The US will extract more money from American taxpayers and businesses as the government’s liabilities become too much to handle, according to a new forecast from JPMorgan Chase.

Michael Cembalest, Chairman of Market and Investment Strategy for JPM’s Wealth and Asset Management branch, cites data from the Congressional Budget Office (CBO) that suggests all Federal government revenues will be consumed by entitlement payments and interest on the Federal debt by the early 2030s.

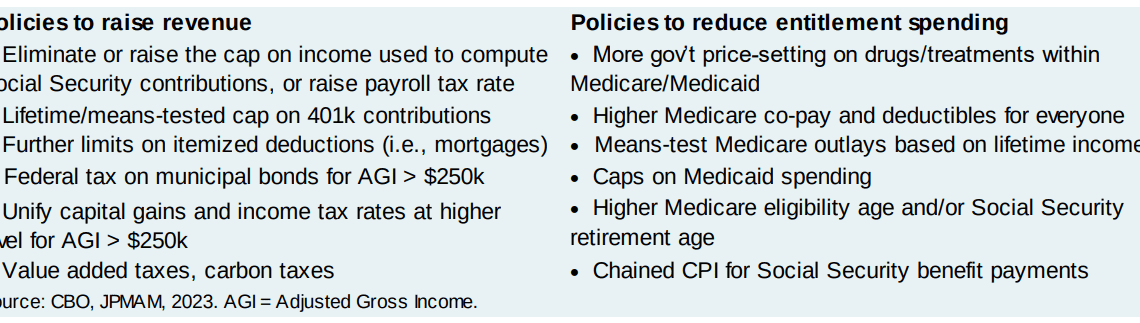

Cembalest says before that happens, lawmakers will be pressured into finding further revenue sources to balance the budget, and a myriad of tax hikes may be on the table.

“Sometime before this happens, I expect a combination of market pressure and rating agency downgrades (which have already begun) to force the US to make substantial changes to taxes and entitlements…

A wealth tax is also a possibility; there’s an active Supreme Court case that might impact its constitutional feasibility (Moore vs United States, which is related to the constitutionality of the Mandatory Repatriation Tax in the 2017 tax bill).

[As well as] further cuts to discretionary spending [are also possible], since the US has run out of road on that one.”

That’s not all – Cembalest details a list of fresh taxes, entitlement cuts and tweaks that could be taken to try and improve the government’s fiscal outlook.

As of January 8th, 2024, the US government’s total debt obligations reached $34,012,198,872,291.

According to the CBO, the Federal government collected $4.9 trillion in revenue in 2022, most of which came from income taxes.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Click Here to Read the Full Original Article at The Daily Hodl…