NEAR Protocol (NEAR) is making waves in the cryptosphere, surging to the top of Google searches and capturing investor attention. This newfound interest, coupled with strong activity data from blockchain analytics platform DappRadar, fuels speculation of a potential price explosion.

Some analysts are predicting a meteoric rise to $16, despite recent dips. However, beneath the bullish bravado lies a layer of technical analysis and short-term volatility that warrants a closer look.

Related Reading

Decoding NEAR’s Google Surge

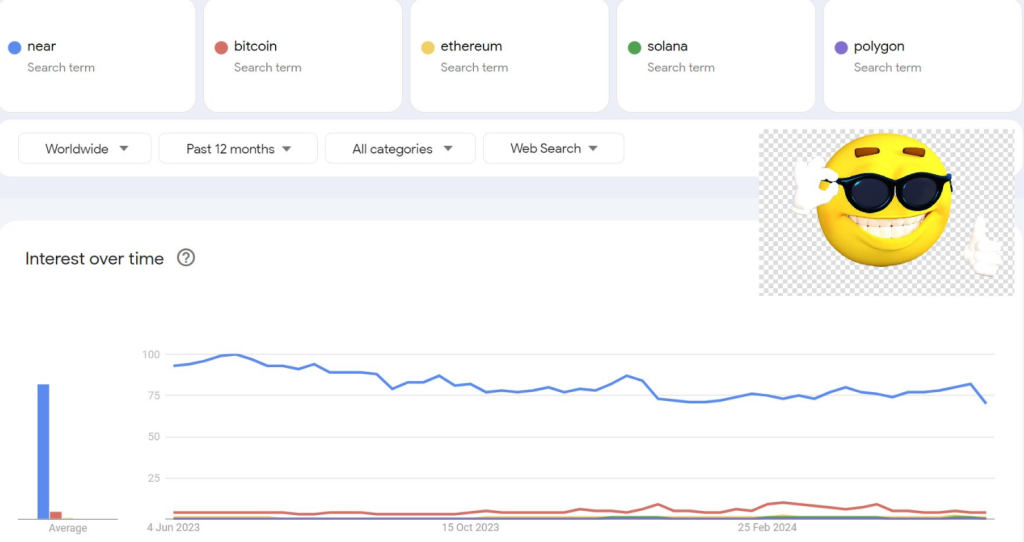

The recent surge in Google searches for NEAR is undeniable. This newfound interest can be interpreted in two ways. Optimists see it as a sign of growing recognition and potential mainstream adoption.

They point to NEAR’s strong fundamentals – its developer-friendly architecture, focus on decentralized finance (DeFi), and active ecosystem with popular DApps like Kai-Ching and Hot Wallet.

heh, sorry kiddos. looks like NEAR is number one in Google Search trends. another huge W. try it for yourself. 😎😎😎😎😎😎😎😎😎😱😱😱😱😱😱😱😱🤩🤩🤩🤩🤩

literally too ez 🥱 pic.twitter.com/eYKWZM0iWK

— NEAR Protocol (@NEARProtocol) June 5, 2024

According to DappRadar, NEAR’s protocol boasts high transaction volume, reflecting strong network activity. Additionally, DappRadar highlights NEAR’s promising DeFi presence with a healthy total value locked (TVL) within its DeFi applications. This combination positions NEAR as a contender in the evolving blockchain landscape, attracting both retail and institutional investors.

However, skeptics caution against overhyping Google Trends. They argue that search volume doesn’t always translate to long-term price appreciation. It’s possible that the surge is a fleeting fad, fueled by short-term marketing campaigns or even social media influencers. They point to the current price dip as evidence of this disconnect between online buzz and actual market movement.

Can Technical Analysis Steer NEAR To $16?

Crypto analyst More Crypto Online has thrown down the gauntlet, presenting a bullish case for NEAR based on the Elliott Wave Theory and Fibonacci retracement levels. The theory suggests that market prices follow predictable wave patterns, and the current price action places NEAR in the potential “second wave” of a five-wave sequence. This, according to More Crypto…

Click Here to Read the Full Original Article at NewsBTC…