The biggest news in the cryptoverse for Nov. 17 includes the high selling tendency of Bitcoin holders older than 10 years, SBF’s $1.6 million personal loan from Alameda Research, and Bitcoin and Ethereum’s emergence as the second and third most shorted crypto asset.

CryptoSlate Top Stories

Who sold the most BTC in the aftermath of the FTX collapse? 10yr holders sell at highest ever rate

The collapse of FTX put immense pressure on investors, while the price of Bitcoin (BTC) fell as low as $15,000.

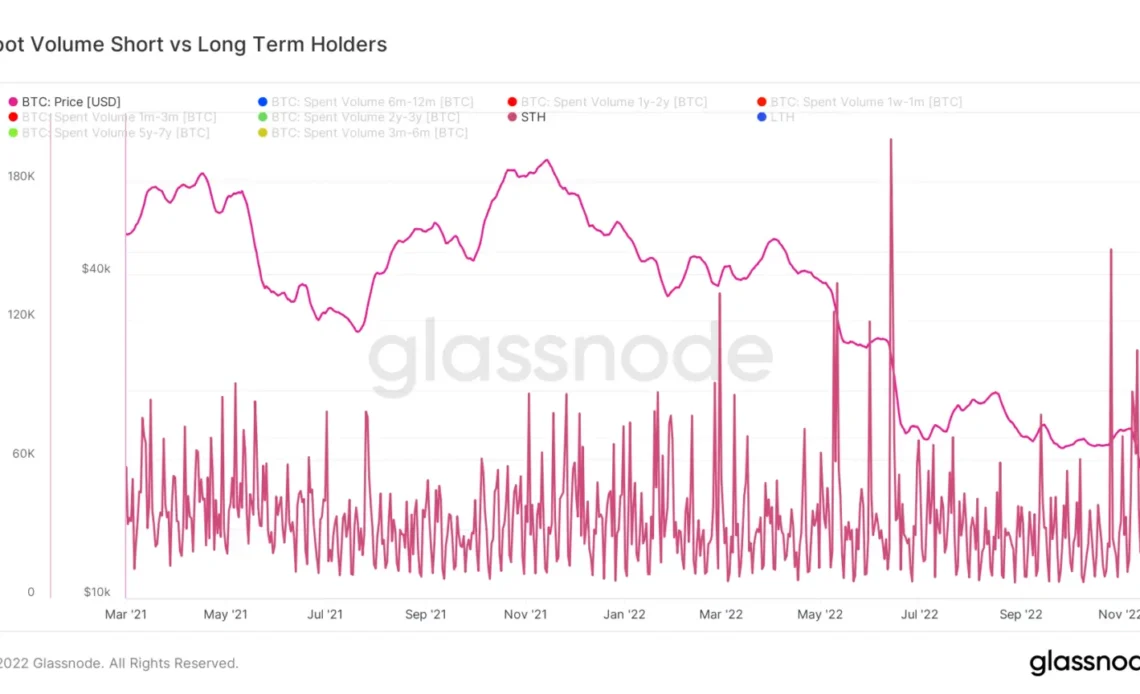

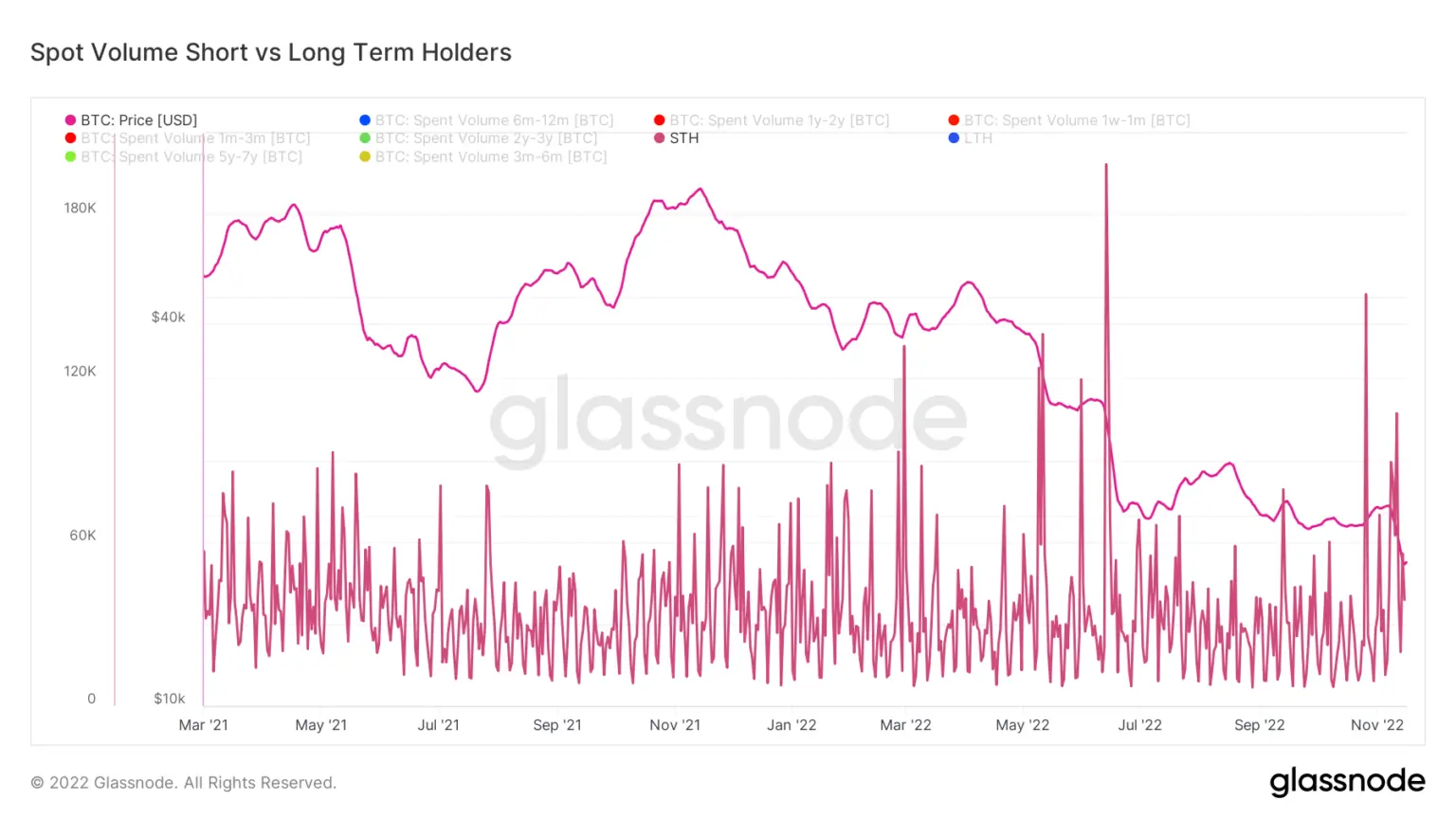

To reveal where the selling pressure was coming from, CryptoSlate analysts examined the short-term (STH) and long-term holders (LTH).

While history shows that the LTH is the first to sell their coins when the numbers start to fall, the turmoil following the FTX collapse didn’t shake the confidence of long-term holders.

Instead, the market recorded its fifth-largest number of STH sellers since March 2021, which translates to around 400,000 Bitcoins sold by STH between Nov. 10 and Nov. 17.

FTX bankruptcy court filing reveals Alameda gave $1.6B in loans to SBF, others

FTX’s new CEO John Ray III’s court filing revealed that Sam Bankman Fried (SBF) got $1 billion in personal loans from Alameda Research.

Ray referred to the situation as a “complete failure of corporate controls and such a complete absence of trustworthy financial information.”

The filing also disclosed that Alameda lent $543 million to FTX director of engineering Nishad Singh and $55 million to FTX Co-CEO Ryan Salame.

FTX collapse sees Bitcoin, Ethereum to be shorted the second and third-most amount

After the FTX collapse, Ethereum (ETH) became the second-most shorted crypto in the market, followed by Bitcoin as the third.

According to the average funding rate set by exchanges for perpetual futures contracts, long positions pay periodically, while shorts pay whenever the rate percentage turns positive. The recent profound negative fund rates indicate an upcoming depression before the markets start healing.

Genesis sought $1B emergency loan but never got it

Crypto lender genesis sought out an emergency loan of $1 billion from investors but never got it, as the Wall Street Journal reported.

The reports noted that Genesis sought the funds because of a “liquidity crunch due to certain illiquid assets on its balance sheets.”

FTX attacker continues swapping tokens; exchanges $7.95M BNB for BUSD, ETH

The FTX attacker kept their hands busy on Nov. 17 and drained around $600 million…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…