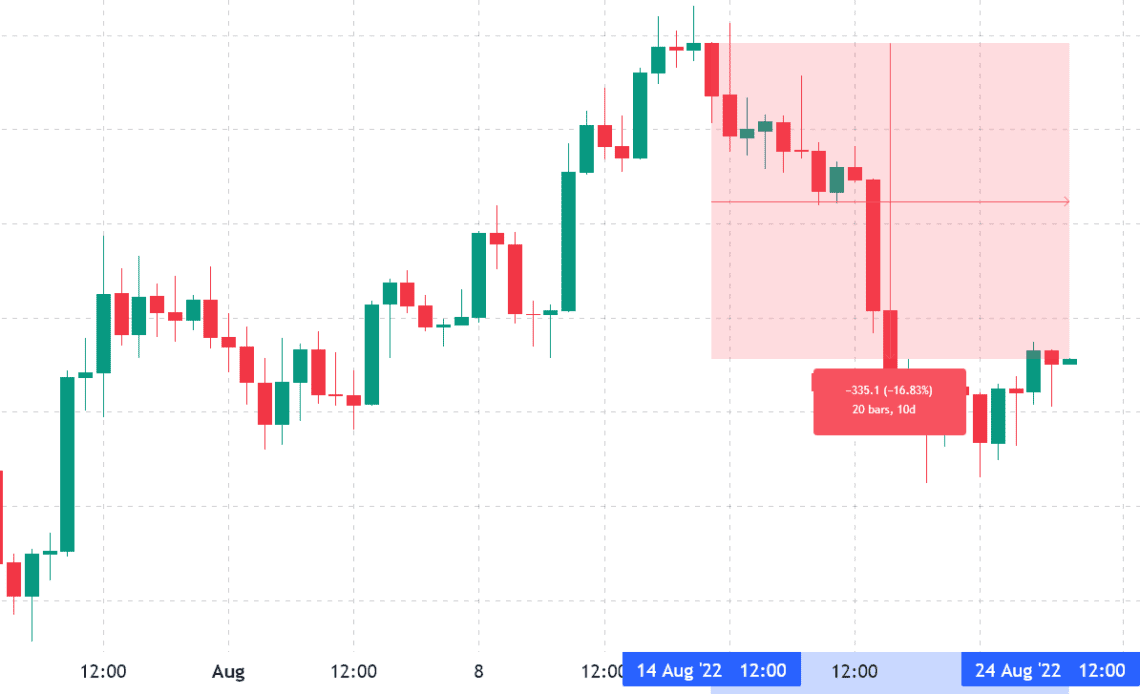

Since failing to close above the $2,000 mark, Ether (ETH) price has faced a steep 16.8% correction, but this was not enough to give bears an edge in the August $1.27 billion monthly options expiry.

Currently there are mixed feelings about the network’s upcoming change to a proof of stake (PoS) consensus network and analysts like @DWhitmanBTC, believe the potential benefits of PoS do not supercede the absence of a supply cap and multiple changes in the monetary policy over time.

uLtRaSoUnD mOnEy

Is #Ethereum even money?

If so, what’s the supply limit? What’s the monetary policy?

How can anyone trust that it won’t be changed?

— Dick Whitmanaut ∞/21M (@DWhitmanBTC) August 24, 2022

Regardless of the long-term impact, Ether price was positively impacted by the tentative Merge migration date announcement from a July 14 Ethereum developers call. Influencer and technical analyst Crypto Rover said that Ether would “drop so hard on the Merge day,” as a result of traders unwinding their positions.

I think #Ethereum will drop so hard on the Merge day.

The whole anticipation is getting not bought up on the spot market but on the futures market.

Be warned.

— Crypto Rover (@rovercrc) August 23, 2022

One thing is for sure, leveraged Ether buyers were not expecting the steep correction on Aug. 18 and data from Coinglass shows the move liquidated $208 million at derivatives exchanges.

Bears placed their bets below $1,600

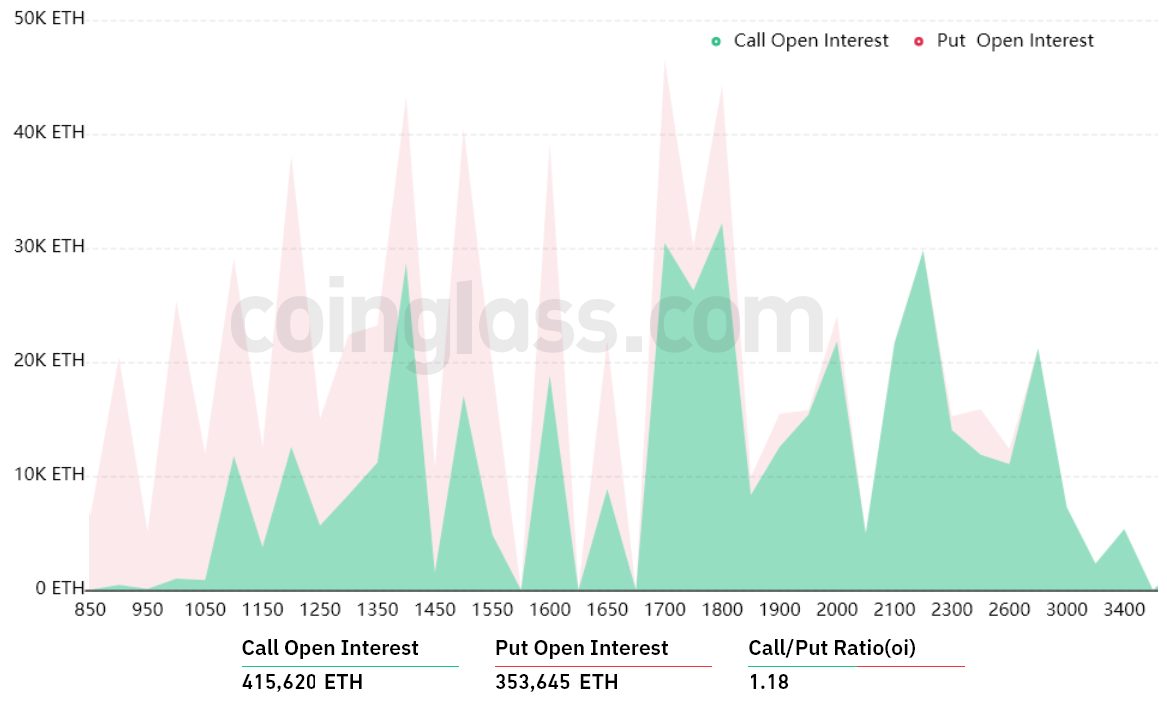

The open interest for Ether’s July monthly options expiry is $1.27 billion, but the actual figure will be lower since bears were overly-optimistic after ETH traded below $1,600 between Aug. 20 and Aug. 22. Breaking above that resistance surprised bears because only 17% of the put (sell) options for Aug. 26 have been placed above that price level.

The 1.18 call-to-put ratio shows the dominance of the $685 million call (buy) open…

Click Here to Read the Full Original Article at Cointelegraph.com News…