Malta’s cryptocurrency market regulator said that none of the local licenses issued under the Markets in Crypto-Assets Regulation (MiCA) are at risk following a recent peer review by European Union regulators.

“No MiCA license in Malta is at risk of revocation or re-evaluation as a result of the peer review outcomes,” a spokesperson for the MFSA told Cointelegraph, adding that the authority has already started addressing the issues identified in the review.

The statement came after the European Securities and Markets Authority (ESMA), Europe’s primary supervisory body overseeing MiCA compliance, on Thursday released a peer review on certain MiCA authorization gaps by Malta’s Financial Services Authority (MFSA).

The MFSA said Malta’s ongoing commitment to close collaboration with EU authorities and its role as a proactive leader in crypto regulation is not in question, despite some level of skepticism in the community.

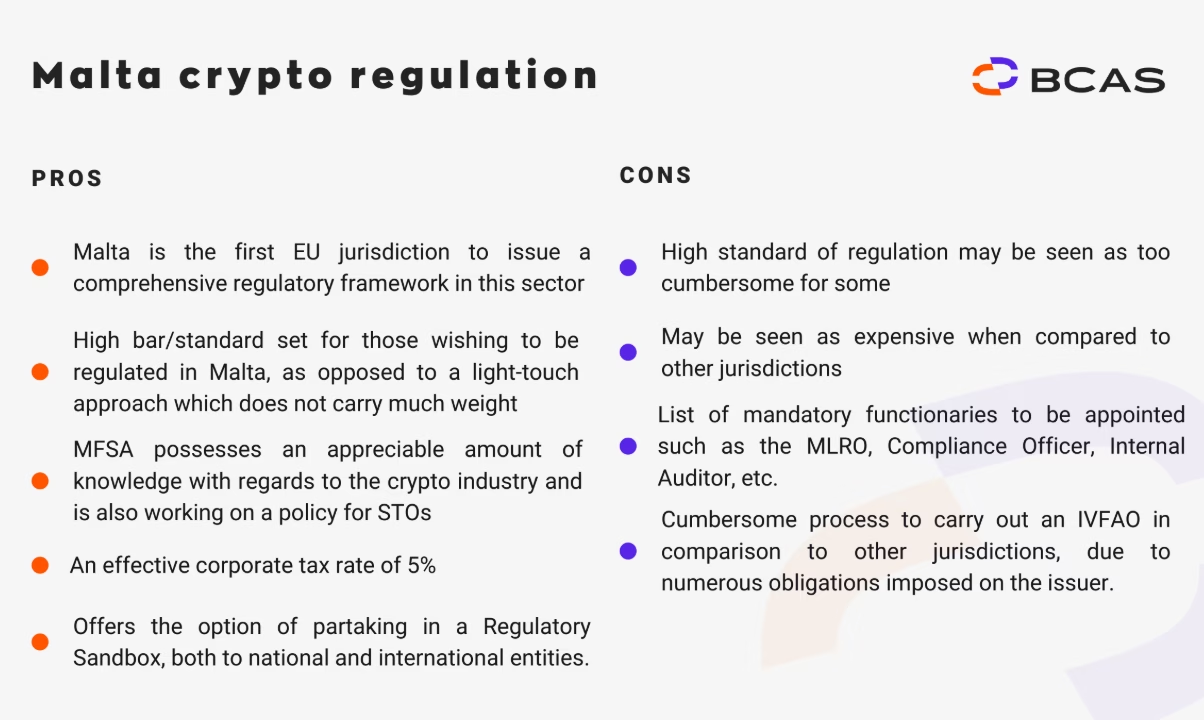

Malta is a pioneer of crypto regulation in EU

A spokesperson for the MFSA said the ESMA report recognized the regulator as a highly effective supervisor.

“This is not surprising considering that Malta was a pioneer in crypto regulation way back in 2018,” the spokesperson said.

“I think the review paints Malta in a good light; many forget that the Maltese have been fully regulating CASPs [crypto asset service providers] before MiCA was even contemplated,” XReg consulting partner Nathan Catania told Cointelegraph.

Since introducing three crypto-related bills in 2018, the Maltese government has emerged as a pioneer of crypto regulation in Europe.

“Malta is the first country to regulate DLT [distributed ledger technology] and crypto assets in such a holistic manner, covering both the technological as well as the financial services components,” the MFSA said in a statement in July 2018.

Malta to implement guidance by September 2025

In the review, the ESMA outlined several recommendations to the MFSA and other National Competent Authorities (NCAs) in the EU to ensure proper supervision under MiCA.

The EU regulator specifically highlighted the need to timely assess CASPs’ growth plans, scrutinize conflicts of interest in multi-service CASPs and evaluate risks from exposure to decentralized finance (DeFi) and unregulated services.

“We trust that this review gives further confidence to those considering licensing in Malta…

Click Here to Read the Full Original Article at Cointelegraph.com News…