Bitcoin (BTC) starts the second week of February in a newly bearish mood as multi-month highs fail to hold.

In what may yet bring vindication to those predicting a major BTC price comedown, BTC/USD is back under $23,000 and making lower lows on hourly timeframes.

Feb. 6 trading may not yet be underway in Europe or the United States, but Asian markets are already falling and the U.S. dollar gaining — potential further hurdles for Bitcoin bulls to overcome.

With some macroeconomic data to come from the Federal Reserve this week, attention is mostly focused on next week’s inflation check in the form of the Consumer Price Index (CPI) for January.

In the build-up to this event, the results of which are already hotly contested, volatility may gain a fresh foothold across risk assets.

Add to that those aforementioned concerns that Bitcoin is long overdue a more significant retracement than those seen in recent weeks, and the recipe is there for difficult, but potentially lucrative trading conditions.

Cointelegraph takes a look at the state of play on Bitcoin this week and considers the factors at play in moving the markets.

BTC price disappoints with weekly close

It is very much a tale of two Bitcoins when it comes to analyzing BTC price action this week.

BTC/USD has managed to retain the majority of its stunning January gains, these totaling almost 40%. At the same time, signs of a comedown on the cards are increasingly making themselves known.

The weekly close, while comparatively strong at just under $23,000, still failed to beat the previous one, and also represented a rejection at a key resistance level from mid-2022.

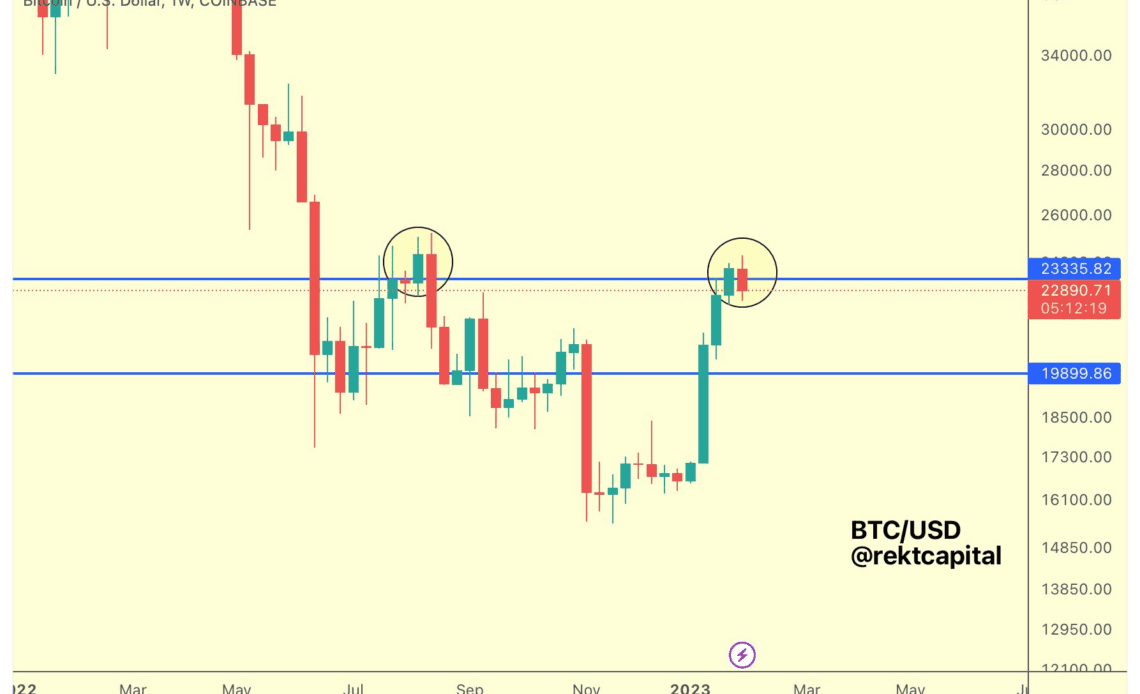

“BTC is failing its retest of ~$23400 for the time being,” popular trader and analyst Rekt Capital summarized about the topic on Feb. 5.

An accompanying weekly chart highlighted the support and resistance zones in play.

“Important BTC can Weekly Close above this level for a chance at upside. August 2022 shows that a failed retest could see BTC drop deeper in the blue-blue range,” he continued.

“Technically, retest still in progress.”

As Cointelegraph reported over the weekend, traders are already betting on where a potential pullback may end up — and which levels could act as definitive support to buoy Bitcoin’s newfound bullish momentum further.

These currently center around $20,000, a psychologically significant number and also the site of Bitcoin’s old all-time high from…

Click Here to Read the Full Original Article at Cointelegraph.com News…