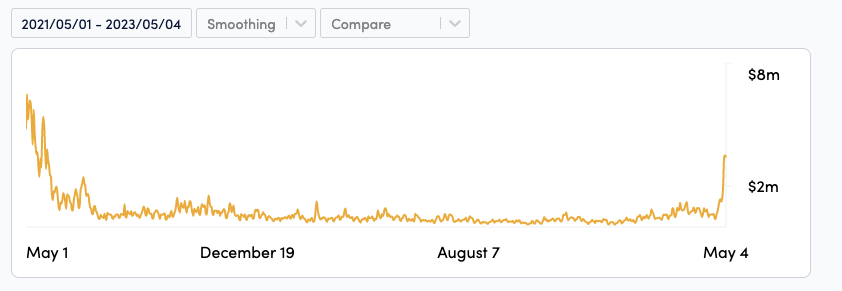

Bitcoin transaction fees saw a sharp surge in early May, reaching their highest point over the past two years, according to data from CryptoFees.

On May 3, the total amount of fees paid on the Bitcoin blockchain reached an amount of $3.5 million, jumping about 400% from late April. The average Bitcoin transaction fee reached as much as $7.2, according to YCharts.

The ongoing trading frenzy of memecoins like Pepe Coin (PEPE) has triggered an unwanted consequence for Bitcoin (BTC), driving its transaction costs to multi-year highs.

The latest increase in BTC transaction fees is largely attributed to a surge in Bitcoin activity involving BRC-20 transactions. According to data from Galaxy Research, 50% of all Bitcoin transactions on May 2 were related to BRC-20 transactions.

Modeled after Ethereum’s ERC-20 token standard, BRC-20 is an experimental token standard allowing users to issue and transfer fungible tokens on the Bitcoin blockchain. The standard was introduced in March 2023 by a pseudonymous on-chain analyst known as Domo.

The BRC-20 token standard has quickly become a major trend in the cryptocurrency industry, specifically amid the sharp growth of the PEPE memecoin. The token has rallied more than 600% over the past seven days, reaching its all-time high of $0.00000216 on May 5.

The Bitcoin blockchain isn’t the only blockchain affected by the ongoing memecoin hype. Gas fees on the Ethereum blockchain have also been skyrocketing to new multi-month highs recently.

On May 2, ETH transaction fees hit an aggregate amount of more than $19 million, a level not seen since May 2022, according to CryptoFees. The Ethereum blockchain remains the most expensive network in terms of transaction fees at the time of writing.

Related: Bitcoin miners have earned $50B from BTC block rewards, fees since 2010

Despite the latest spike in Bitcoin…

Click Here to Read the Full Original Article at Cointelegraph.com News…