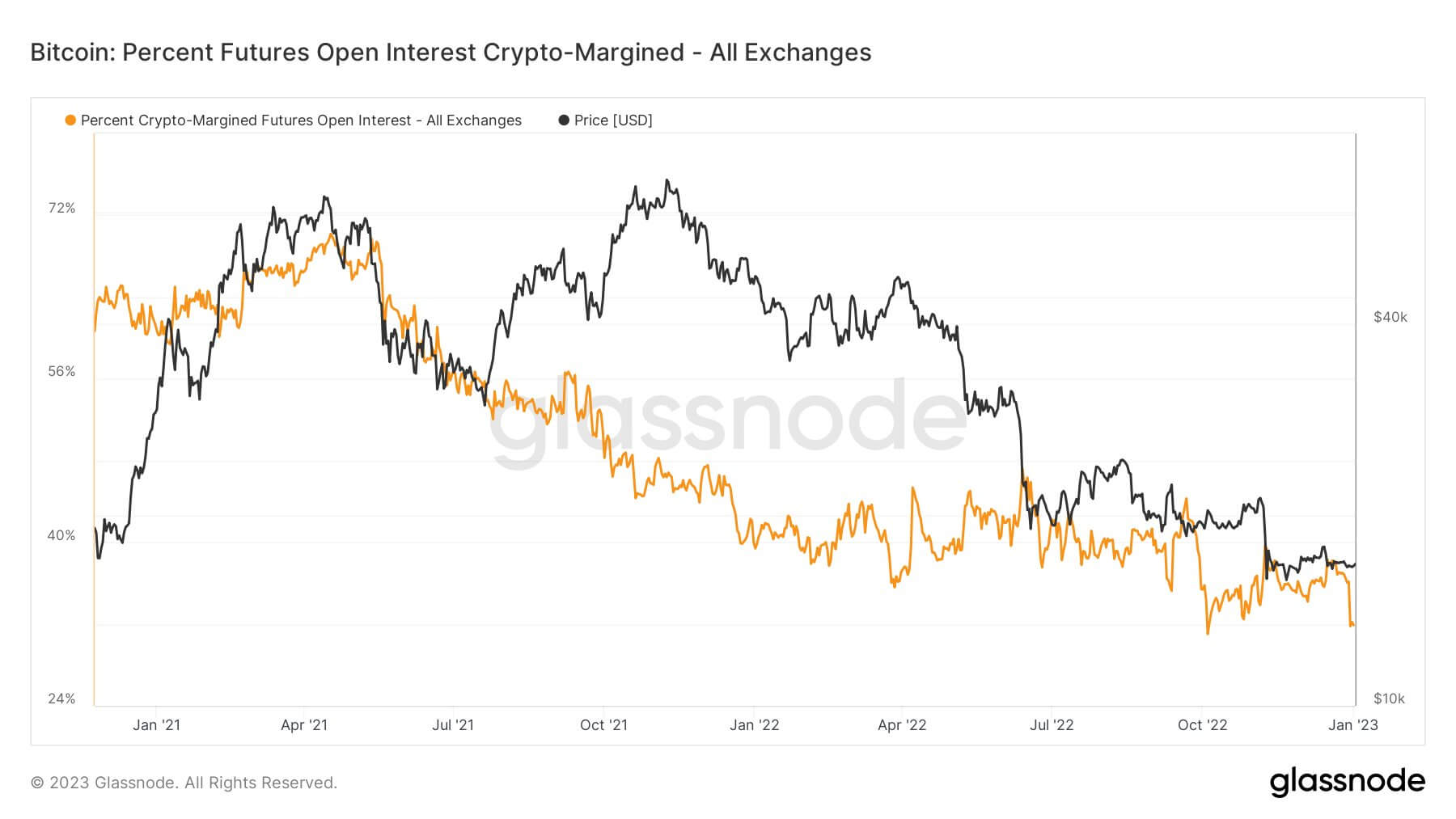

Bitcoin (BTC) began the year risk-off — as seen in the Futures Open Interest (OI) Crypto-Margined metric displayed below.

The decline in BTC Futures OI percentage seen from July 2021 into 2022 portrayed a recovery into a risk-on narrative throughout 2022. However, starting at almost the lowest point in two years, risk is coming off the table fast as we begin 2023.

Throughout 2021, over 60% of Futures contracts were using BTC as the underlying asset — lending to the risk-on narrative as BTC is more volatile compared to a stablecoin.

Meanwhile, in 2022, crypto-backed margin remained relatively flat in the 35% to 40% range — lower than 2021, but suggestive of stability returning. However, a 15% adjustment to the downside as we begin 2023 indicates that risk is coming off fast into the first quarter.

Crypto-backed margin also fell similarly on four previous occasions:

- In May 2021 following the China ban on crypto

- Between November and December 2021 just after the all-time high (ATH)

- In April 2022 around the Luna collapse

- In October 2022 with the lead up to the FTX collapse entering a rocky Q4 from a macro standpoint.

