Since finance YouTuber Andrei Jikh recently covered the so-called Bitcoin Power Model, there has been a notable debate within the Bitcoin community around its viability.

Jikh opened his video entitled “2024 Bitcoin Price Prediction (CRAZY!)” by stating,

“Today I want to show how a simple math rule that’s able to predict patterns of the universe has also accurately tracked the last 15 years of Bitcoin’s price, and I want to show you what this formula says Bitcoin should be worth 10 years from now.”

He mentions a ‘rule’ based on a model that describes Bitcoin’s price growth as following a power law principle over time. The model is based on the work of astrophysicist Giovani Santasi, who has analyzed 15 years of Bitcoin data.

A power law is a statistical relationship between two quantities, where a relative change in one quantity results in a proportional relative change in the other, independent of the initial size of those quantities. This means that one quantity varies as a power of another. For example, if you double the length of a side of a square, the area will quadruple, demonstrating a power law relationship.

Jikh discusses how power laws have been used to predict various phenomena, including Bitcoin’s price patterns. The video suggests that Bitcoin’s price could potentially reach $200,000 in the next cycle and $1 million by 2033.

The significance of power laws in this context is that they allegedly allow for accurate predictions across different domains. In the case of Bitcoin, Santasi claims they explain its price patterns with a high degree of accuracy, as indicated by a 95.3% accuracy based on regression analysis.

In a blog post from Jan. 12, Santasi suggested renaming the model the BTC Scaling Law for reference.

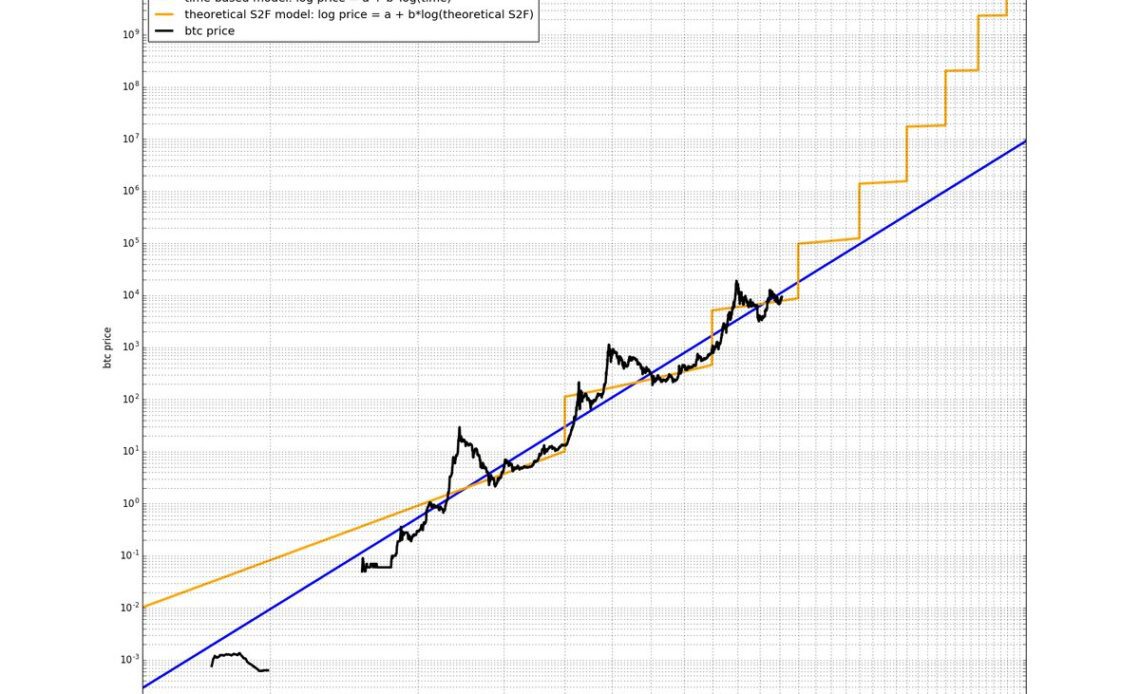

Unsurprisingly, comparisons with PlanB’s Stock to Flow (S2F) quickly emerged as both models depict bullish scenarios for the world’s leading digital asset. On Jan. 30, Santasi shared a graph comparing the Power Law prediction for Bitcoin to S2F and commented,

“I wish S2F was true. But I rather count on a more realistic model that seems correct than on a model that is too optimistic and then to get disappointed. Also it is not good for BTC PR for the community to make these unrealistic claims.

I don’t think it is possible to get to tens of millions by 2033 (as S2F predicts). 1 M is already amazing (more realistic Power Law in time prediction).”

There has been a…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…