After a brief struggle to regain footing, Bitcoin finally broke through the $52,000 barrier on Feb. 14. While $50,000 was a critical psychological benchmark, trading above $52,000 indicates rising market confidence in Bitcoin and can mean the end of the bear market.

During periods of price volatility, especially significant upward movements, it’s important to analyze the availability of Bitcoin’s supply. Knowing how much of Bitcoin’s supply is theoretically available for trading can show us the amount of buying or selling pressure the market could absorb. An increase in supply ready to be traded can cause the price to drop if there’s no demand to meet it. Conversely, a decrease in the supply of Bitcoin that can be quickly bought can cause a supply crunch that leads to an increase in price.

Supply availability can’t be seen through a single metric. The supply of Bitcoin sitting in exchange wallets is usually taken as the best proxy, but it offers little depth. CryptoSlate analyzed several other on-chain metrics, including UTXOs and accumulation addresses, to better understand whether the tradeable supply is tightening.

There are, of course, many other metrics that can further and better show the state of the market. For example, the differences in long-term and short-term holder supplies can show if there’s an increase in the tradeable (STH) and non-tradeable (LTH) supply, which could create a crunch. However, focusing on less widely used metrics like UTXOs can provide a fresh view of a heavily-analyzed topic.

Unspent Transaction Outputs (UTXOs) are essential in understanding the Bitcoin network. UTXOs represent the amount of BTC that remains unspent and stored in a wallet after a transaction, serving as a fundamental indicator of Bitcoin’s liquidity and movement within the market.

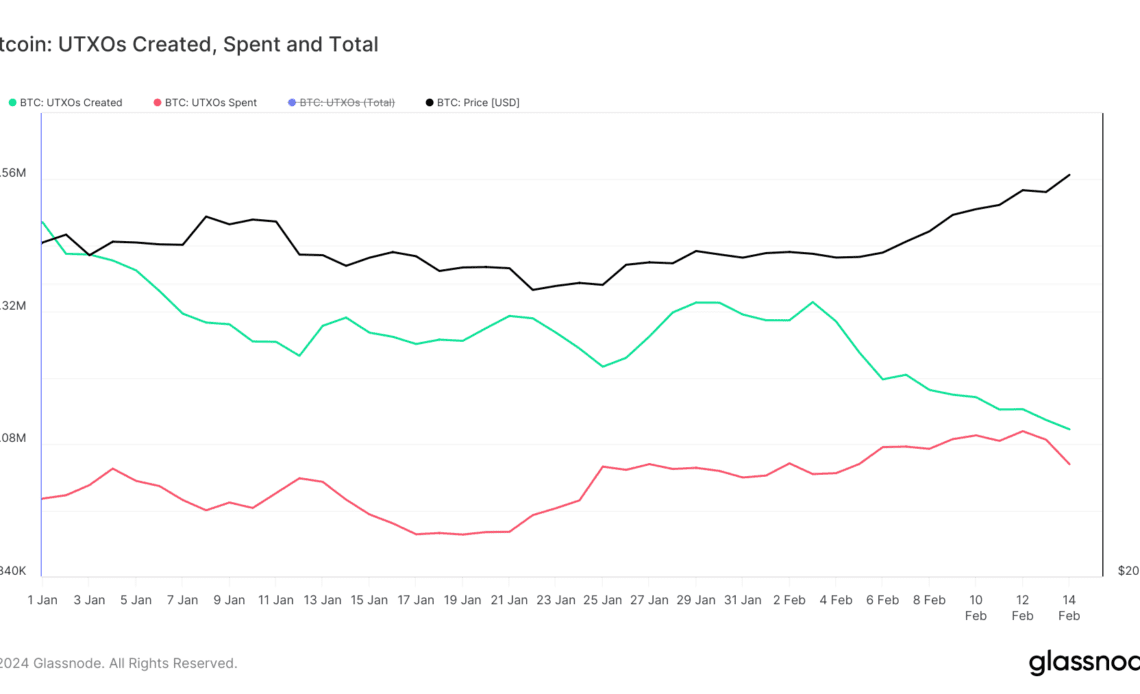

On Feb. 1, the number of created UTXOs stood at 1.304 million, which decreased to 1.106 million by Feb. 14. Concurrently, the number of spent UTXOs remained relatively stable. This drop suggests that there has been a decrease in the willingness to transfer BTC between addresses.

This trend can be seen as the first sign of a potential liquidity crunch, which could significantly impact Bitcoin’s price in the coming weeks.

The launch of spot Bitcoin ETFs in the US was one of the most significant milestones for Bitcoin when it comes to institutional adoption,…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…