According to a recent report by Messari, smart contract platform Algorand (ALGO), showcased notable growth and outperformed the general crypto market during the fourth quarter of 2023.

Algorand Outperforms Crypto Market Growth

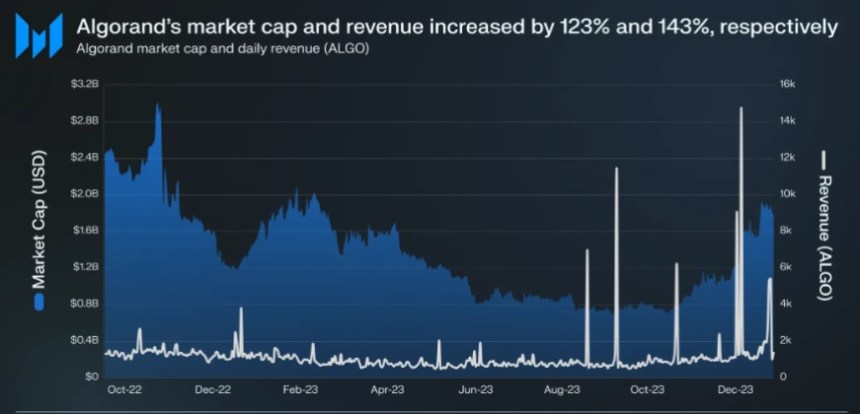

Per the report, Algorand experienced a surge in market capitalization during Q4 2023, with a significant growth rate of 123%. This substantial increase can be attributed to the overall positive momentum of the crypto market, which witnessed a 53% growth in market capitalization during the same period.

Transactions on the Algorand network also saw a significant uptick, increasing by 58% quarter-on-quarter (QoQ). Consequently, fee revenue rose by 60%, reaching its highest level in a year when measured in ALGO terms, while revenue in USD terms surged by an impressive 143%.

According to Messari, Algorand’s success can be attributed to its “thriving” ecosystem, which saw the launch of multiple innovative applications in Q4 2023. These applications covered diverse areas such as regulated and programmable euro, tokenized farmland, and a developer marketplace for selling code snippets.

The introduction of these applications further solidified Algorand’s position as a “dynamic and versatile” platform, attracting users from various domains, according to the report.

Moreover, Algorand witnessed a substantial increase in user adoption during Q4 2023, with the addition of 1.9 million new addresses, representing a 72% QoQ growth.

The platform also experienced a surge in transaction volume, with transactions surpassing 5.5 million towards the end of the quarter, marking the highest number recorded in the past year. Notably, ALGO transactions increased by 43% QoQ.

Messari further suggests that the rise in transactions can be attributed to the popularity of sticky applications like Lofty.ai, which boasted over 7,000 monthly active users, and TravelX, which issued over 2 million NFT plane tickets, with over 1 million issued in Q4 alone.

Decrease In Staked ALGO

Despite growth in key metrics, the report highlighted a decline in the amount of staked ALGO during Q4, with a 49% year-on-year (YoY) decrease. Messari attributed this decline to the reduction in rewards per governance period.

The diminishing rewards indicate a preference among users to utilize the native asset for transactions rather than committing it to…

Click Here to Read the Full Original Article at NewsBTC…