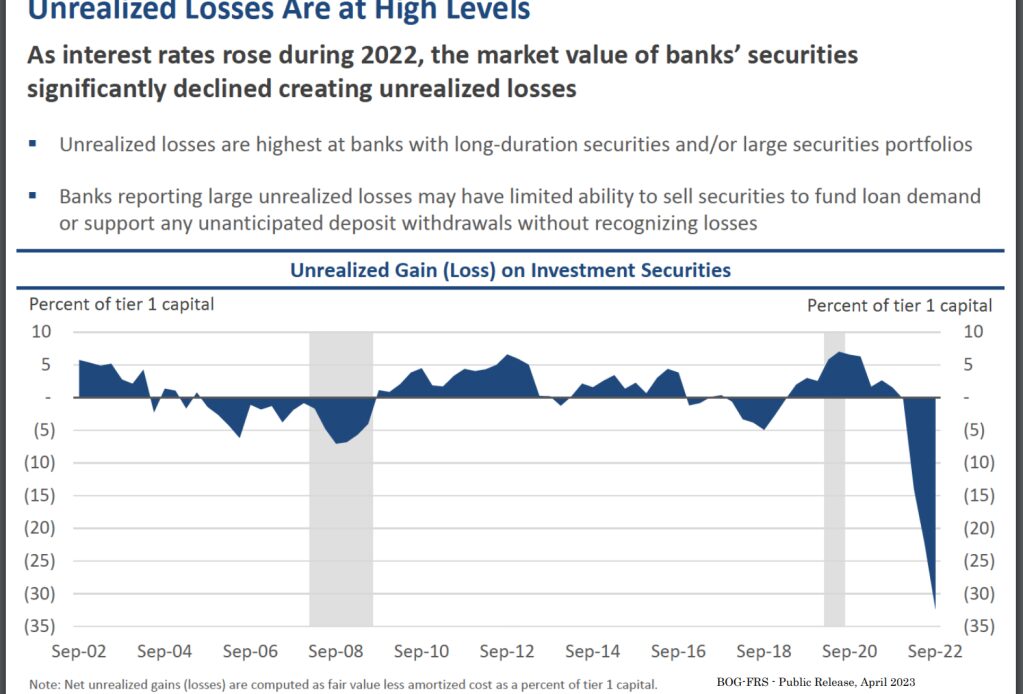

Newly released data from the Federal Reserve shows more than 700 American banks are facing “significant safety and soundness risk” due to massive unrealized losses on their balance sheets.

According to the Fed, more than 700 banks have self-reported unrealized losses that exceed 50% of their capital.

The report, which was recently released on the Federal Reserve’s website and includes self-reported data compiled in February, says banks have been taking steps to try and avoid further losses for months.

Those steps include changing the accounting treatment of their securities, hedging interest rate risk and retaining more tangible capital.

The Fed points to its own interest rate rises as the catalyst for the losses.

“Banks with large unrealized losses face significant safety and soundness risks. Securities have traditionally been used for liquidity purposes; Today, the level of unrealized losses are causing some banks to face tough choices…

The rising interest rate environment is increasing financial risks for many banks. We are concerned with banks that have investment portfolios with large unrealized loss positions. As rates rise, investment portfolios which have traditionally been a source of liquidity will be further limited.

Higher than anticipated deposit outflows and limited available contingency funding may cause banks to make difficult choices, including reliance on higher-cost wholesale funding or curtailing lending.”

The Fed says its analysis is based on data that was compiled by the third quarter of 2022.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Click Here to Read the Full Original Article at The Daily Hodl…