Bitcoin (BTC) prepares to exit a grim November just above $16,000 — what could be on the menu for BTC price this week?

In a time of what analyst Willy Woo has called “unprecedented deleveraging,” Bitcoin is far from out of the woods after losing over 20% this month.

The impact of the FTX implosion remains unknown, and warning signs continue to flow in even after the first wave of crypto business bankruptcies.

In particular this week, eyes are on miners, who are seeing profits squeezed by falling spot price and surging hash rate.

Upheaval is in the air, and should another “capitulation” among miners occur, the entire ecosystem could be in for a further shock.

As “max pain” looms for the average hodler, Cointelegraph takes a look at some of the main factors affecting BTC/USD in the short term.

Bitcoin miners due “capitulation” — analyst

Like others, Bitcoin miners are seeing a major squeeze when it comes to selling accumulated BTC at a profit.

It remains to be seen exactly how much financial pain the average miner is in, but one classic metric is preparing to call “capitulation” once more.

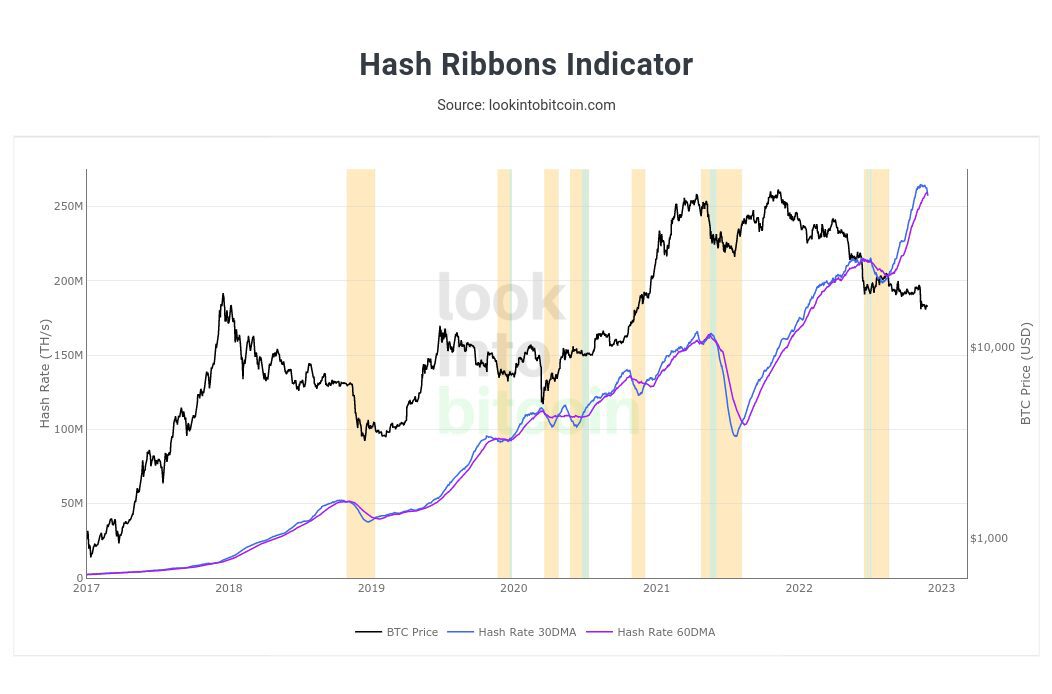

Just months after the last such period, Hash Ribbons is warning that conditions are again becoming unsustainable.

Hash Ribbons uses two moving averages of hash rate to infer conclusions about miner participation in the Bitcoin network. Crossovers of the trend lines denote capitulatory and recovery phases.

For Kripto Mevismi, a contributor to on-chain analytics platform CryptoQuant, the time is approaching for the former to reappear.

“So right now bitcoin difficulty is really high for miners so that means; costs are getting higher and doing business in this kind of environment is getting harder,” he wrote in a blog post.

“That’s why miners do not work in full force. If they have efficient- new generation mining machines, they put them into work but that’s all. Inflation is high and people feels effect of living costs, bitcoin price is declining, mining cost and difficulty is getting higher. Tough environment for miners.”

Kripto Mevismi added that a significant change in mining difficulty could help the situation.

Estimates from BTC.com for the next adjustment on Dec. 6 put the difficulty drop at 6.4% at the time of writing. Should it go to fruition, it will be the largest such drop since July 2021.

BTC.com and others likewise estimate that hash rate is now declining from record levels as miners wind down…

Click Here to Read the Full Original Article at Cointelegraph.com News…