The cryptocurrency total market capitalization fell to $1.02 trillion on June 15, its lowest level in three months. But while the derivatives market’s resilience and end-of-week price gains amid uncertainty in stablecoins’ reserves provides hope for bulls, it might be too soon to celebrate.

Crypto regulatory conditions deteriorate

The past few week have seen a bearish trend fueled by regulatory uncertainty. Last week, Bitcoin (BTC) and BNB saw 2.5% gains, but XRP dropped 5.2%, and Ether (ETH) traded down 0.7%.

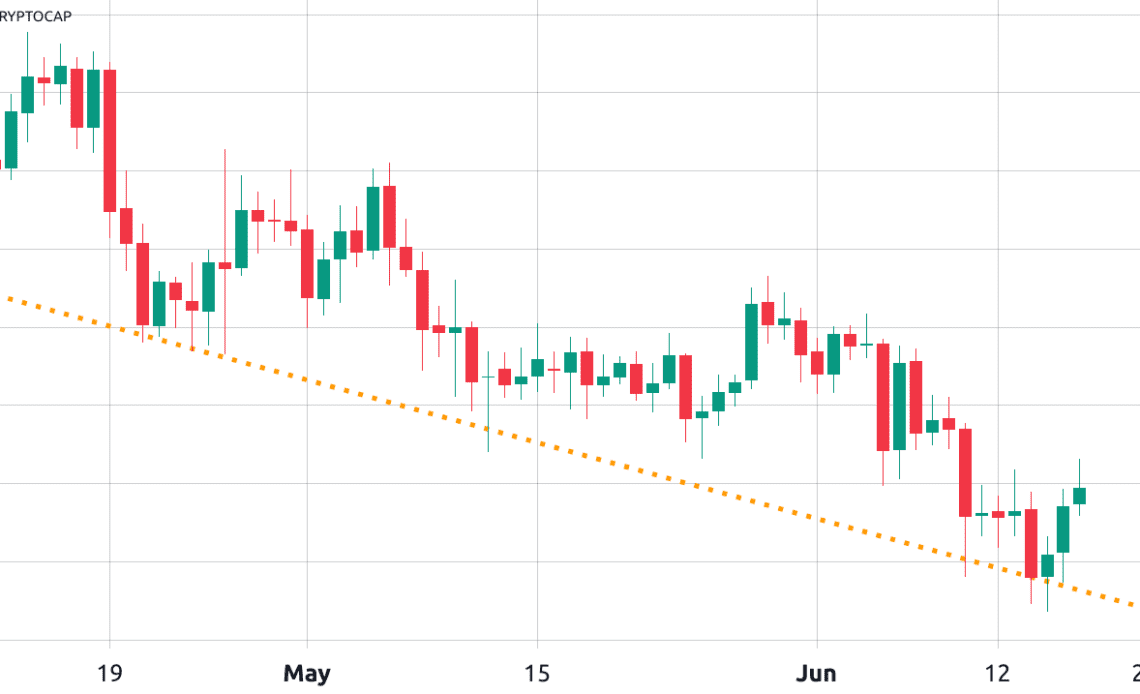

Notice that the 10-week long pattern has tested the support level in multiple instances, signaling that bulls will have a hard time breaking from the bearish trend while regulatory conditions have worsened across the globe.

For starters, New York-based derivatives exchange Bakkt is delisting Solana (SOL), Polygon (MATIC) and Cardano (ADA) due to recent regulatory developments in the United States. The decision follows last week’s lawsuits brought by the Securities and Exchange Commission (SEC) against crypto exchanges Binance and Coinbase.

Related: Why is the crypto market up today?

More recently, on June 16, Binance has been the subject of a preliminary investigation in France since February 2022. The France-based arm of the crypto exchange reportedly failed to obtain an operating license and illegally offered its services to French customers. Furthermore, the exchange lacked Know-Your-Customer procedures, according to regulators.

Also on June 16, Binance announced its departure from the Netherlands, with users being asked to withdraw their funds as soon as possible. The decision to exit the Dutch market occurred after the exchange failed to obtain a virtual asset service provider (VASP) license.

Despite the worsening crypto regulatory environment, two derivatives metrics indicate that bulls are not yet throwing in the towel. Nevertheless, they’ll likely have a hard time breaking the bearish price formation to the upside.

Derivatives show balanced demand for BTC, ETH leverage

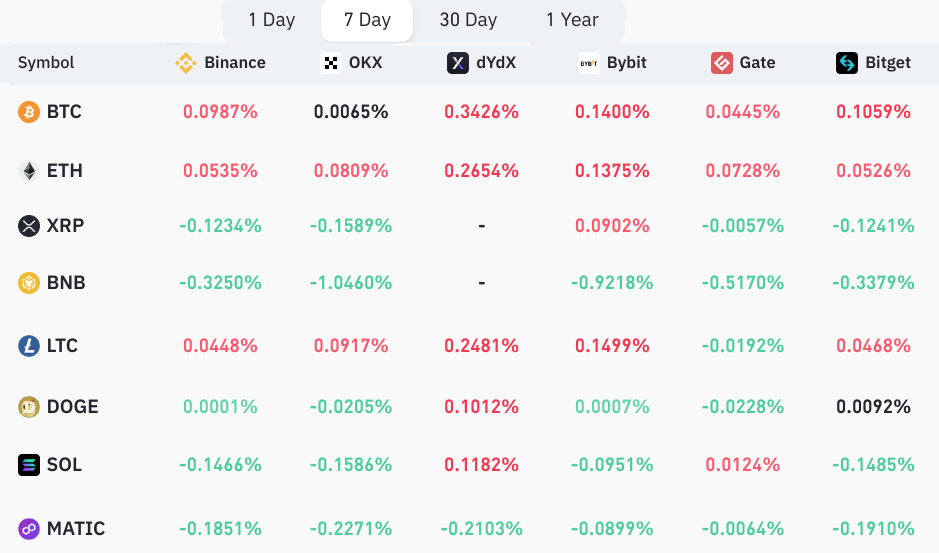

Perpetual contracts, also known as inverse swaps, have an embedded rate that is usually charged every eight hours.

A positive funding rate indicates that longs (buyers) demand more leverage. Still, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

The seven-day funding rate…

Click Here to Read the Full Original Article at Cointelegraph.com News…