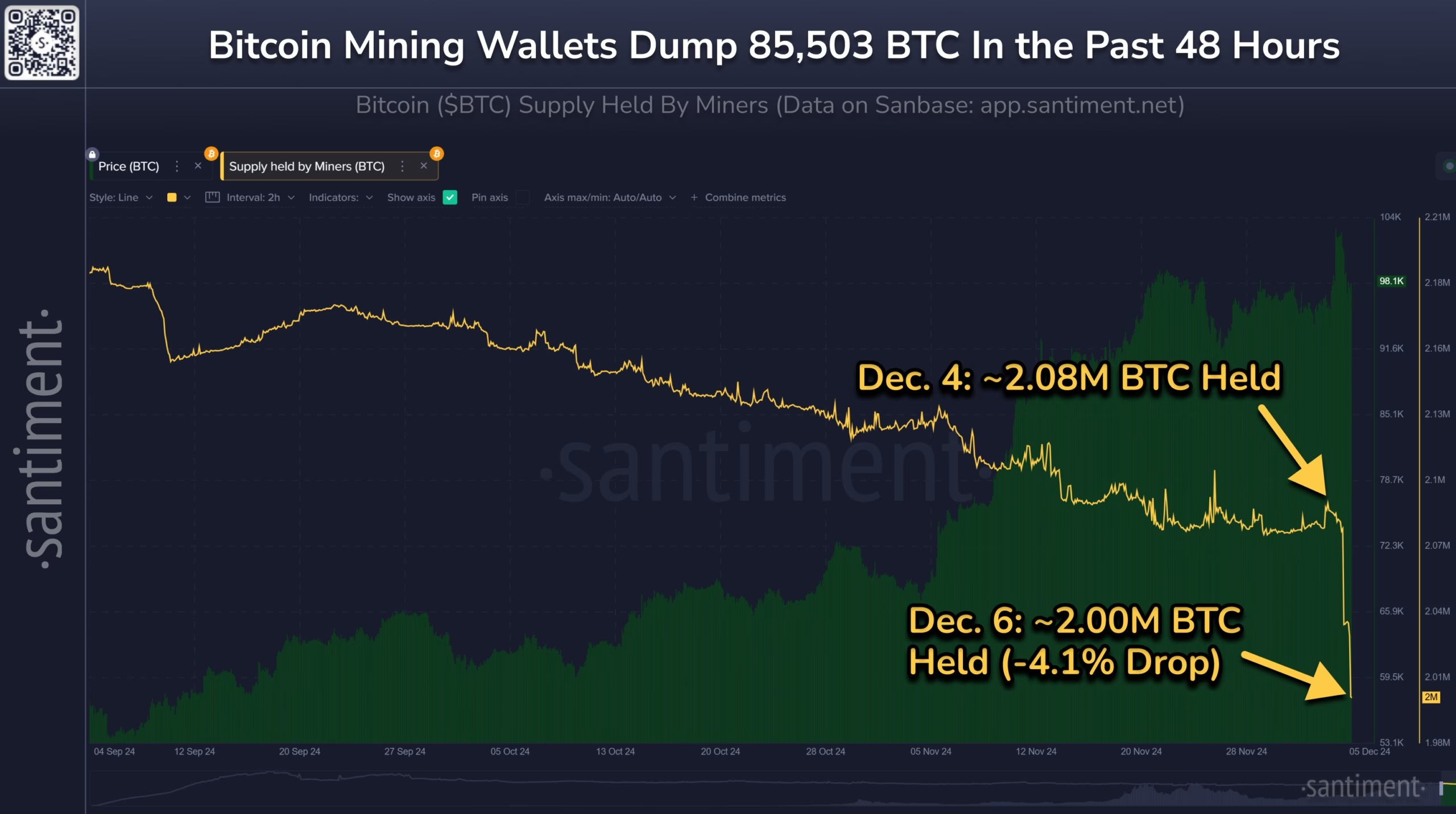

A prominent crypto analytics firm says one of the most important Bitcoin investor cohorts is unloading BTC at a rapid rate.

Santiment says on the social media platform X that Bitcoin miners offloaded over $8.55 billion worth of BTC in just two days, representing the largest distribution of the last 10 months.

While Bitcoin miners are heavily unloading their BTC stacks, Santiment notes that other deep-pocketed investors are picking up the slack.

“Bitcoin’s collective mining balances have been dropping since April 2024.

However, this latest drop of 85,503 BTC in just 48 hours is the most extreme we’ve seen since late February (two weeks before the then $73,000 all-time high).

Note that these wallets have NOT been correlative with price for most of this year. Overall, non-mining whales and sharks are still accumulating. Consider this a net-neutral signal for the time being.”

