Blockchain protocol MakerDAO (MKR) continues to see significant gains, maintaining a strong upward trend throughout the year. MKR has seen significant growth of over 358%, accompanied by positive metrics reflecting increased adoption and usage of the protocol.

In addition, upcoming voting initiatives aim to further increase the platform’s benefits for its stakeholders.

MakerDAO Announces Plans For Rate System Changes

In a recent announcement, MakerDAO stated that it closely monitors developments in the cryptocurrency market and has gained a better understanding of the impact of recent proposals.

As a result, the protocol is recommending the next set of changes to its rate system. MakerDAO emphasized that further adjustments will likely be introduced shortly, contingent upon market dynamics, such as prices, leverage demand, and the external rate environment encompassing centralized finance (CeFi) funding rates and decentralized (DeFi) effective borrowing rates.

The protocol further noted that the Maker rate system will be adjusted accordingly if the external rate environment continues to exhibit signs of decline.

Efforts are underway to update the rate system language within the Stability Scope, including developing a new iteration of the Exposure model. These updates aim to ensure that the system can adjust rates more gradually and effectively in the future.

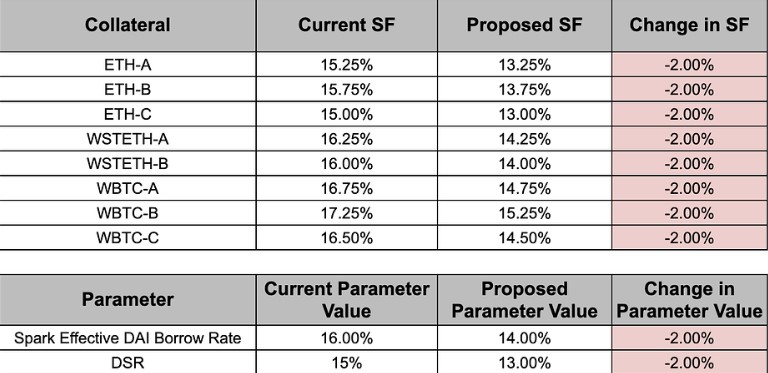

Based on recommendations from BA Labs, a blockchain infrastructure provider, the Stability Facilitator proposes various parameter changes to the Maker Rate system, which will be subject to an upcoming Executive vote.

As shown in the table above, the proposed changes include reducing the Stability Fee by 2 percentage points for various collateral types such as ETH-A, ETH-B, ETH-C, WSTETH-A, WSTETH-B, WBTC-A, WBTC-B, WBTC-C. In addition, the Dai Savings Rate (DSR) and the Effective DAI Borrowing Rate for Spark will also be reduced by 2 percentage points.

However, one active protocol user offered an alternative viewpoint, suggesting using the demand shock opportunity to expand the net interest margin. While agreeing with the proposed 2% interest rate reduction for borrowers, the user advocates for a larger 4% reduction in the DSR, which he believes will further benefit MakerDAO’s net interest margin.

Ultimately, the outcome of the voting process will determine whether these proposed changes…

Click Here to Read the Full Original Article at NewsBTC…