The battle to scoop up investors’ money for newly approved bitcoin ETFs is shaping up to be a fierce one among BlackRock, Fidelity and other financial firms.

If the newcomers want to take a giant leap forward, experts say they could consider buying the incumbent in bitcoin investing: Grayscale.

The crypto asset manager earlier this month got permission to convert its Grayscale Bitcoin Trust (GBTC) into an ETF. At the same time, nine other companies won the ability to create their own bitcoin ETFs.

Follow the latest bitcoin ETF approval coverage Here

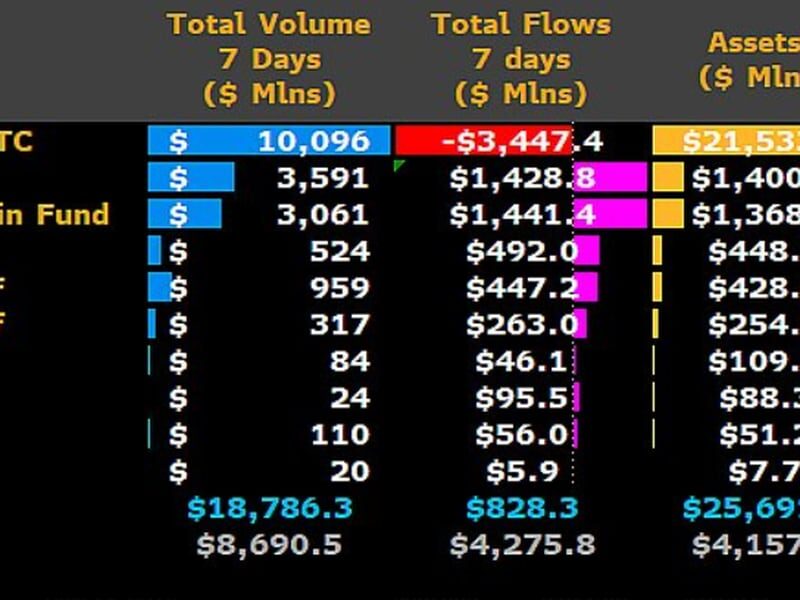

Grayscale started with a huge lead. After a decade operating as a closed-end fund, the investment pool had accumulated almost $30 billion of bitcoin. The newcomers started at zero. The gap has shrunk some as investors remove money from GBTC and the new funds collect money. But, at $22 billion, GBTC remains far ahead of the next two companies in the assets ranking: BlackRock and Fidelity, both at $1.4 billion.

Anyone looking to catch up might want to take a look.

“It’s certainly possible that Grayscale could get acquired,” said Brian D. Evans, CEO and founder of BDE Ventures. “They are sort of the standard now, and even my dad had heard of GBTC from a long time ago, so an acquisition could happen because they have some name recognition already.”

A representative of Grayscale could not be reached for comment.

One of the strategies traditional financial players have used to grow their businesses is buying out their competitors. The recent launch of ten new spot bitcoin ETFs marked an unprecedented event in the world of finance: major players from crypto and TradFi competing for the same turf.

“A strategic acquisition of a firm such as Grayscale makes a ton of sense for the right traditional ETF issuer assuming the price is palatable,” said Nate Geraci, president of the ETF Store, an advisory firm. “While only two weeks old, the spot bitcoin ETF category is already wildly competitive and has clearly turned into a scale game given how low expense ratios are. A traditional ETF issuer could quickly boost assets under management, gain business operating expertise, and also acquire some ‘crypto street cred’ by targeting the right crypto-fund native firm.”

Read more: Ben Franklin’s Laser Eyes Suggest a Tough – and Quirky – Battle for Bitcoin…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…