but since its rollout, subsequent blocks have more than doubled on average – negatively affecting speed and scalability. Additionally, higher transaction fees and chain bloat, through a backlog of unconfirmed transactions, have added to useability problems.

Here come the BRC-20 tokens

Things stepped up in March when anonymous developer “Domo” launched BRC-20 tokens – bringing a fungible token standard to Bitcoin. By…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…