Blockchain analytics platform Santiment says that a key social metric indicates crypto markets may soon rebound after crashing.

Santiment says that after Bitcoin’s sudden collapse below $26,000, the use of the term “bear market” has increased to an 11-week high on social media platforms, which is a bullish signal.

“A positive sign that crypto markets will rebound is the fact that traders are increasingly referring to current market conditions as a bear market. Historically, when traders show FUD (fear, uncertainty and doubt), the probability of price rises increases considerably.”

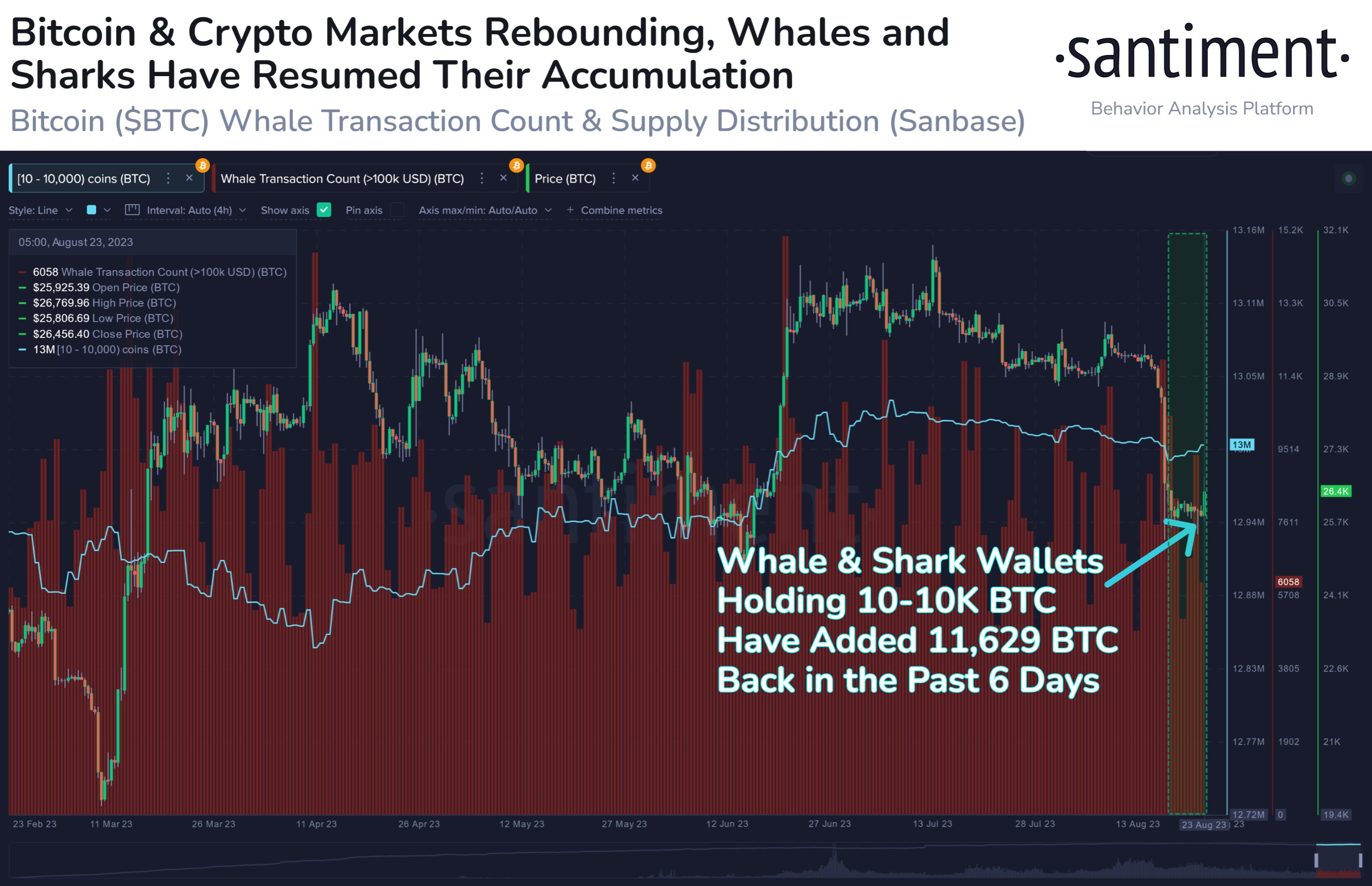

According to the analytics firm, deep-pocketed investors have started accumulating Bitcoin again, which contributed to BTC’s rally on Wednesday.