![Bitcoin: Futures Open INterest crypto-Margined [BTC] - Source: Glassnode.com](https://vcpcrypto.com/wp-content/uploads/2023/01/Only-150K-Bitcoin-remain-in-Future-OI-as-switch-to.png)

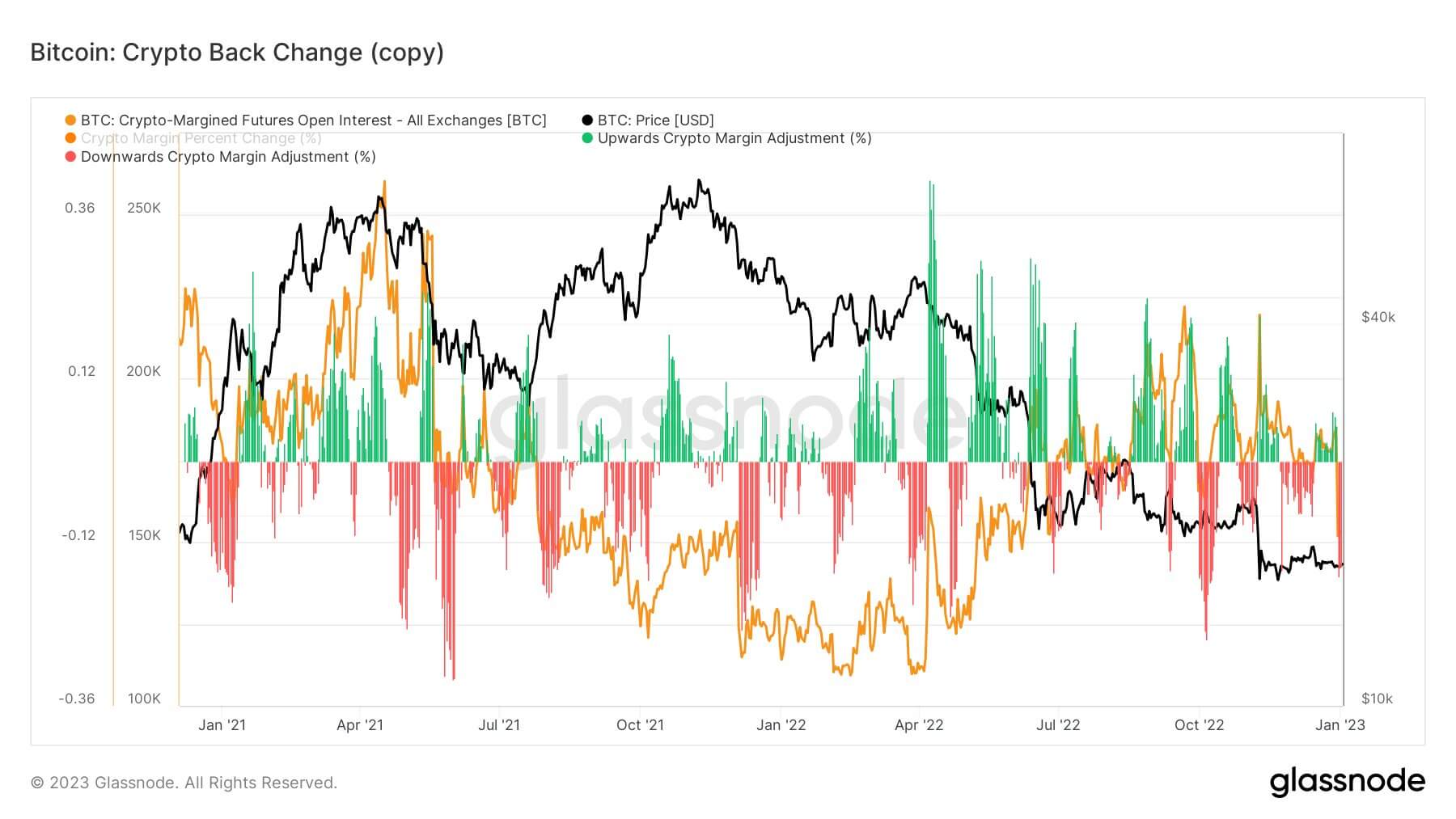

Approximately 150,000 BTC remains in Futures OI — its lowest levels since April 2022 — as the risk-off trend decline continues to emerge.

To further reveal the distinct switch away from BTC to risk-off and cash, the ‘Cash-Margined’ metric shows a constant incline since April 2021 to a current level of 327,000 BTC — backed by cash as the underlying asset.

![Bitcoin: Futures Open Interest Cash-Margined [BTC] - Source: Glassnode](https://vcpcrypto.com/wp-content/uploads/2023/01/1672765325_982_Only-150K-Bitcoin-remain-in-Future-OI-as-switch-to.png)

Disclaimer: The levels displayed only represent exchanges covered in Glassnode data.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…