Following the Bitcoin price surge back to $64,000, crypto analyst Rekt Capital is predicting a major breakout move in the coming weeks. In a new video analysis, the analyst forecasts a significant market movement around October 2024, based on historical precedents and current chart patterns.

Will October Be Bullish For Bitcoin Again?

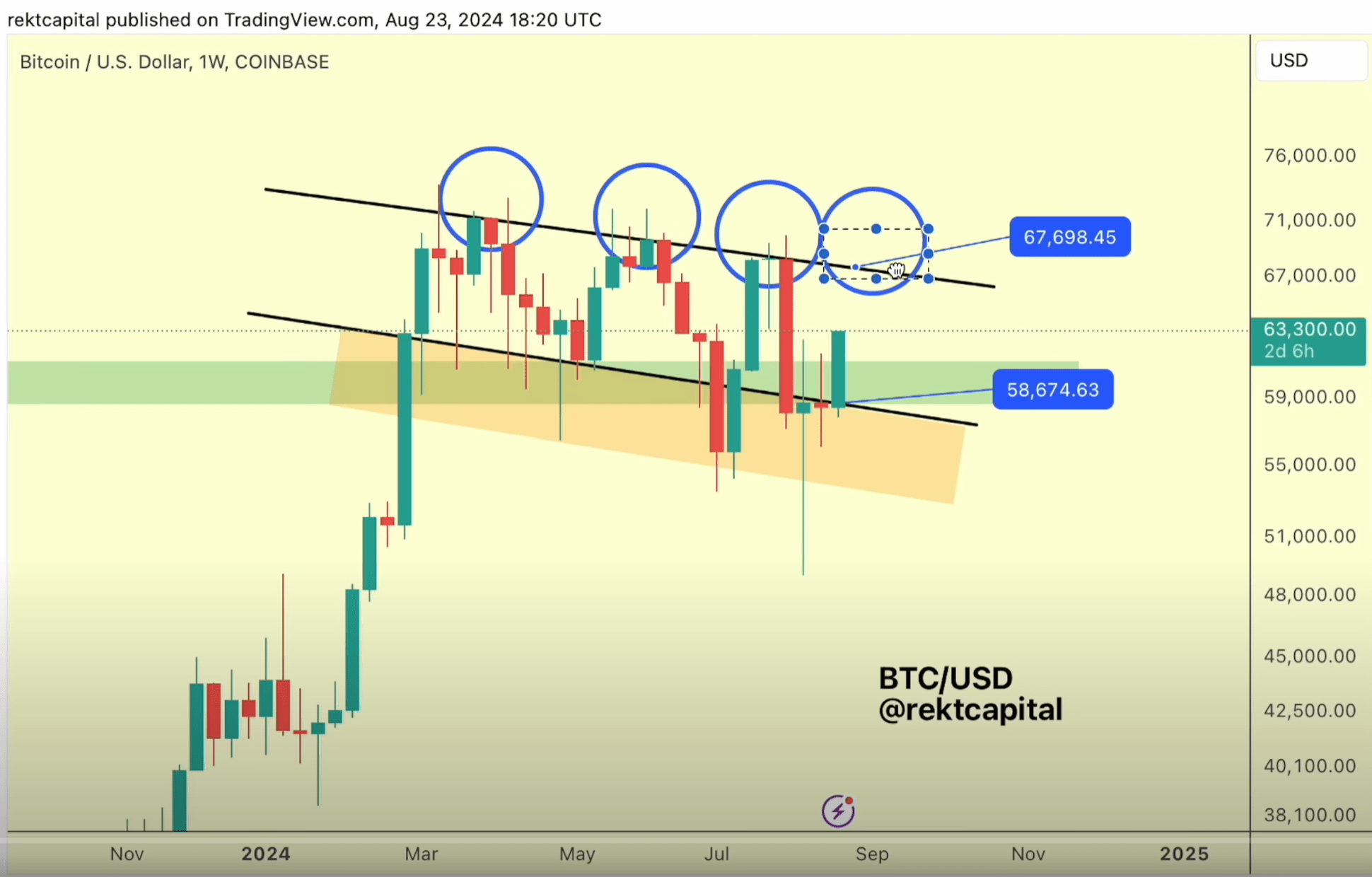

Looking at the weekly chart, Rekt Capital identifies a downtrending channel. Over the past four weeks, BTC has been deviating below this channel, searching for support that would enable a price expansion above the channel’s bottom. This movement has been met with a “fantastic recovery,” signaling potential for a return to the channel top at around $67,000 in the coming weeks.

“The channel bottom rebound is crucial as it has historically taken price from the channel bottom to the top in approximately two weeks on average,” Rekt Capital explained. He highlighted the importance of weekly candle closes above specific levels, particularly at $67,500 and eventually at $71,500, which would mark a break from the reaccumulation range high established post-halving.

Related Reading

“The consistent pattern of bouncing from the channel bottom to the top typically spans an average of two weeks, but in the current context, we are observing a potentially elongated consolidation phase at these lower levels,” explained Rekt Capital. This observation suggests that while the rebound trajectory follows historical patterns, the consolidation at lower prices could afford investors bargain buying opportunities.

Focusing on the technical thresholds, Rekt Capital emphasized the criticality of several weekly candle closes above pivotal price points. Firstly, a close above $66,000 would reconfirm the reaccumulation range’s lower boundary as a newfound support, setting the stage for further upward movement. More importantly, a decisive weekly close above $67,500 would signify a breach of the persistent lower highs trend that has dominated since March of this year.

Related Reading

“The weekly close above these specific levels is not merely a technical achievement but a psychological victory for market participants, indicating a weakening of sell-side pressure and a regain of bullish momentum,” noted Rekt Capital.

Historically, Bitcoin shows a tendency to initiate major rallies approximately 150 to 160 days following a halving event. Drawing parallels…

Click Here to Read the Full Original Article at NewsBTC…