Europe’s largest digital asset investment group Coinshares believes there is only “minor negative sentiment” within the crypto markets now following a grueling 2022 bear market.

As Bitcoin threatens to touch $18,000 for the first time since mid-December, Coinshares analysis reveals that outflows from global crypto funds are starting to wane. According to a recent blog post, Bitcoin saw just $6.5 million in outflows, indicating that sentiment “remains negative,” but only just.

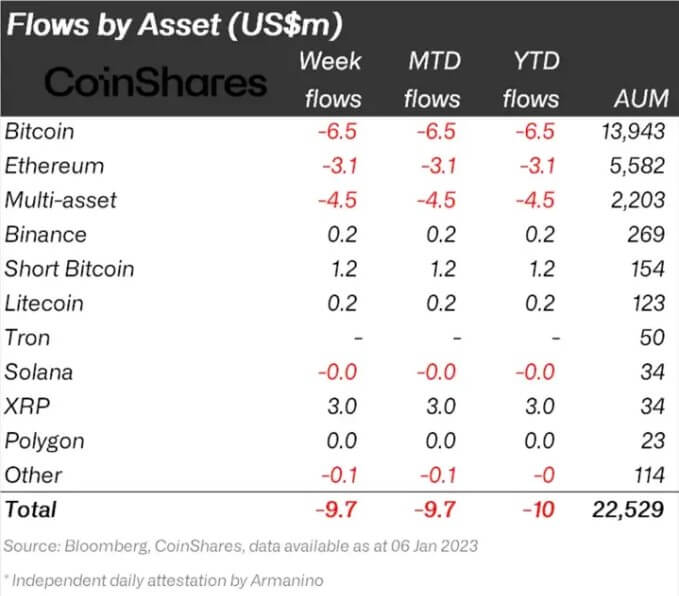

“Digital asset investment products saw outflows totaling US$9.7m, highlighting continued mild negative sentiment that has persisted for the last 3 weeks.”

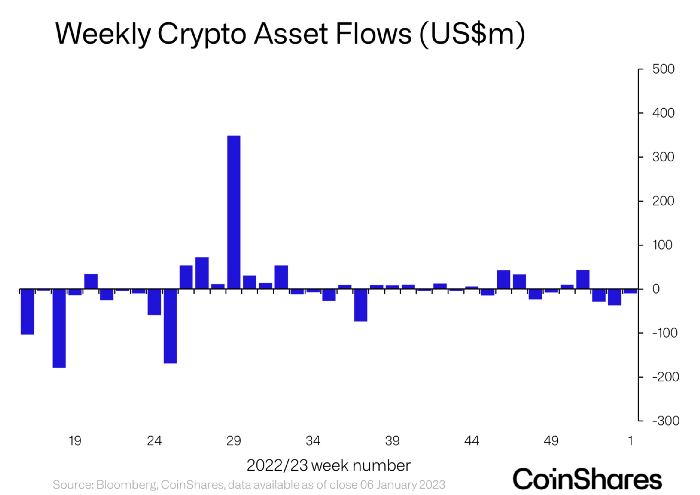

The chart below showcases the persistent outflows from crypto funds, consistent over the past six months, with only five weeks of inflows throughout the period. However, outflows have failed to amass any substantial volume, as figures suggest inflows and outflows canceled out to remain reasonably flat.

The largest weekly outflow over the past 52-week period reached roughly $175 million, while the most significant inflow hit around $350 million.

Eighteen weeks of outflows compare to seventeen weeks of inflows throughout a challenging bear market across the past 52 weeks.

However, Ripple’s XRP “bucked the trend,” as it saw $3 million in inflows over the last week, which Coinshares attributed to “the improving clarity on its legal case with the SEC.”

Alongside XRP, other assets that avoided positive outflows included Binance (BNB Chain,) Litecoin, and Polygon. These assets had either nominal inflows or remained flat across the week.

The bearish trend within crypto has yet to be broken, as highlighted by the $1.2 million inflows into “Short Bitcoin” funds.

Coinshares referred to the trend as “continued mild negative sentiment that has persisted for the last three weeks.” However, the first chart clearly shows that the increased outflows seen during the FTX crisis have abated in the first week of 2023.

According to Coinshares disclosure, it currently has $1.4 billion in assets under management. Its crypt funds look to serve those seeking exposure to crypto through traditional financial Exchange Traded Products (ETPs.)

Such investment vehicles may no longer be fully representative of the overall crypto market sentiment as investors move toward cold storage following the collapse of BlockFi, Voyager, Celsius, and FTX.

While crypto exchanges differ from ETPs in…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…