When it comes to NFT lending, NFT oracles are one of the most important factors in the lending process. NFT oracles must show accurate prices, mitigate risk and be cost-efficient.

To date, we’ve partnered with Chainlink for our oracles due to their effective risk management and mitigation systems, which are powered by their unique algorithm.

We can safely say that their algorithm has worked well to mitigate risk, resulting in ParaX formerly ParaSpace to have the lowest number of liquidations compared to other NFT lending platforms.

While Chainlink’s oracle algorithm has been great at mitigating risk, it falls short on price accuracy, which is also extremely important for NFT lending.

Inaccurate price data could result in unhealthy accounts, a lower borrowing amount and more.

Previously, we’ve tried solving the price inaccuracies by developing our own NFT oracles, which are currently being used for the Bored Ape Yacht Club collection and several other collections.

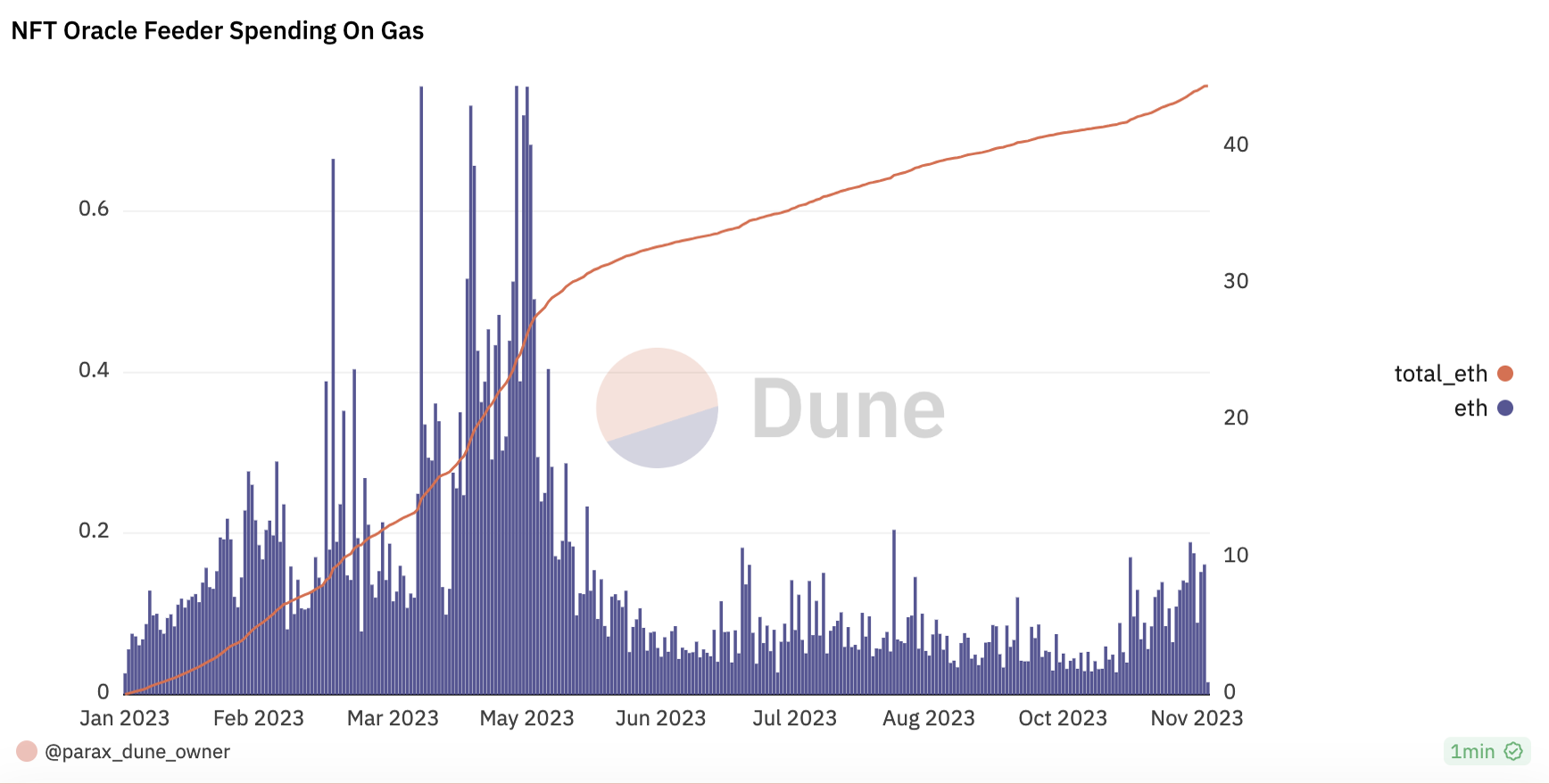

The main drawback of creating our own oracles is that they consume a lot of gas, which leads to large costs, especially for a protocol that needs price data for over 20 NFT collections.

However, we have found a new way with Chainlink’s CCIP (Cross-Chain Interoperability Protocol), and we’re excited to announce a new NFT oracle solution.

ParaX’s new open-source NFT oracles will now be more accurate and more gas-efficient, while still maintaining best-in-class risk management systems.

By using Chainlink’s CCIP, ParaX can create interoperable NFT oracles which feed price data between a layer two, such as Arbitrum and Ethereum.

By feeding price data on Arbitrum, this enables greater price accuracy and reduces gas consumption by over 50% due to Arbitrum’s minimal gas fees.

Chainlink’s CCIP enables ParaX to securely transfer NFT floor price data cross-chain, whereas the current method involves feeding price data on Ethereum mainnet through three clients.

The first two clients provide straightforward price feeds, while the third client aggregates all the prices onchain to generate a ‘finalize price.’

These transactions are conducted on Ethereum mainnet and thus consume a large amount of gas.

Using CCIP, ParaX can securely transmit NFT price data between a layer two such as Arbitrum to Ethereum mainnet.

The process involves using three clients on Arbitrum to feed price data to ParaX’s ‘NFTFloorOracleProvider.’

After generating the finalize price, it is…

Click Here to Read the Full Original Article at The Daily Hodl…