Blockchain analytics platform Santiment says a key metric is flashing bullish for Bitcoin (BTC) as it did in November 2022.

Santiment says that the level of fear in the digital assets space, based on trending crypto terms, is similar to the time after the FTX collapse last year, which proved to be a market bottom at the time.

“One of the primary signs of fear is when the top trending crypto keywords are almost all related to hardware wallets and security. We saw similar safety concerns from traders in November [2022] after the FTX collapse. That marked a market bottom.”

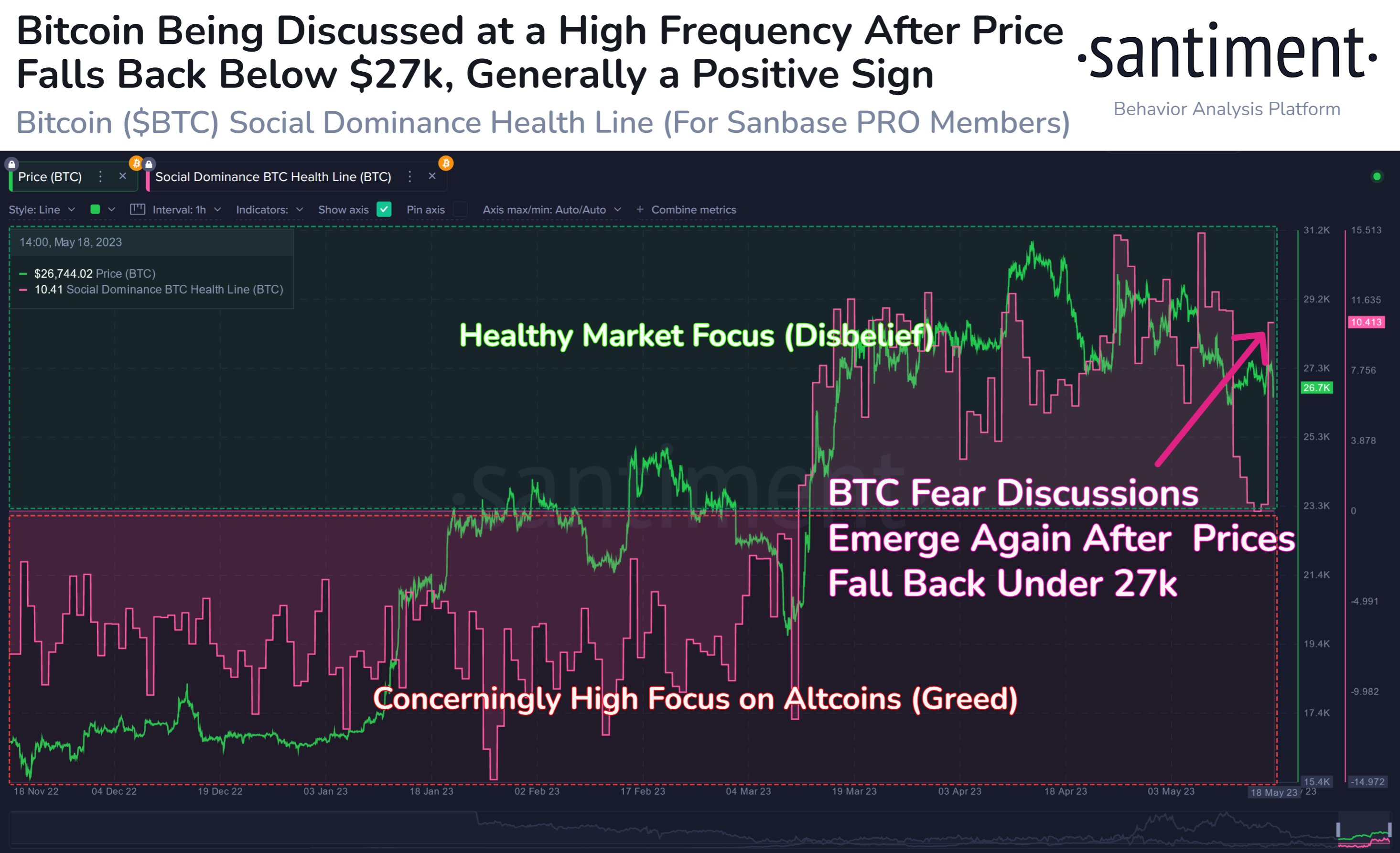

Santiment also notices that as Bitcoin’s price recently declined to the $26,000 level, the amount of chatter on social media about the crypto king has picked up, which is another signal that indicates BTC may bounce in the near term.

