In crypto’s fast-moving world, traders have long relied on charts, such as candlesticks, Fibonacci lines and Bollinger Bands, to interpret price action. But a quiet shift is underway.

Instead of staring at graphs or toggling between indicators, traders are increasingly turning to AI models like ChatGPT and Grok for real-time context, sentiment analysis and narrative framing. These tools don’t replace charts outright, but they’re becoming the first stop for insight, transforming how many retail and semi-professional traders approach decisions.

Here’s how and why it matters.

The crypto chart fatigue shift

Crypto charts are dense with data, but that doesn’t always translate into clarity. Reading them well requires not just technical skill but also emotional control and pattern recognition. For newer traders, charts can become overwhelming: a wall of indicators, conflicting signals or simply visual noise.

That’s where conversational AI steps in. Instead of decoding relative strength index bands or candlestick wicks, traders are now asking models questions like, “Is this a good time to buy Solana (SOL)?”

AI tools like ChatGPT and Grok offer an alternative path to insight, one that’s faster, more intuitive and less intimidating. Rather than parsing charts, users are feeding in natural-language prompts such as:

Example 1

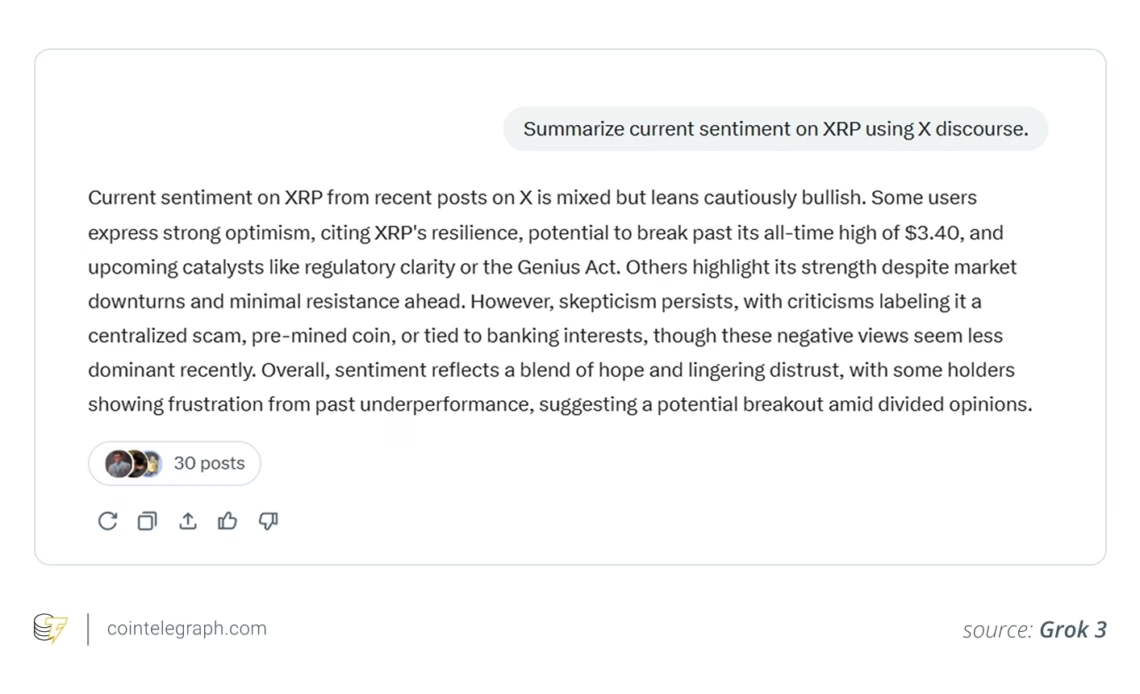

Prompt: Summarize current sentiment on XRP using X discourse.

According to Grok, XRP (XRP) sentiment on X is mixed but cautiously bullish. It highlights optimism around regulatory catalysts and resilience while acknowledging lingering skepticism over centralization and past underperformance. The summary is well-balanced, context-rich and captures the emotional and narrative divide within the XRP community.

