Cardano (ADA), the tenth largest cryptocurrency by market capitalization, has been a rollercoaster ride for investors in recent months. After a steep price decline in March, ADA has seen a minor uptick, leaving analysts divided on its future trajectory. Could a repeat of a historical price pattern propel ADA to new heights in 2024, or are there warning signs lurking beneath the surface?

Cardano Mimics 2020: Bullish Echo Or False Hope?

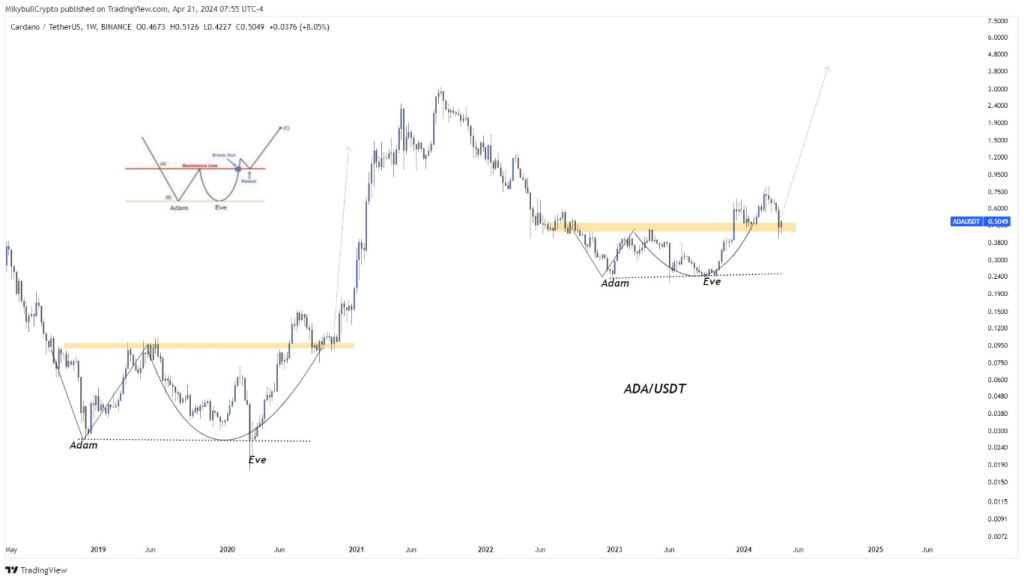

Hopeful investors are clinging to a familiar chart pattern. According to popular crypto analyst Milkybull, ADA’s price movement appears to be mirroring its action in 2020. Back then, an “Adam and Eve” double bottom pattern preceded a significant price surge. If history rhymes, a breakout from this pattern could see ADA revisit its all-time high this year.

It’s following the same path of 2020 that initiated an explosive rally. pic.twitter.com/rI5FDzcn4P

— Mikybull 🐂Crypto (@MikybullCrypto) April 21, 2024

However, historical comparisons are a double-edged sword. While past trends can offer some insight, blindly relying on them can be misleading, especially in the ever-evolving cryptocurrency market.

Technical Indicators Flash Green, But Network Activity Sputters

Technical indicators often used to gauge market sentiment seem to be painting a bullish picture for Cardano. The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) are both trending upwards, suggesting a potential price increase.

Total crypto market cap currently at $2.3 trillion. Chart: TradingView

Meanwhile, a crucial metric paints a contrasting picture. Cardano’s daily active addresses, which reflect the number of unique users interacting with the network, have dipped slightly in the past few days. This decline in network activity could be a cause for concern, as it might indicate dwindling user interest in the Cardano ecosystem.

Cardano’s Future: A Balancing Act

The outlook for Cardano remains uncertain. While the potential for a bull run based on historical patterns and bullish technical indicators exists, the decline in network activity raises questions about its long-term sustainability. Investors should carefully consider these conflicting signals before making any investment decisions.

Source: Santiment

Further developments within the Cardano ecosystem, such as the successful rollout of smart contracts or increased adoption of decentralized applications (dApps) built on the Cardano blockchain,…

Click Here to Read the Full Original Article at NewsBTC…