In a recent blog post, cryptocurrency legend and former BitMEX CEO Arthur Hayes mentioned he holds sizable bags of GMX and LOOKS tokens. According to Hayes, his main reasoning for investing in both tokens was their platform revenue and the potential of both assets to outperform standard treasury bills.

Let’s take a brief look at on-chain data and compare GMX and LOOKS to competitors to determine whether Arthur’s assumption will work out.

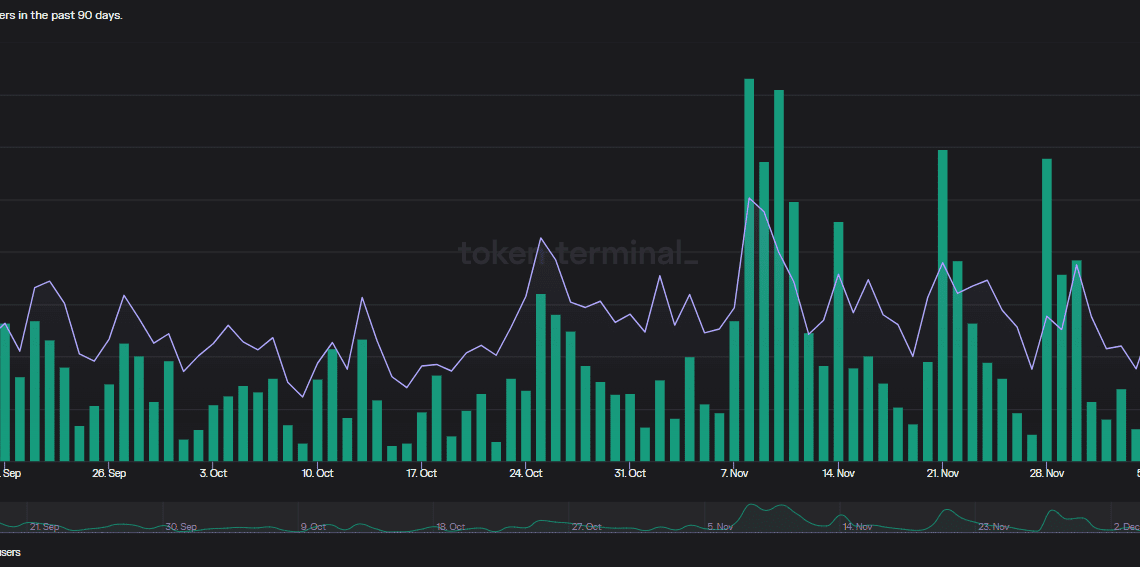

GMX usage cooling after a strong November

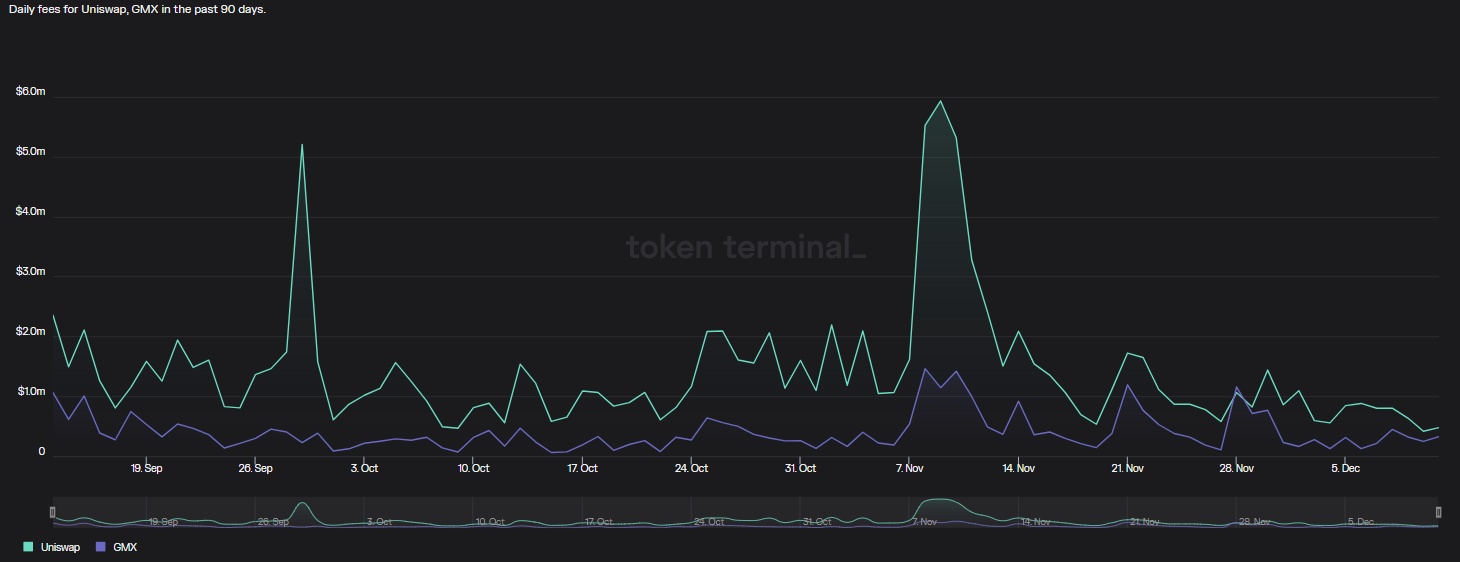

The week prior to Nov. 16 provided decentralized Finance (DeFi) with a significant influx in fees after the centralized exchange (CEX) exodus triggered by FTX’s bankruptcy. The temporary high inflows to DeFi propelled GMX to outperform Uniswap in protocol fees.

