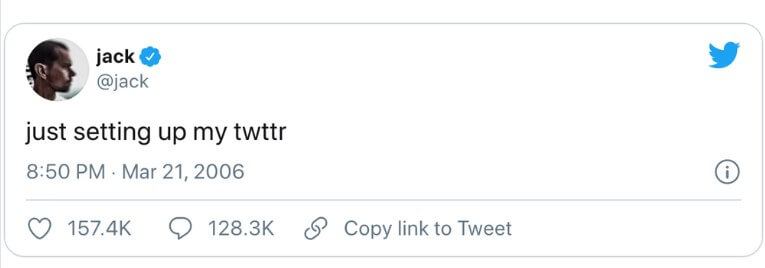

During the peak of the non-fungible token (NFT) market in 2021, crypto entrepreneur Sina Estavi made headlines when he purchased Twitter’s co-founder Jack Dorsey’s first tweet as an NFT for $2.9 million.

At the time of his purchase, the Iranian investor tied the NFT’s value to its uniqueness and its association with a valuable company like Twitter.

Two years later, the value perception of the same NFT has significantly changed with the best offer currently standing at just $3.77, according to the latest data from OpenSea.

While Estavi has been trying to resell the NFT since 2022, his efforts have been futile as he had listed the digital asset for $48 million. Estavi promised to donate half of his proceeds to charity at the time.

But the offer of a philanthropic gesture did not galvanize the community towards the NFT as the bids for the asset were as low as $280, while the highest amount offered then was $6,800. This greatly discouraged Estavi, who reportedly said he might never sell the NFT.

Estavi did not respond to CryptoSlate’s request for comment as of press time.

With the broader crypto market undergoing a record market downturn, the NFT sector has seen a further decline in activity and valuation since then, and bids for digital assets have drastically dropped. In fact, blue-chip NFT collections like Bored Apes and Crypto Punks have seen more than a 70% decrease in their floor price compared to their peak levels.

In the opinion of former SEC official John Reek Stark, a fractionalized link to a JPEG of a ‘bored ape’ with funny glasses and a colorful hat, or the NFT of a Tweet, regardless of the author, is neither a sound investment, a sensible means of commerce, nor a prudent pathway to financial success.

Former SEC enforcement official John Reek Stark described NFTs as a terrible investment that is essentially worthless.

“A fractionalized link to a JPEG of a “bored ape” with funny glasses and a colorful hat is not a sound…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…