Example 2

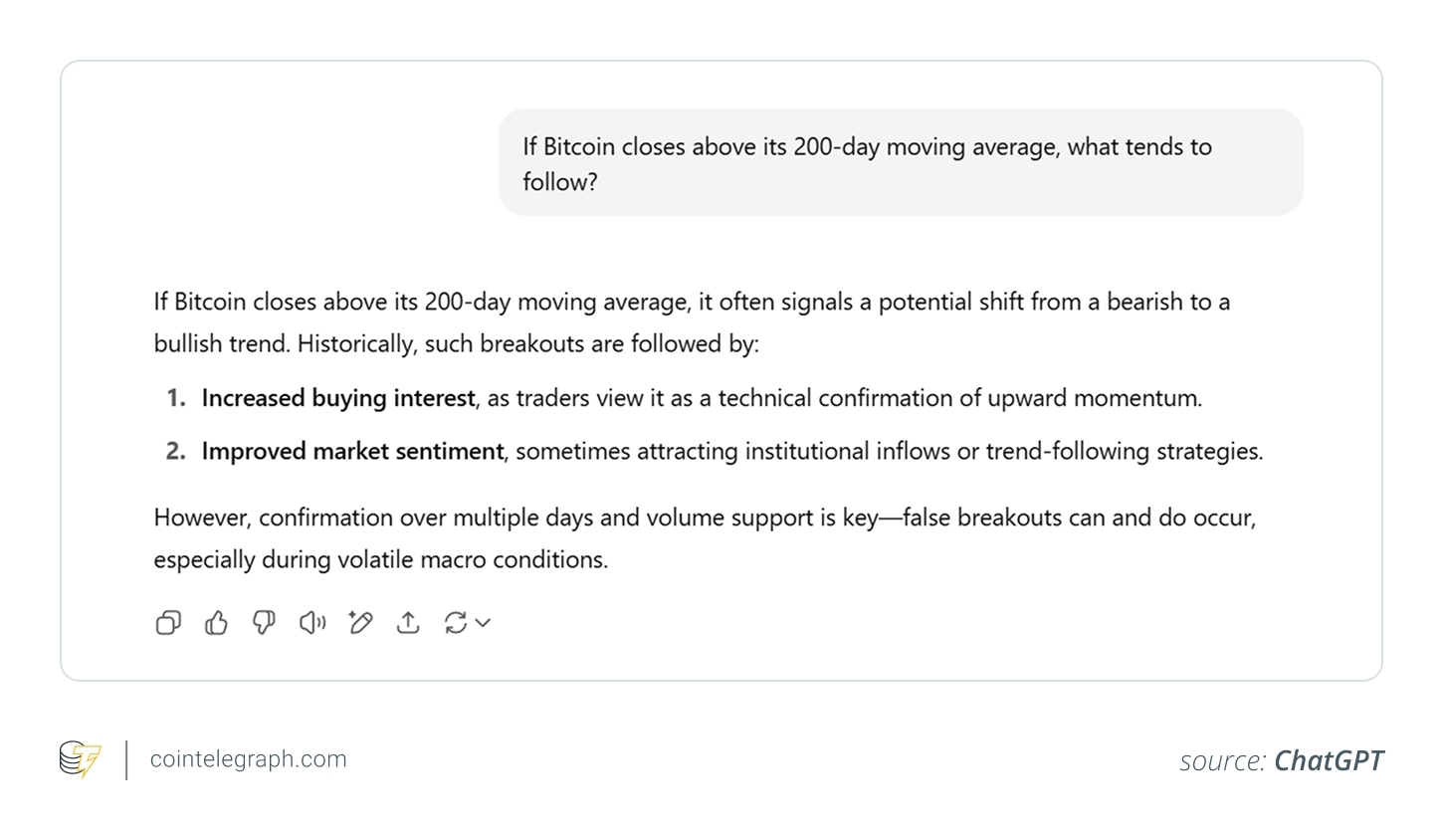

Prompt: If Bitcoin closes above its 200-day moving average, what tends to follow?

ChatGPT’s response highlights the historical implications of a 200-day moving average breakout, such as increased buying interest and improved sentiment. It also responsibly noted the risk of false breakouts. The tone is balanced, with emphasis on confirmation and context, making it suitable for both beginners and intermediate traders.

Example 3

Prompt: Compare Solana and Avalanche in terms of user activity this month.

Grok’s response, as shown in the image below, provides a clear, data-backed comparison, highlighting Solana’s dominance in user activity, transaction volume and decentralized exchange engagement. It contrasts Avalanche’s…

Click Here to Read the Full Original Article at Cointelegraph.com News…