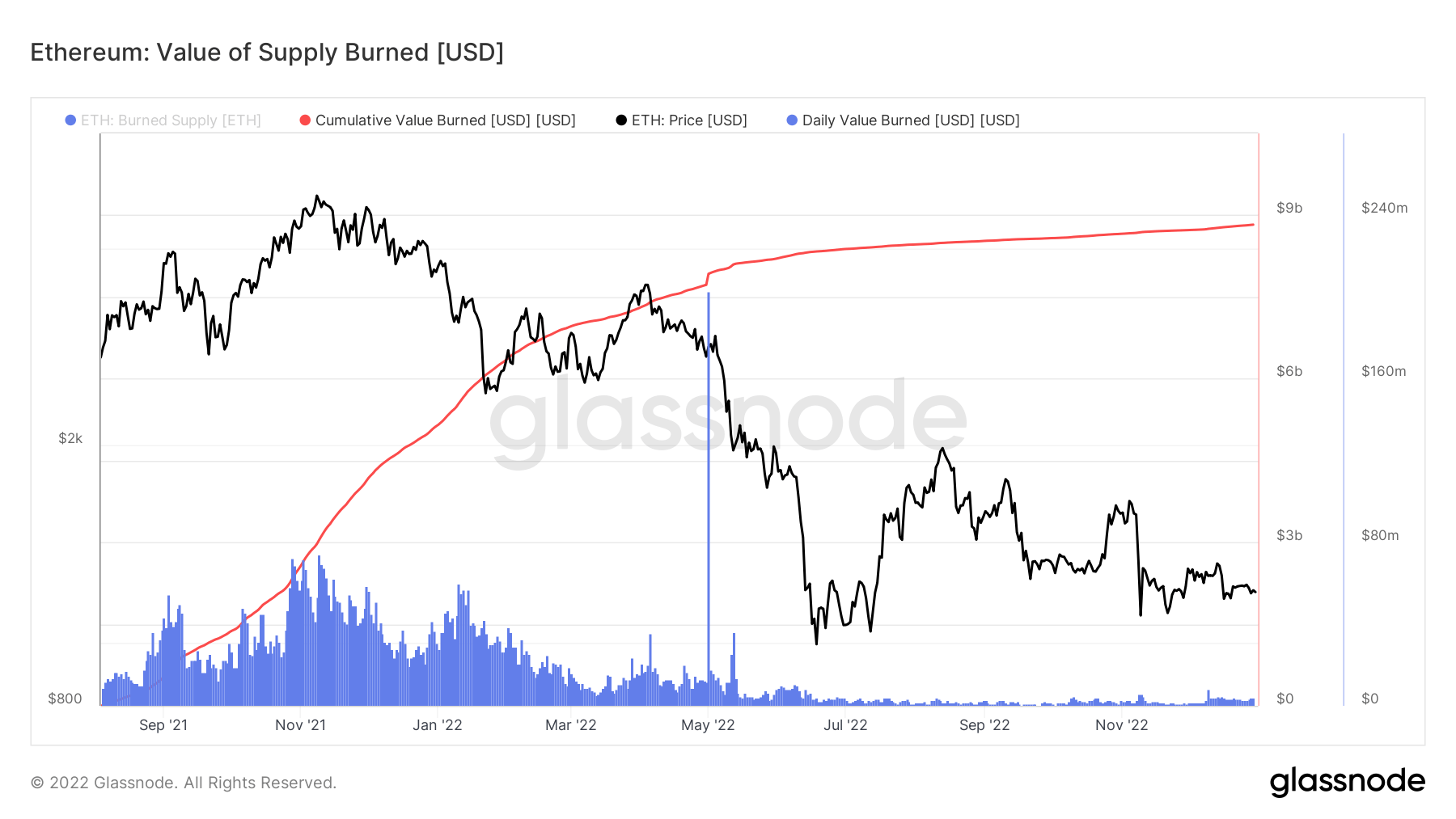

The second largest cryptocurrency by market cap, Ethereum (ETH), implemented a token burn mechanism on Aug. 5, 2021, through the Ethereum Improvement Proposal (EIP) 1559 upgrade. Since then, nearly $9 billion worth of tokens have been burned cumulatively, data from Glassnode indicates.

A total of around 2.8 million ETH tokens have been removed from the supply since the burn mechanism was instituted, according to data from ultrasound.money.

In the above chart from Glassnode, blue reflects the daily ETH supply burned at the spot price, while red stands for the cumulative value of ETH burned over time. An analysis of the Glassnode data by CryptoSlate suggests that Ethereum’s daily burn rate has decreased significantly and nearly stagnated since the collapse of Terra-Luna in May 2022.

During the bull run of 2021, $20 million to $75 million worth of ETH was being destroyed daily. This has fallen to only around $2 million to $4 million worth of ETH burned every day in December 2022. According to ultrasound.money, 1,896.30 ETH, worth around $2.2 million was burned over the past day.

It is to be noted that the fall in the daily burn rate of Ethereum is a direct reflection of the fall in Ethereum activity amid the current bear market.

Understanding the significance of ETH burn

Buring of tokens refers to sending tokens to an address from which the tokens become irretrievable. Also referred to as destroying tokens, burning tokens reduces the asset’s circulating supply and contracts overall supply over time. The burning mechanism aimed to regulate Ethereum’s gas fees — the fees paid for carrying out transactions on Ethereum.

Prior to the burn mechanism, Ethereum users had to guess the fees they had to pay to have their transactions included in the blockchain. This caused high volatility in Ethereum gas fees, especially during times of high network congestion.

With millions of users complaining about steep gas fees,…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…