Most crypto investors probably aren’t thinking about divorce or what will happen to their digital assets in the event of separation, but lawyers say it’s becoming a very common scenario as more people hold crypto assets.

Last year, market research firm GWI suggested that as much as 10.2% of global internet users aged 16 to 64 own crypto, with most ownership skewed toward nations experiencing high inflation or fluctuation in the value of their national currency.

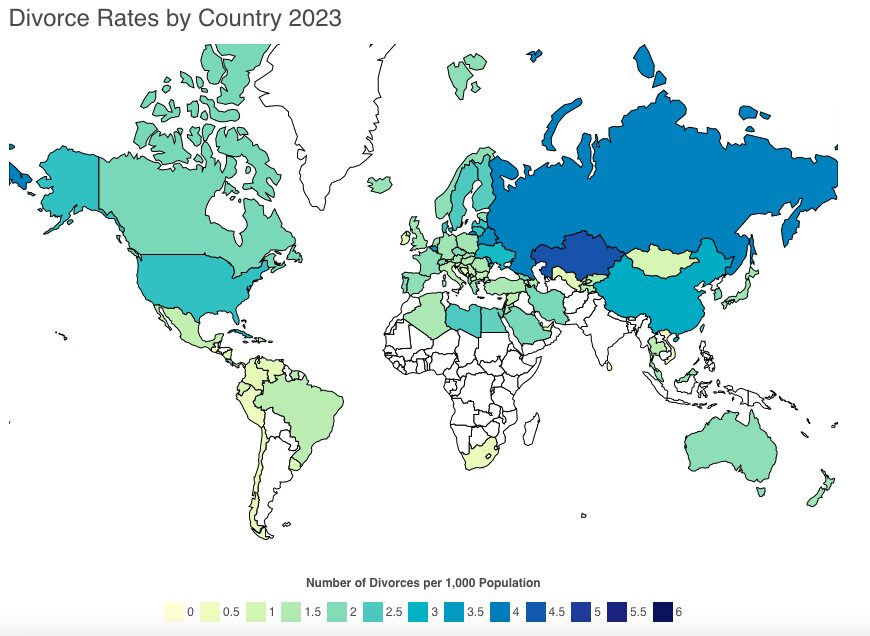

Independent data and statistics tracker World Population Review suggests the divorce rate worldwide varies between lows of 0.15 divorces per 1,000 residents in Sri Lanka to highs of 5.52 per 1,000 people in the Maldives.

Speaking to Cointelegraph, Claire Walczak, a senior associate from independent law firm Lander & Rogers, who works in the firm’s family and relationship law practice, says family lawyers are seeing an increasing number of divorce settlements featuring digital assets.

She says it’s a “rapidly changing and evolving area of law,” so it’s important to have specialist family law advice if you have a matter involving digital assets.

According to Walczak, once divorce proceedings start, the court follows a process to determine how property and financial matters will be settled.

This can include determining what assets are available for division, assessing the parties’ respective contributions, considering whether it is just and equitable to make any adjustments, and evaluating each party’s future needs.

The same process applies when dealing with digital assets. Both parties in the divorce are obligated to disclose all documents concerning their assets, digital or otherwise.

Walczak says both parties to a property settlement are entitled to retain the crypto as part of their overall property settlement entitlements, regardless of whose name it is held.

If both parties seek to retain the crypto and fail to reach an agreement, courts may consider factors such as, who paid for the crypto, and who owns the wallet, when deciding who retains the asset.

“As part of this process, the court identifies and values the existing assets of the parties, which includes all digital assets,” Walczak said.

“In the case of cryptocurrency, the value of the asset type is determined by the open market and can be assessed via an exchange,” she added.

Market fluctuations can affect values

The crypto market can be volatile at the best…

Click Here to Read the Full Original Article at Cointelegraph.com News…