The market saw a dramatic Bitcoin price drop over the past two days, plunging from a high of $64,500 on Sunday to a low of $58,474. Yesterday’s steep decline followed an unexpected announcement from the trustee of the defunct Mt. Gox exchange, revealing plans to commence BTC and BCH payouts in early July—a move that has sent shockwaves through the market.

This news raises urgent questions about the immediate future of Bitcoin’s price trajectory. Amidst this market turmoil, several prominent cryptocurrency analysts have weighed in, offering their insights on whether Bitcoin could be nearing a local bottom. Here is a deeper dive into their analysis and perspectives:

Bitcoin Technical Analysis

Tony “The Bull” Severino, Chief Analyst at NewsBTC, provided a technical breakdown of the current situation. Utilizing the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements, Severino pointed out that the RSI levels are now as oversold as they were during the collapse of FTX, suggesting a potential cyclical bottom.

Related Reading

“Bitcoin’s daily RSI is as oversold as during the FTX collapse, indicating a cyclical bottom might be forming,” said Severino. This analysis implies that, historically, such levels have often preceded a rebound or at least a stabilization in price.

Volume And Market Behavior

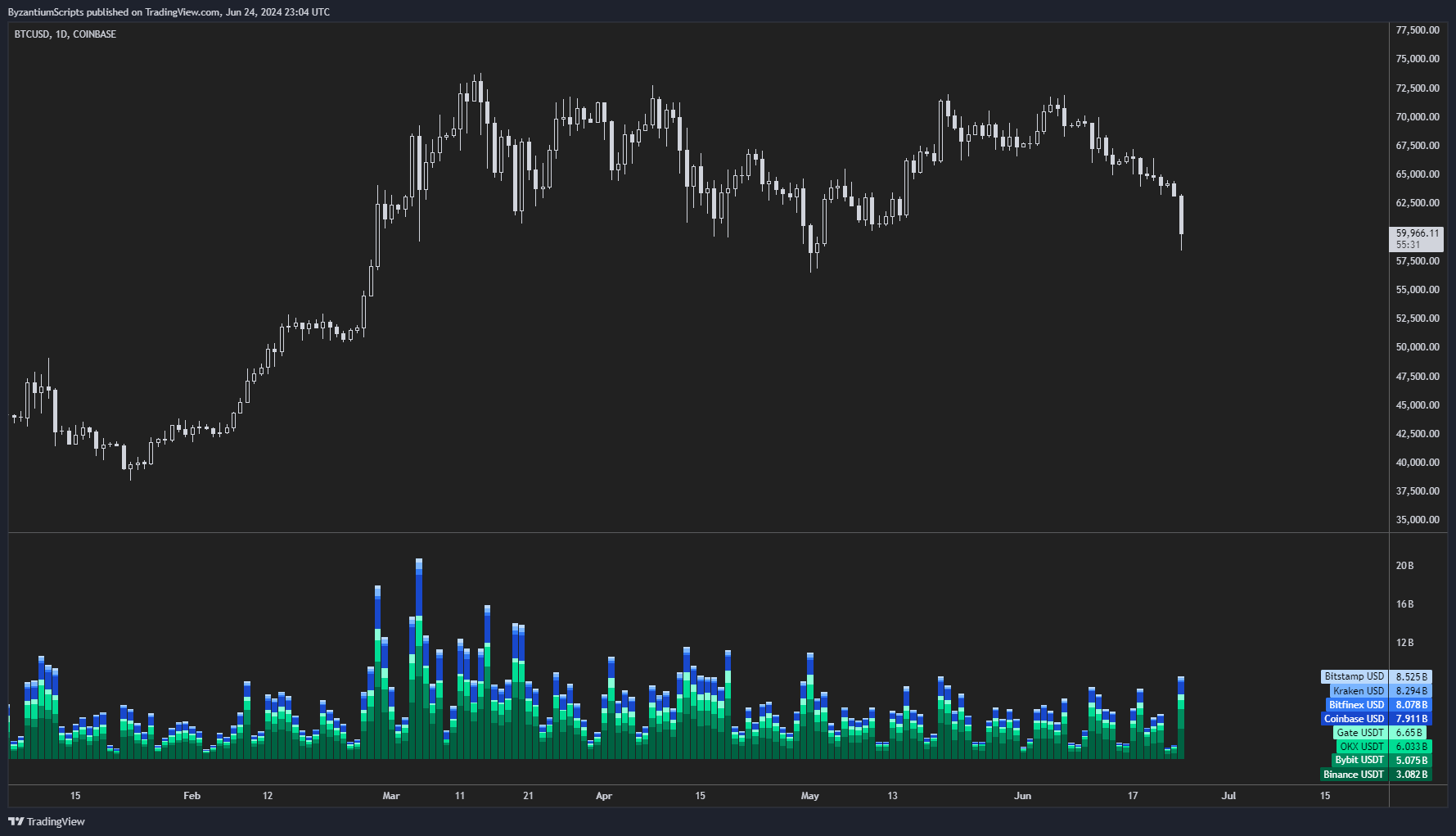

The Byzantine General, a trader and market strategist, noted the unusually high spot volume accompanying the price drop. “We’re seeing significantly high spot volume, which historically can signal a local bottom,” he remarked. High trading volumes during a price drop can indicate panic selling, which often exhausts itself leading to potential recovery.

Social Media Sentiment

Santiment, an analytics platform focusing on social metrics, observed a spike in discussions around the term “bottom” across various social media platforms. “This is one of the highest spikes in social volume and dominance for the word ‘bottom’ we’ve observed in the past year,” they reported. Historically, such spikes can signify heightened market attention that may correlate with pivotal market movements.

Related Reading

Historical Patterns And Technical Indicators

Teddy (@TeddyCleps), a cryptocurrency trader, emphasized the importance…

Click Here to Read the Full Original Article at NewsBTC…