“With Bitcoin revisiting the $26,000 level, traders are showing increased worries of prices falling back to the $20,000 to $25,000 range. BTC social dominance has jumped high again, typically a sign of fear. Fear signals increase the probability of a rebound.”

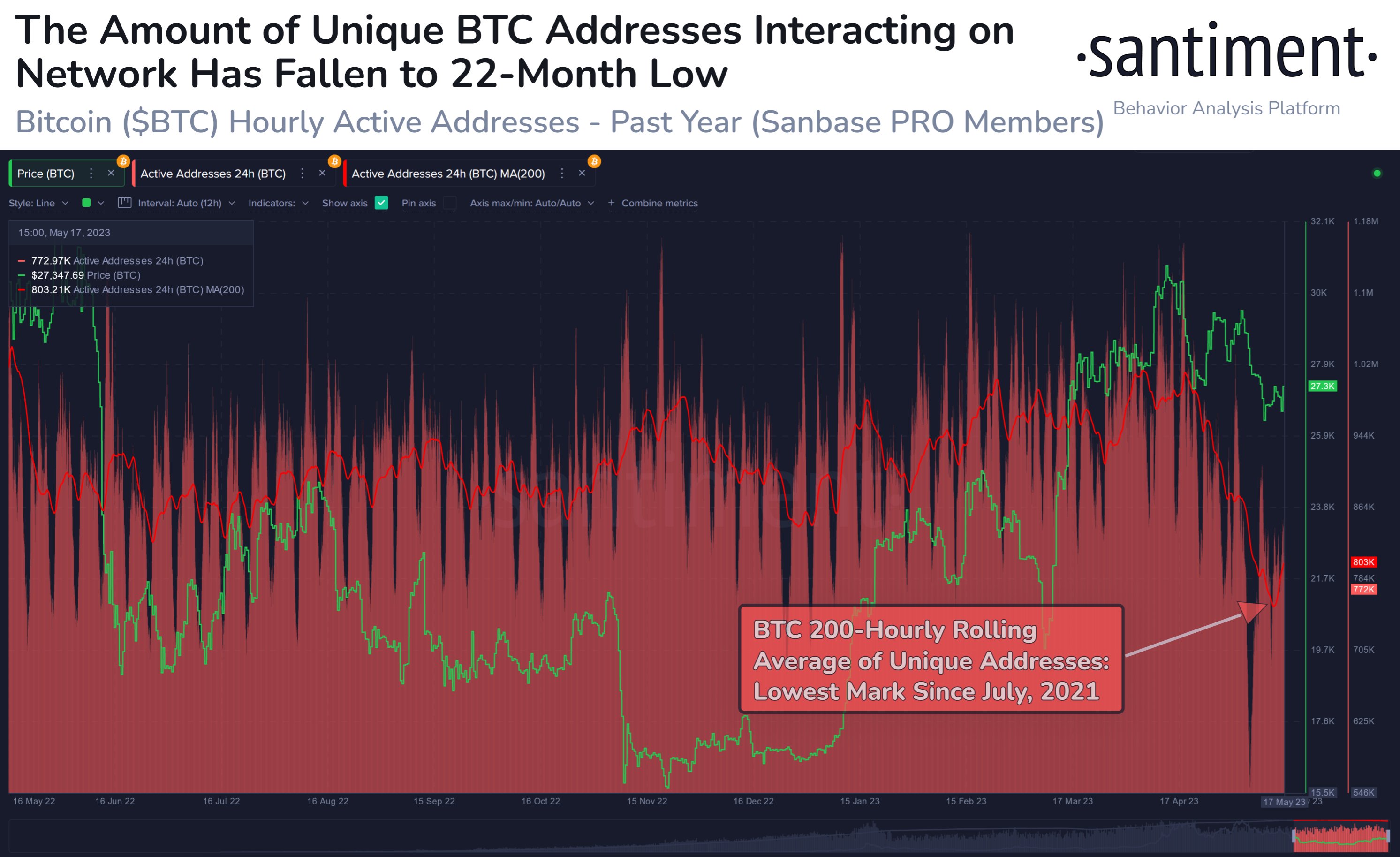

Lastly, Santiment says that Bitcoin transactions have declined to a low last seen 22 months ago in July 2021, when Bitcoin bottomed at around $29,000 before rallying to its all-time high at around $69,000.

“Bitcoin’s utility has shown some serious drop-off here in May, as prices have corrected market-wide. For the first time since July 2021, we’re seeing less than 800,000 daily unique BTC addresses transacting on the network.”

Bitcoin is trading for $26,891 at time of writing, up 0.2% during the last 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image:…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…