A major Indian cryptocurrency exchange, Wazirx, has had its bank assets of more than $8 million frozen by the Directorate of Enforcement (ED). The exchange was supposedly acquired by Binance in 2019. However, Binance CEO Changpeng Zhao (CZ) now claims that the acquisition was “never completed.” Wazirx, however, maintains that it was acquired by Binance.

ED’s Action Against Wazirx

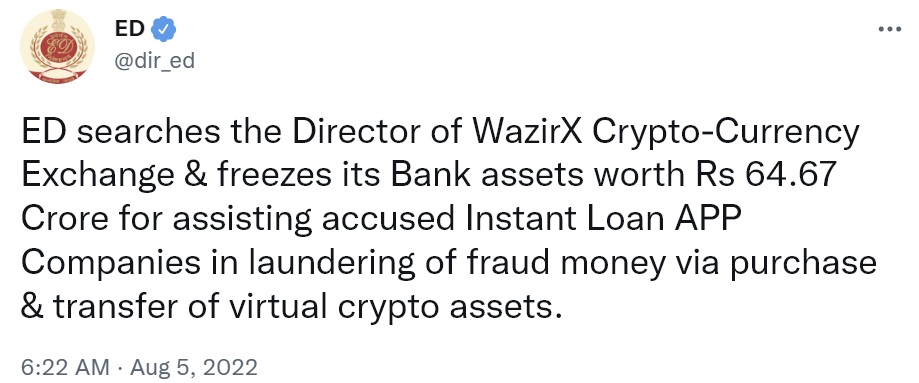

India’s Directorate of Enforcement (ED) issued a press release Friday concerning Wazirx, a major crypto exchange in India. ED is a law enforcement and economic intelligence agency of the government of India. The announcement details:

Directorate of Enforcement (ED) has conducted searches on one of the directors of M/s Zanmai Lab Pvt Ltd, which owns the popular cryptocurrency exchange Wazirx and has issued a freezing order to freeze their bank balances to the tune of INR 64.67 crore.

ED stated that this action is part of its money laundering investigation against non-bank financial companies (NBFC) and their fintech partners for “predatory lending practices in violation of the RBI [Reserve Bank of India] guidelines.”

The announcement describes: “ED found that large amount of funds were diverted by the fintech companies to purchase crypto assets and then launder them abroad. These companies and the virtual assets are untraceable at the moment.”

ED alleged that Zanmai Labs created a web of agreements with Crowdfire Inc. (USA), Binance (Cayman Island), and Zettai Pte Ltd. (Singapore) “to obscure the ownership of Wazirx.” The authority further claimed that Wazirx gave “contradictory” and “ambiguous” answers “to evade oversight by Indian regulatory agencies,” noting that the exchange failed to provide crypto transactions of suspected fintech companies.

“Because of the non-cooperative stand of the director of Wazirx exchange, a search operation was conducted,” ED stressed. “It was found that Mr. Sameer Mhatre, director of Wazirx, has complete remote access to the database of Wazirx, but despite that he is not providing the details of the transactions relating to the crypto assets, purchased from the proceeds of crime of Instant Loan APP fraud.” The law enforcement agency further alleged:

The lax KYC norms, loose regulatory control of transactions between Wazirx & Binance, non-recording of transactions on blockchains to save costs and non-recording of the KYC of the opposite wallets has ensured that Wazirx is not able to give any account…

Click Here to Read the Full Original Article at Bitcoin News…