A sharp rebound in the Polygon (MATIC) market in the last four months has increased its price by 200% when measured from its June 2022 bottom of $0.31. And now, the token is showing signs of undergoing another major market rally.

MATIC exchange balance hits nine-month low

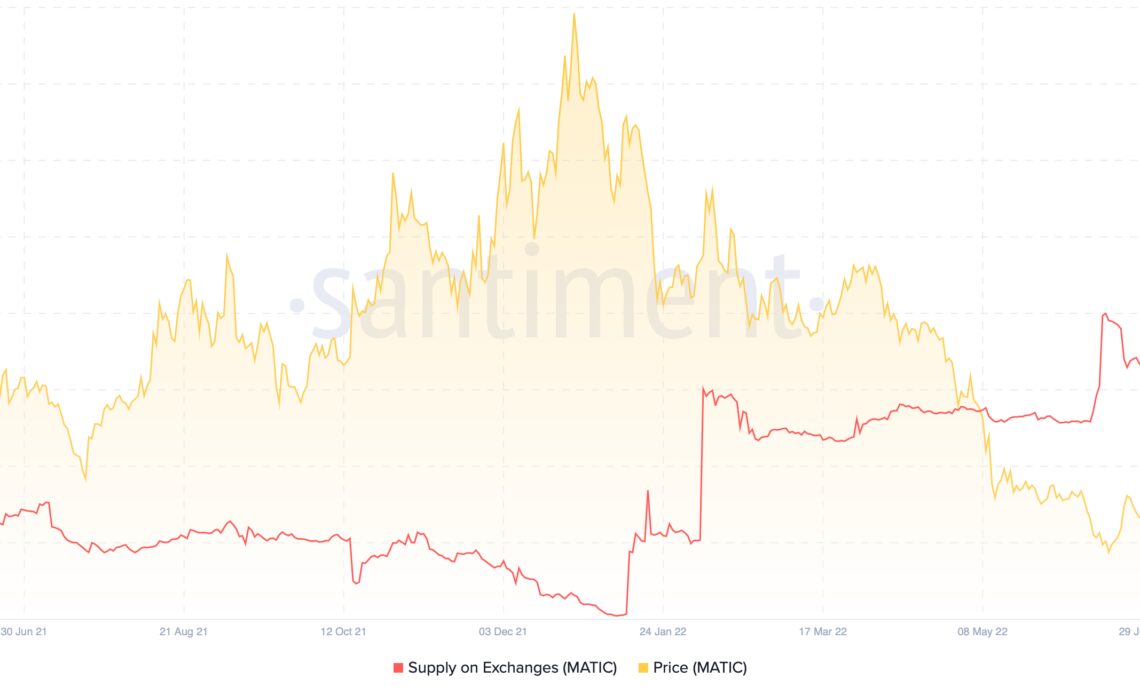

Notably, the MATIC supply held by all crypto exchanges fell to 802.15 million on Oct. 26, its lowest level since January 2022. The plunge came as a part of a broader downtrend that has witnessed over 600 million MATIC leaving exchanges in the last four months, data on Santiment shows.

A declining crypto balance across exchanges is perceived as bullish by the market since traders typically withdraw their funds from trading platforms when they want to hold the tokens long term.

The MATIC chart above shows a similar albeit erratic negative correlation between its price and supply on exchanges. As a result, a period of decline in MATIC reserves at exchanges has historically coincided with an uptrend in price, and vice versa.

Therefore, the latest plunge in MATIC supply across exchanges hints at more upside for the token in the coming weeks.

Reddit using Polygon to mint collectible NFT avatars

More cues for a potential MATIC price rally come from the news of Polygon’s adoption by mainstream fintech companies.

Notably, Nubank, a Brazilian neobank bank backed by Warren Buffett’s Berkshire Hathaway, picked Polygon to build its native Web3 ecosystem. Since the Oct. 20 announcement, MATIC price has rallied by nearly 12% and was trading for $0.95 as of Oct. 26.

