Pension funds are in a perpetual crisis worldwide, with low demographic rates in many countries foreshadowing a dim future for such investments, combined with young people’s lack of faith in the continued existence of social security models.

In order to stay afloat, many pension funds have strived to remain apprised of new investment opportunities, including cryptocurrencies. According to a 2022 study published by the CFA Institute, “94% of state and government-sponsored pension funds are invested in one or more cryptocurrencies.”

But pension fund interest in volatile cryptocurrencies has not come without consequences.

In April 2023, Ontario Teachers’ Pension Plan (OTPP) backed off from investing in the cryptocurrency sector after losing $95 million on its stake in FTX. The failure of OTPP may have discouraged other pension plans from getting close to crypto or other emerging assets and technologies for their investment plans.

Artificial intelligence (AI) and digital assets share a similar hype.

For better or for worse, this relationship could affect them. Cryptocurrencies offer a wide versatility, although mainstream investors may categorize them as vulgar speculative assets. AI, the new kid on the block, could offer many more use cases.

AI is not something that investors can avoid or escape, so is it safe for pension funds to adopt?

Pension funds worldwide are in jeopardy

According to the “Mercer CFA Institute Global Pension Index 2023” report, numerous countries’ pension systems have “major risks and/or shortcomings that should be addressed,” with the United States being one of them.

Many others, such as Argentina, are in real danger. Without improvements, “the efficacy and sustainability [of the pension system] are in doubt” in these countries.

Only a handful of countries, with the Netherlands taking the lead, have a “robust” and “sustainable” retirement system.

Pension funds need to avoid putting “at risk the well-being of current and future pensioners,” as stated in the 2022 “Pensions Outlook” of the Organization for Economic Cooperation and Development (OECD).

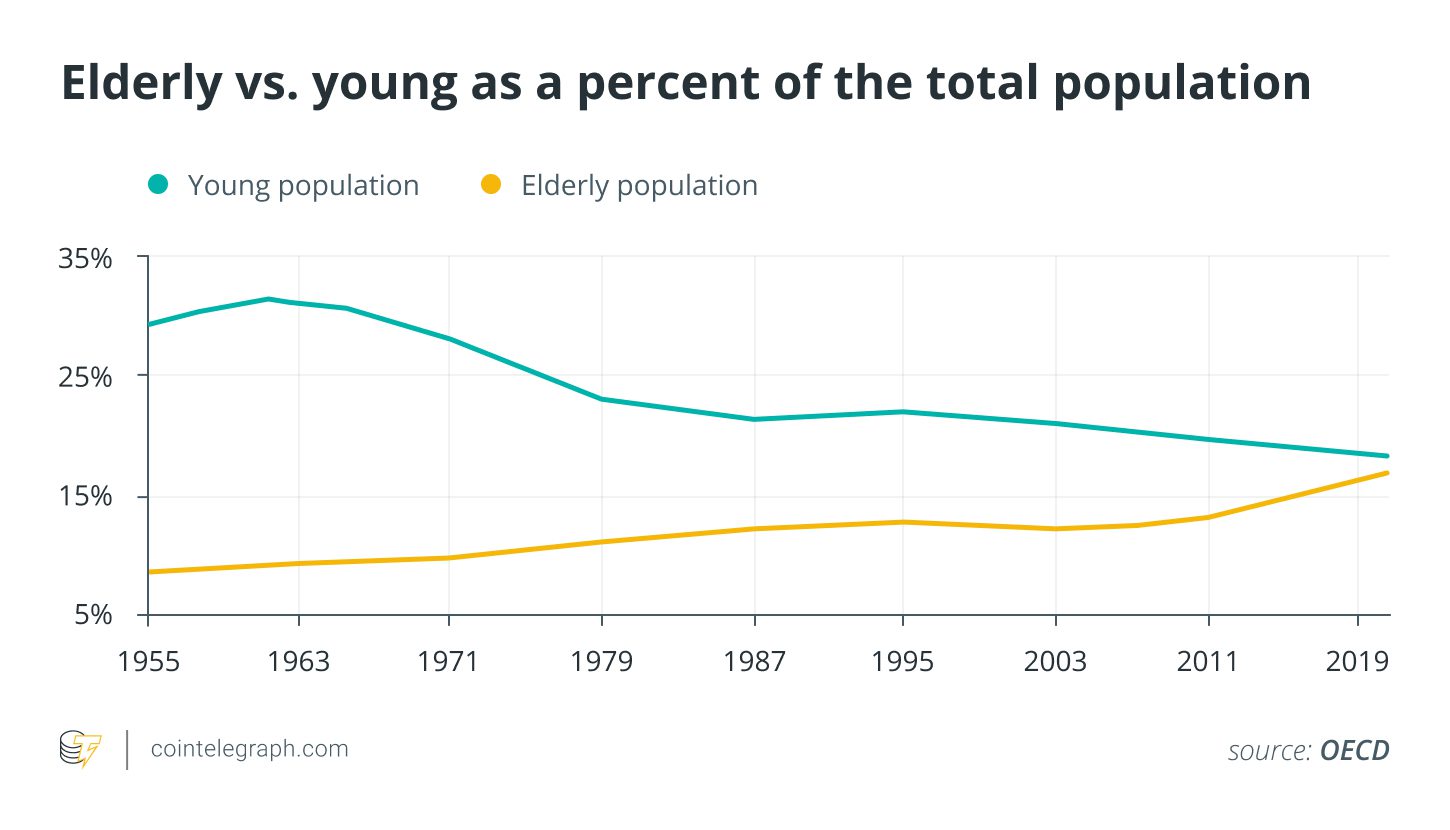

Systematic inflation isn’t helping, but the main problem future pensions will face is record-low birth rates, a phenomenon known as the “graying” of society.

This issue is primarily occurring in developed countries. For example, Japan has seen its birth rate drop to 1.25, the U.S. is currently at 1.66, and almost all European countries are breaking…

Click Here to Read the Full Original Article at Cointelegraph.com News…