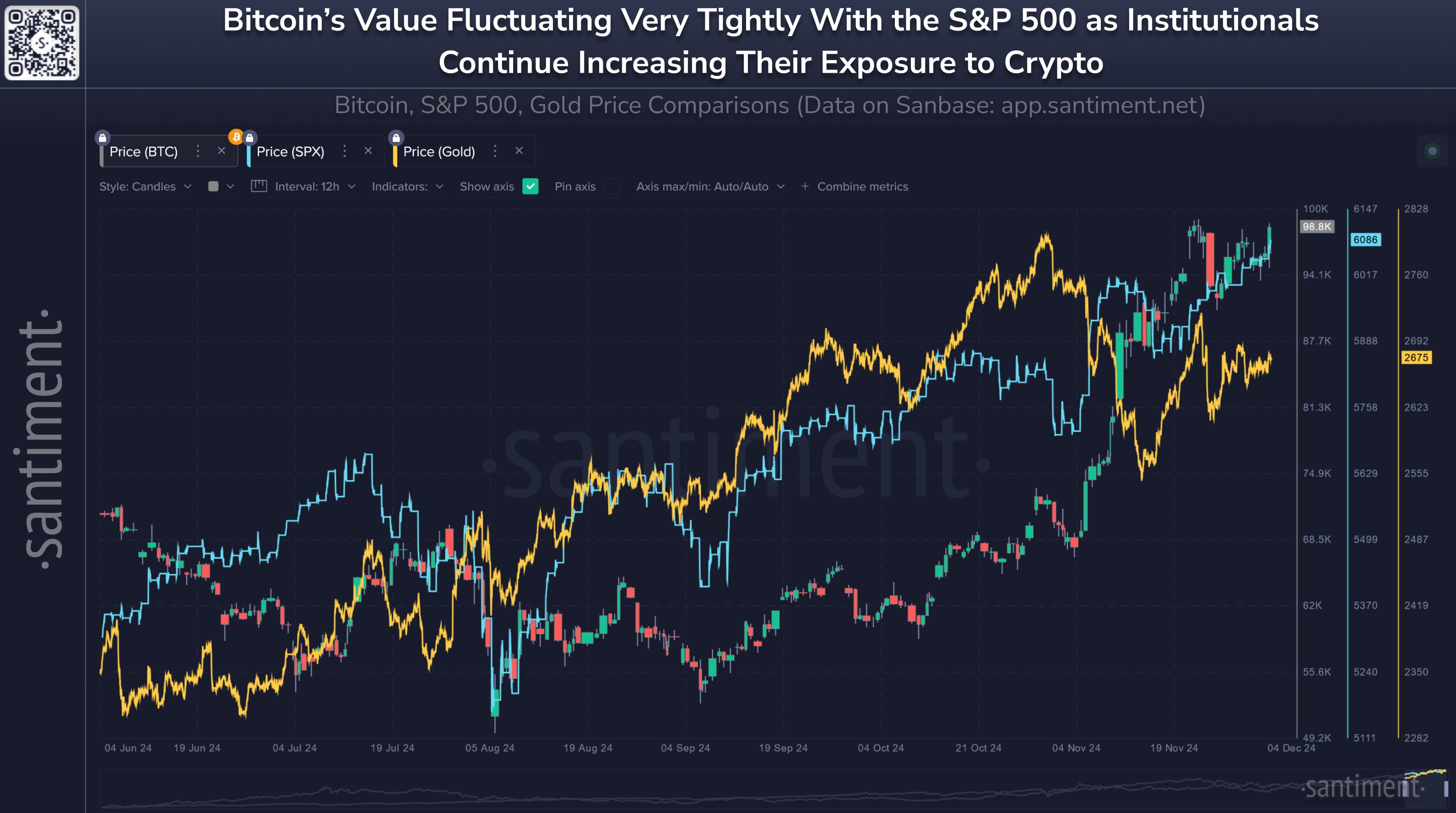

Looking at Bitcoin’s current price action, the analytics firm says BTC appears to be trading in tandem with the S&P 500 (SPX). According to Santiment, breaking the price correlation between stocks and Bitcoin will bode well for BTC.

“After crypto’s ‘Trump Pump’ has settled down over the past two weeks, Bitcoin has began to range in close correlation with the S&P 500.

In fact, most of the year has seen a fairly tight bond between the two, with BTC often being memed about being a ‘high leveraged tech stock’ by cryptocurrency traders.

Regardless, pay attention to a more mid or long-term break between crypto and equities. If this correlation begins to weaken, it would be a bullish signal.

Historically, crypto has flourished when there is little to no reliance on world stock markets.”

At time of writing, Bitcoin is trading for $99,856.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…