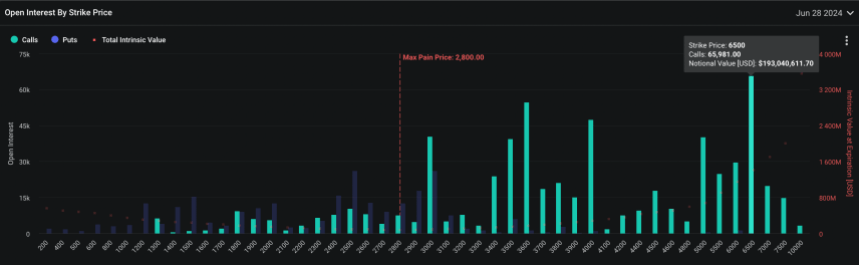

Ethereum (ETH) options for June show a marked interest in higher strike prices, focusing on levels exceeding $3,600.

Data from Deribit reveals a concentrated bet among traders on calls surpassing this price, indicating a bullish sentiment toward Ethereum’s near-term trajectory. The most favored strike price among these optimistic bets is an ambitious $6,500.

Related Reading

Options Market Bullish On Ethereum

Notably, options are contracts that give traders the right, but not the obligation, to buy (in the case of calls) or sell (in the case of puts) the underlying asset at a specified strike price by the expiry date.

A call option is typically purchased by traders who believe the asset will increase in price, allowing them to buy at a lower rate and potentially sell at a higher market price. Conversely, put options are favored by those anticipating a decline in the asset’s price, aiming to sell at the current rate and repurchase at a lower value.

Currently, the Ethereum options market is tilting heavily towards calls, with the aggregate open interest—representing the total number of outstanding contract options—showing a preference for higher strike prices.

This concentration of calls, primarily above the $3,600 mark, suggests that a significant market segment is positioning for Ethereum to ascend to higher levels by the end of June.

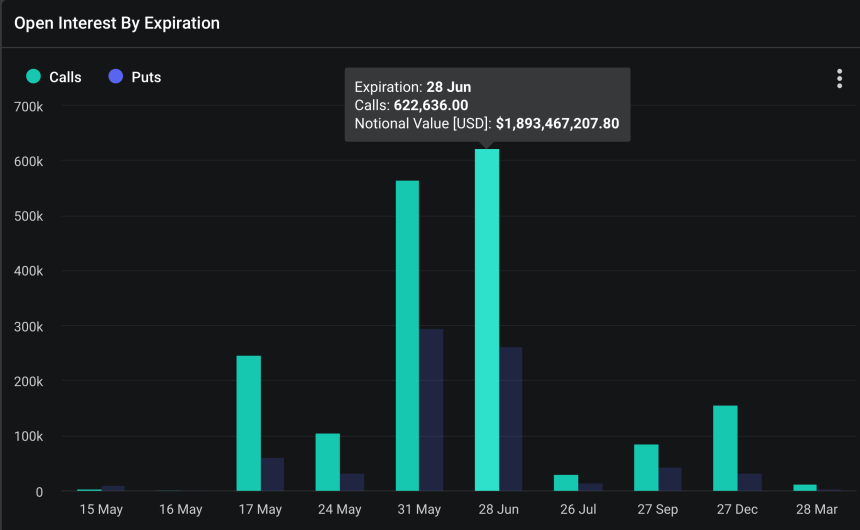

According to Deribit data, roughly 622,636 Ethereum call contracts are set to expire by June’s end, encapsulating a notional value above $1.8 billion. Such substantial positioning underscores the market’s confidence in Ethereum’s potential uplift.

Data further shows that the most substantial open interest is clustered around the $6,500 strike price, with a notional value of $193 million.

This concentration reflects trader optimism and supports Ethereum’s market price, especially if these options are exercised as the asset price approaches or surpasses these strike levels.

Despite the optimism embedded in these options, Ethereum is currently navigating a slight downturn. It has dropped 5.4% over the past week and 2.2% in the last 24 hours, positioning it below $2,900. This decline places even more focus on upcoming market catalysts that could significantly sway ETH’s price.

Regulatory…

Click Here to Read the Full Original Article at NewsBTC…