Recent on-chain activity suggests that blue-chip investors are the force behind Bitcoin’s (BTC) latest price action, according to a popular crypto analyst.

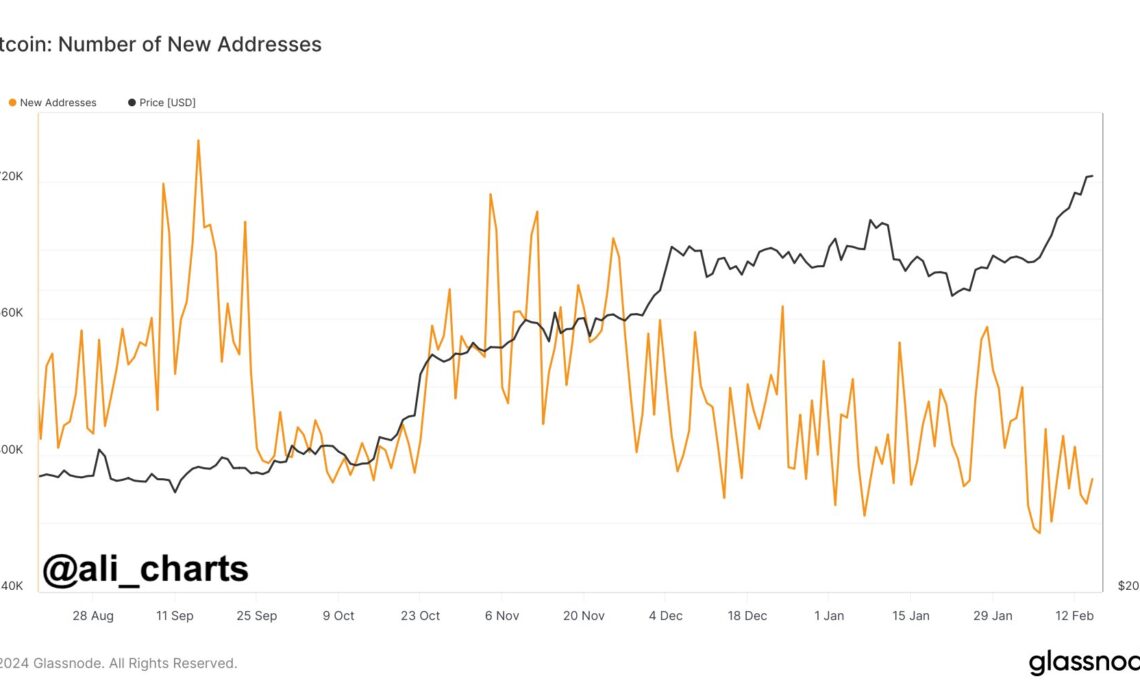

Ali Martinez tells his 45,800 followers on the social media platform X that there’s been a “noticeable decline” in the daily creation of new BTC addresses amid Bitcoin’s recent price surge.

According the Martinez, the reduction in the creation of new BTC wallets indicates that institutions heavily account for the recent price movement of BTC as retail traders are still waiting on the sidelines.

“This trend points towards a lack of retail participation in the current BTC bull rally, suggesting that the recent price action is primarily fueled by institutional demand.”

BTC is trading at $52,048 at time of writing. The top-ranked crypto asset by market cap is up 10% in the past week and nearly 22% in the past month.