“Bitcoin jumped back as high as $26,800 Wednesday as key whale and shark addresses are now collectively adding to their stacks once again. There are currently 156,660 wallets holding 10 to 10,000 BTC, and they have accumulated $308.6 million since August 17th.”

Bitcoin is trading for $26,042 at time of writing, down 0.4% in the last 24 hours.

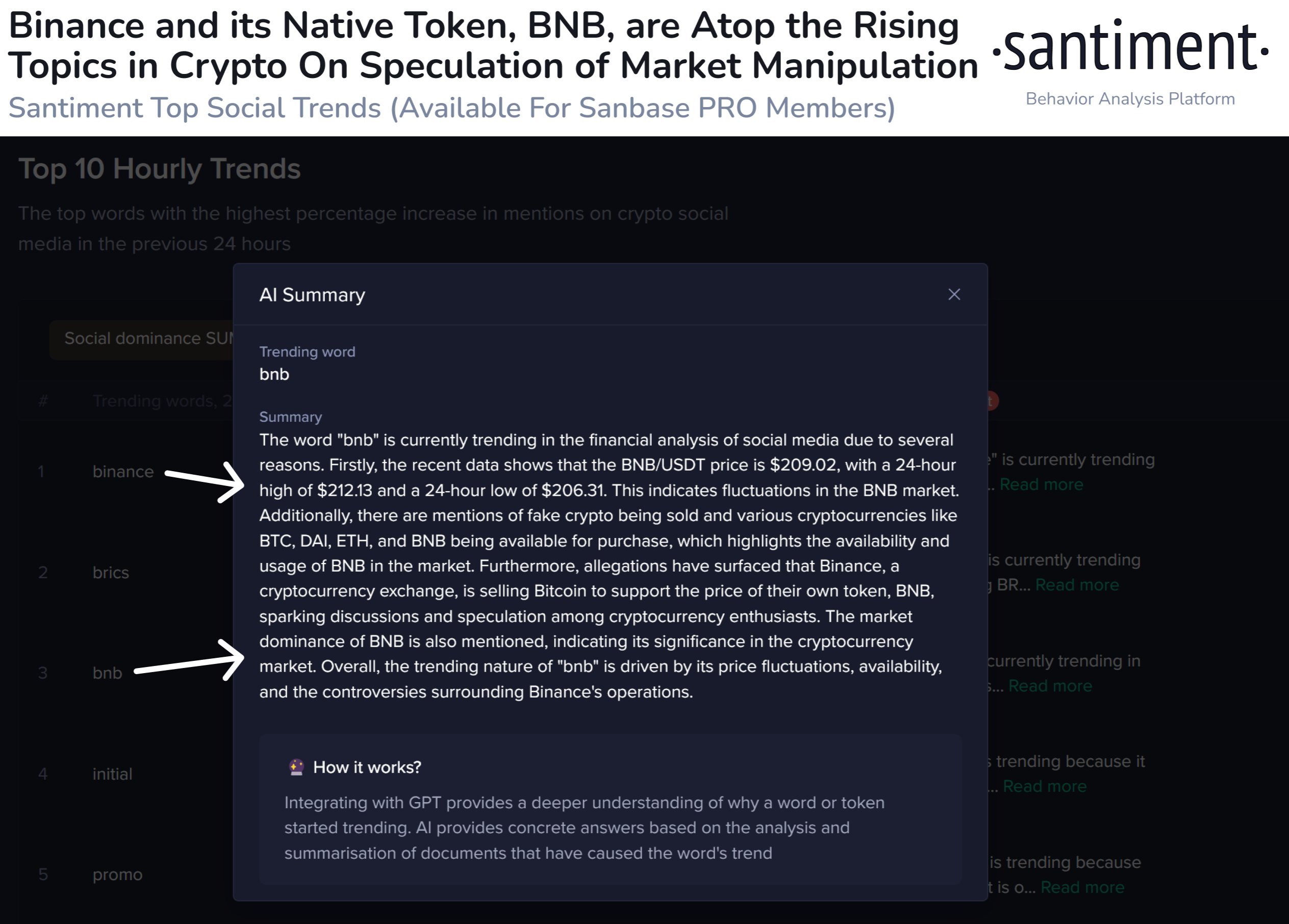

Santiment also notices that there is increasing concern on social media about the state of the world’s top crypto exchange Binance, including market manipulation rumors that may be impacting Bitcoin’s price.

“Binance and BNB are currently the first and third (respectively) fastest-rising topics in crypto. Major allegations point to [Binance CEO Changpeng Zhao] continuing to actively sell off their share of Bitcoin to support their own native token and keep it propped up above key support levels.”

BNB is trading for $216 at time of writing, up 0.6% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate…

Click Here to Read the Full Original Article at The Daily Hodl…