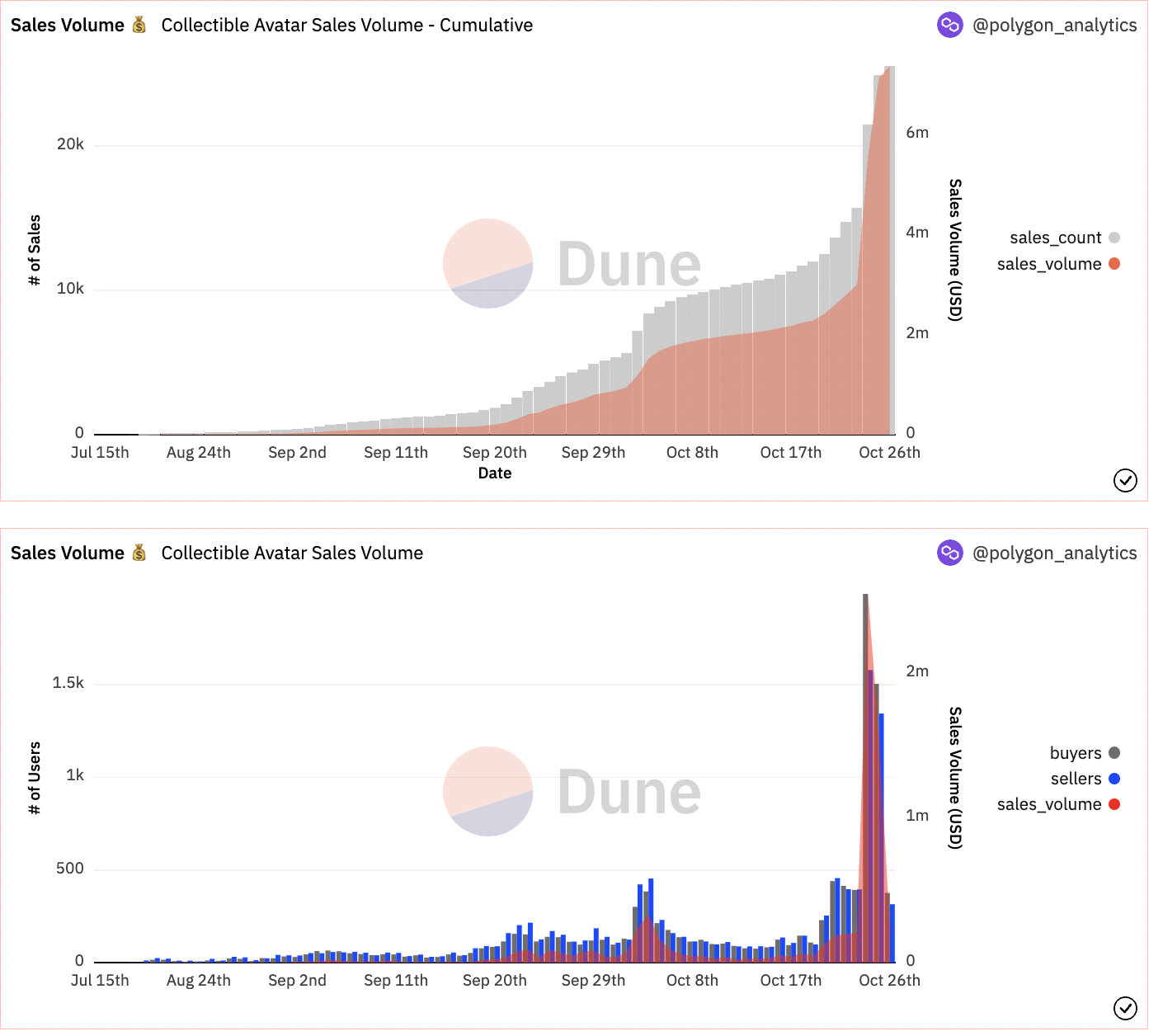

Furthermore, the massive MATIC outflow from exchanges coincides with the soaring trading and sales volume of Reddit nonfungible token (NFT) avatars. These digital collectibles are minted as NFTs on the Polygon blockchain.

From a technical perspective, MATIC has broken out of a bullish continuation pattern, dubbed a bull flag, whose profit target sits almost double the token’s current valuation, as shown below.

MATIC also shows similar strength against Bitcoin (BTC), according to a technical setup shared by Kaleo, an independent market analyst.

“The predominate structure is a HTF [higher timeframe] flag dating back to May of ’21 that looks ready for another leg higher,” the analyst wrote while citing the chart below.

“I’m expecting a small retrace…

Click Here to Read the Full Original Article at Cointelegraph.com News…