On Nov. 28, GMX earned about $1.15 million in daily trading fees, which surpassed Uniswap’s $1.06 million in trading fees on the same day.

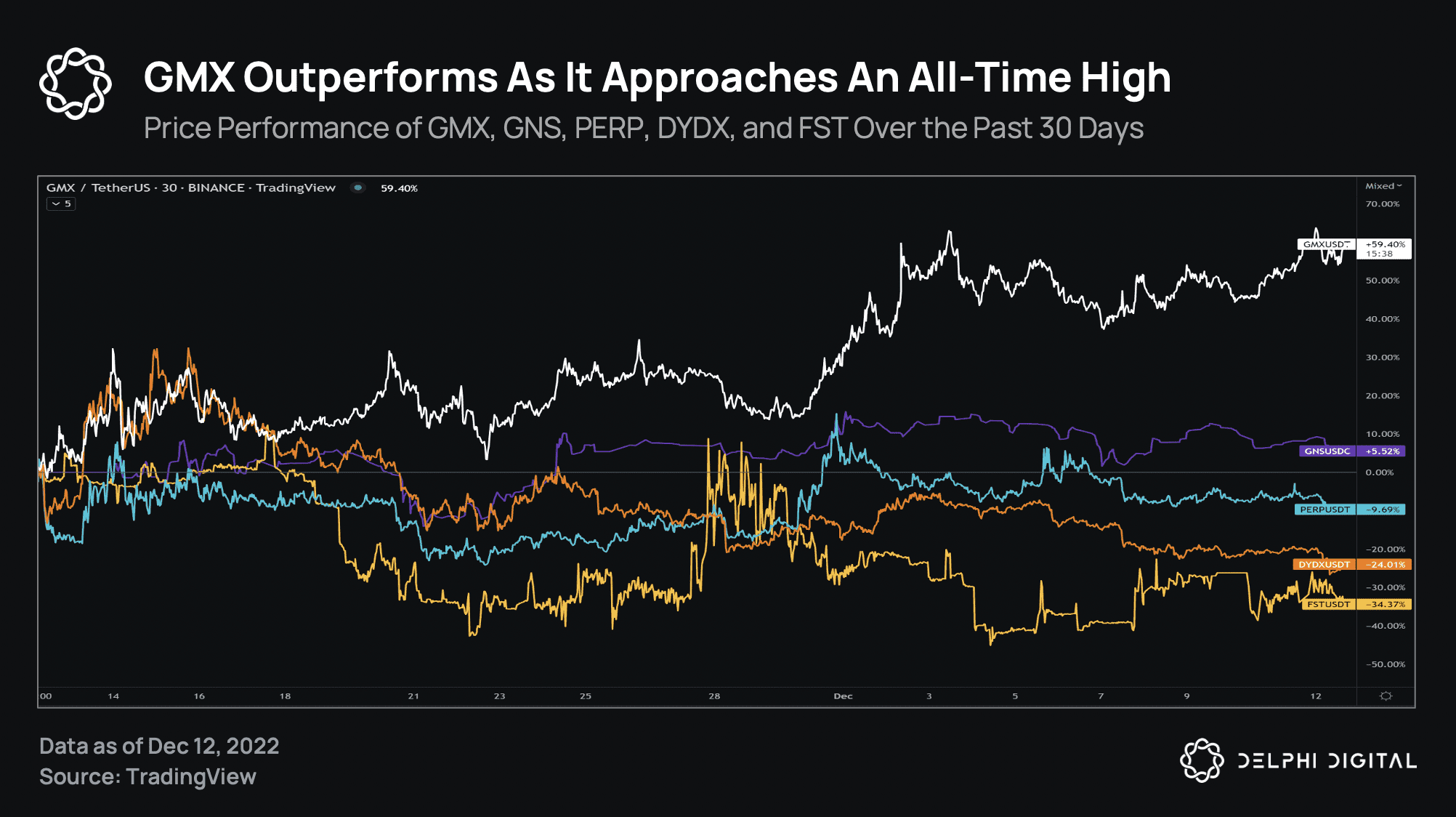

While usage of GMX may be decreasing, the token is outperforming the industry. The GMX token is only 8% away from an all-time high after gaining 59% in the past 30-days.

Since Uniswap is the closest competitor to GMX, comparing the two protocols can show which users prefer to use for trading. Aside from Nov. 28 where the fee flip is noticed, Uniswap continues to outperform GMX in terms of fee revenue and daily active users. Unlike Uniswap, GMX distributes fees to stakers of various GMX and GLP tokens.

The 90-day peak for Uniswap fees is $5.9 million whereas GMX’s high in daily fees is only $1.4 million. The major difference in peak fees may show that GMX has reached capacity when it comes to platform usage.

The fees that GMX accrues are split 30% to GMX token holders and 70% to GLP holders. The current homepage for GMX cites the estimated APY on the GMX tokens is around 10% and for GLP tokens, 20%. While GLP would fit Hayes’ 20% annual yield goal, liquidity providers are susceptible to impairment loss and price declines making it difficult to ensure success against the conservative treasury bill strategy.

OpenSea usage continues to dominate LooksRare

LooksRare, which is also the home of the LOOKS token, was also mentioned by Hayes due to the fees the NFT protocol earns. To date, NFT marketplaces, including Coinbase, have struggled to chip away at OpenSea’s market dominance.

While OpenSea seems to have a natural flow of…

Click Here to Read the Full Original Article at Cointelegraph.com News…