The recent Bitcoin halving event, which cut the block reward for miners in half on April 20, 2024, has sparked a wave of optimism in the cryptocurrency market. While a brief dip in a key futures metric hinted at potential short-term bearishness, overall market indicators suggest a bullish trend taking hold.

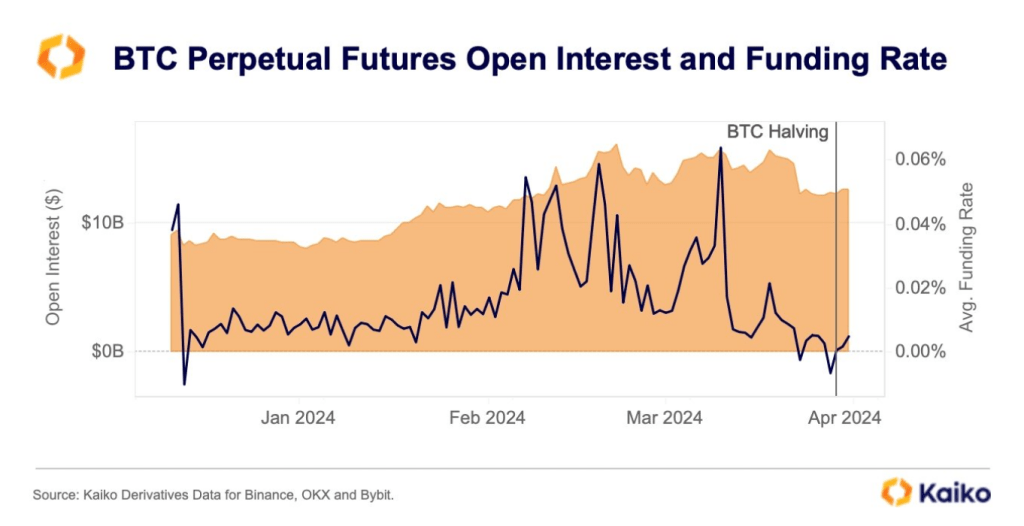

Analysts at Kaiko, a market data provider specializing in crypto derivatives and futures, reported a shift in Bitcoin’s funding rate leading up to the halving. The funding rate is a fee paid between long and short position holders in futures contracts.

A negative rate signifies that short positions are compensating long positions, potentially indicating a bearish outlook. Notably, Bitcoin’s funding rate dipped into negative territory for the first time this year on April 18th, just two days before the halving.

Bitcoin Bounces Back With Renewed Bullishness

However, this short-lived bearishness seems to have been overshadowed by a broader sense of optimism. Following the halving, Bitcoin’s funding rate swiftly recovered and currently sits at a positive 0.0051. This suggests a return to the status quo where long positions are incentivized, reflecting a more bullish market sentiment.

Funding rates for $BTC perps turned negative for the first time since late 2023 in the lead up to the halving. pic.twitter.com/MjiU4C1L5m

— Kaiko (@KaikoData) April 24, 2024

Further bolstering this positive outlook is the uptick in Bitcoin’s Open Interest (OI), a metric that represents the total amount of outstanding futures contracts. Despite a dip last week, OI has since rebounded to over $17 billion, indicating continued investor engagement in the Bitcoin market.

Bitcoin is now trading at 64.250. Chart: TradingView

Halving Impact Exceeds Historical Trends

Perhaps the most intriguing finding from Kaiko’s analysis is the suggestion that this halving event might be having a more positive impact on Bitcoin’s price compared to previous halvings.

At the time of the report, Bitcoin was up 2.8% since the halving, exceeding the price increases observed immediately after the 2012, 2016, and 2020 halving events. Despite a slight price correction in the following days, Bitcoin remains nearly 3% up since the halving.

However, analysts caution against drawing definitive conclusions from this initial data. The cryptocurrency market is inherently volatile, and short-term fluctuations are to be expected.

Some experts point to historical…

Click Here to Read the Full Original Article at NewsBTC…