Since March 2022, traders and so-called analysts have been forecasting a policy change or pivot from the United States Federal Reserve.

Apparently, such a move would prove that the Fed’s only available option is to print into oblivion, further diminishing the value of the dollar and enshrining Bitcoin (BTC) as the world’s future reserve asset and ultimate store of value.

Apparently.

Well, this week (Nov. 2) theFed raised interest rates by the expected 0.75%, and equities and crypto rallied like they usually do.

But this time, there was a twist. Prior to the FOMC gathering, there were a few unconfirmed leaks that the Fed and White House were considering a “policy pivot.”

According to comments issued by the FOMC and during Jerome Powell’s presser, Powell emphasized that the Fed is aware of and monitoring how policy is impacting markets and that the latency of interest rate hikes is being acknowledged and considered.

According to the Fed:

“In order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Sounds a bit pivot-y, no? The crypto market seemed to think not, and shortly after Powell gave his live comments, Bitcoin, altcoins and equities retracted their brief single-digit gains.

The shock here is not that Bitcoin’s price pulled back prior to the FOMC, rallied after the estimated hike was announced and then retracted before the stock market closed. This is to be expected, and I wouldn’t be surprised if BTC returns to the lower end of $21,000 since $20,000 appears to be solidified as support.

What is surprising is there was a dash of pivot language, and markets didn’t react accordingly. Let that be a lesson on buying into narratives too deeply.

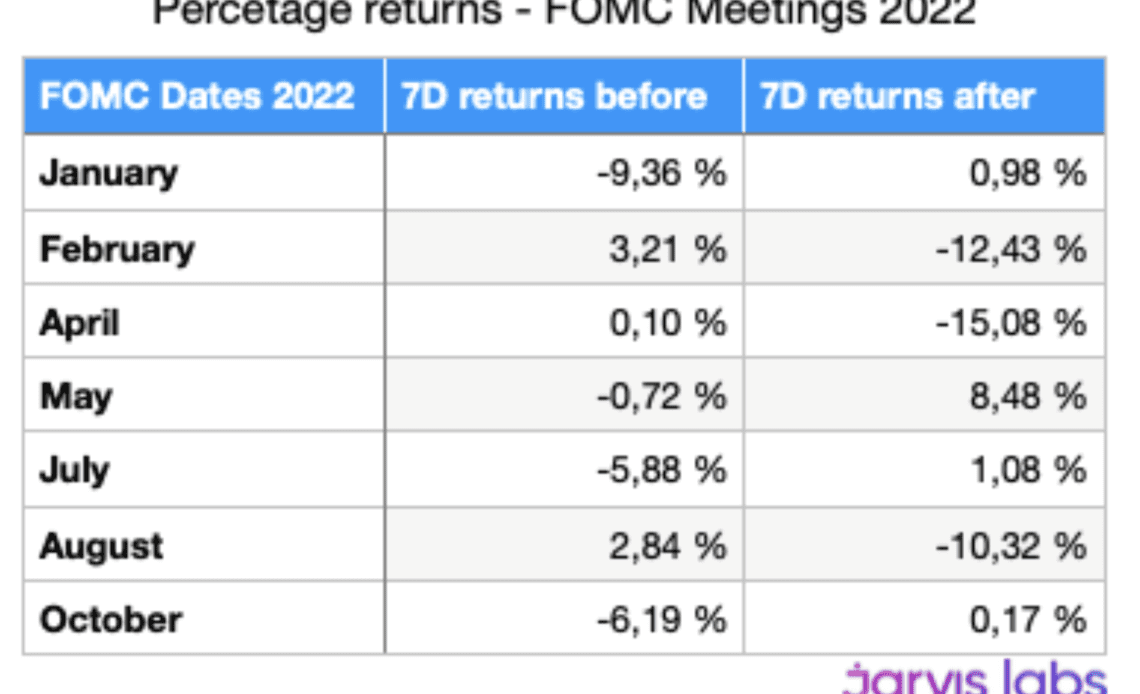

In my opinion, trading the FOMC, CPI and rate hikes is not the way to go. Sure, if you’re a day trader, have deep pockets to benefit from those 2% or 4% moves or are an experienced, skilled professional trader, then go for it. But, as shown in the chart from Jarvis Labs, trading FOMC and CPI really can just chop traders up.

I’m of the mind that intraday price moves from Bitcoin on a less-than-daily…

Click Here to Read the Full Original Article at Cointelegraph.com News…