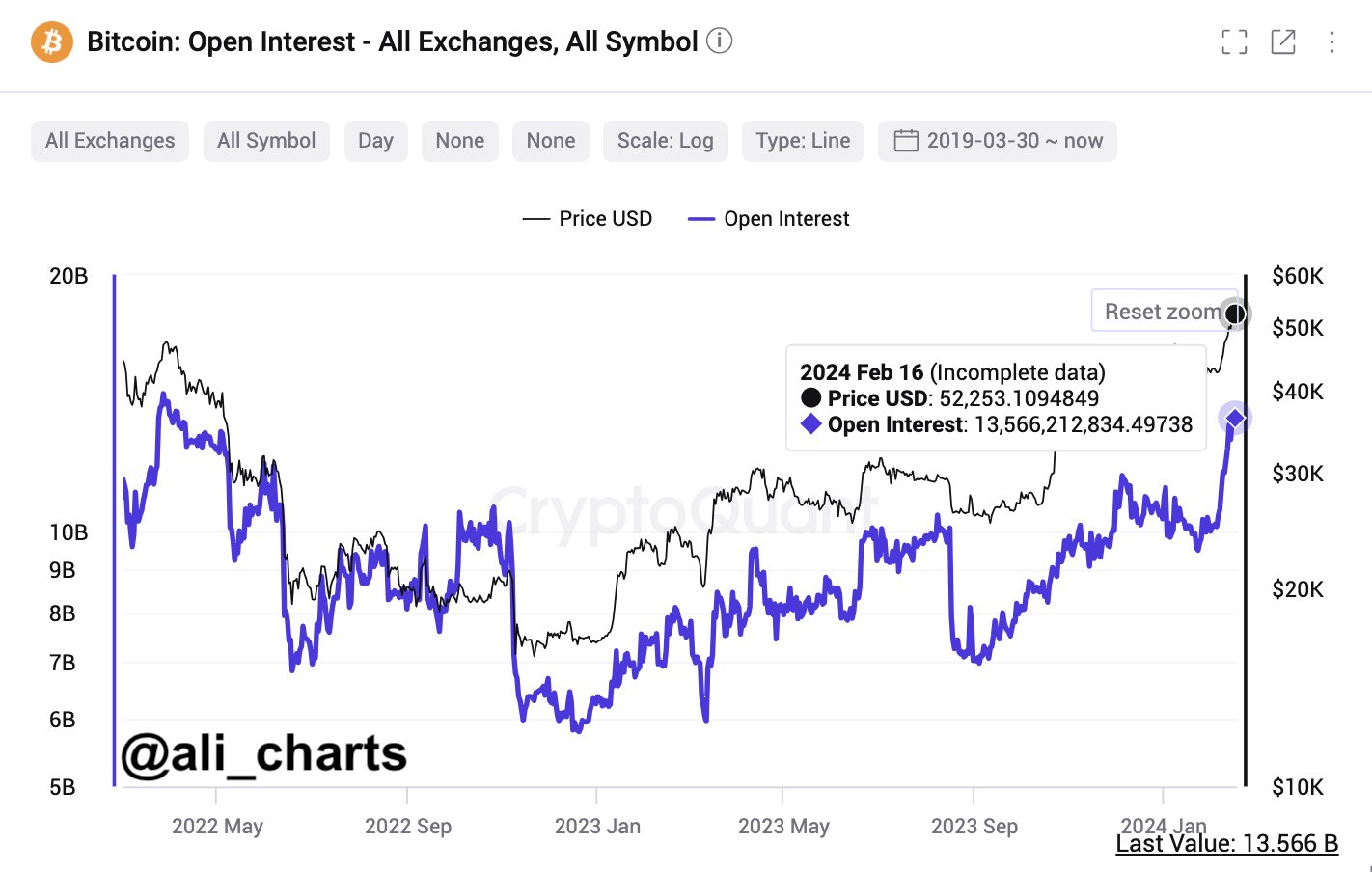

Martinez notes that Bitcoin’s open interest (OI) across all exchanges has jumped to $13.57 billion, its highest level since April 2022. Open interest is a metric that tracks the total amount of open BTC long and short positions.

The trader also points out that Bitcoin whales have purchased more than 100,000 BTC in the past ten days worth about $5 billion.

In terms of other crypto assets, Martinez says Ethereum (ETH) rival Cardano (ADA) could break out earlier than expected.

“Still, if history repeats itself, we are anticipating ADA to rise to $0.80, retrace to $0.60, and then enter a bull run toward $8 by January 2025!”

ADA is trading around $0.596 at time of writing. The ninth-ranked crypto asset by market cap is up more than 10% in the past week.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…