Longer-term Bitcoin (BTC) holders have begun trading their coins off to new investors entering the market, according to on-chain analytics firm Glassnode.

In a new report, Glassnode says that Bitcoin’s recent move into price discovery above new all-time highs has enticed holders who were far in profit to distribute to a newer investor cohort.

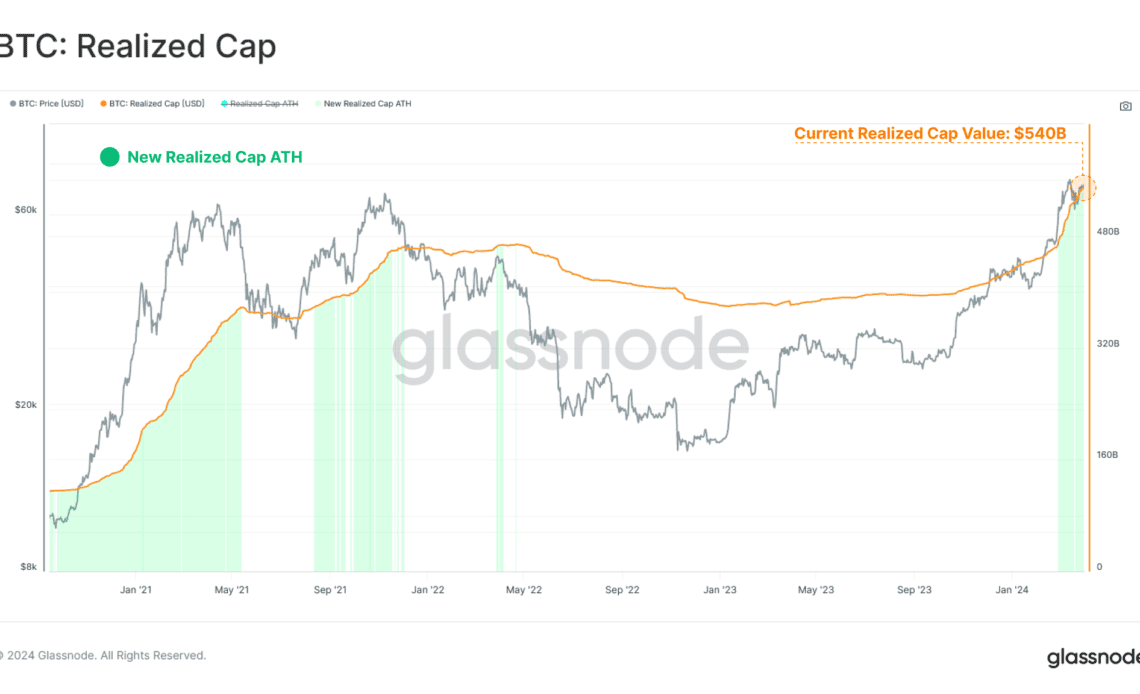

The firm uses the Realized Cap metric, which records the price at which each coin moved and aims to gauge how many holders are in profit or at a loss, is currently at an all-time high, according to Glassnode.

“This results in spent coins generally being revalued from a lower cost-basis, to a higher one. As these coins change hands, we can also consider this to be an injection of fresh demand and liquidity into the asset class.

This mechanic is elegantly expressed by the Realized Cap metric, tracking the cumulative USD liquidity ‘stored’ in the asset the class. The Realized Cap is now at a new ATH value of $540 billion, and is increasing at an unprecedented rate of over $79 billion/month.”

Glassnode says that 44% of all BTC in circulation are now being held by newer addresses that have been holding for less than 3 months. Based on the firm’s data, the crossing above the 44% level has historically coincided with mid-stage bull markets.

“If we segregate for coin-ages younger than 3 months, we can see a sharp increase over recent months, with these newer investors now owning ~44% of the aggregate network wealth. This uptick in younger coins is a direct result of Long-Term Holders spending their coins at higher prices to satisfy the wave of inflowing demand.”

At time of writing, BTC is trading for $65,004, 18% from its all-time high.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Click Here to Read the Full Original Article at The Daily Hodl…